Region:Global

Author(s):Shubham

Product Code:KRAA1758

Pages:94

Published On:August 2025

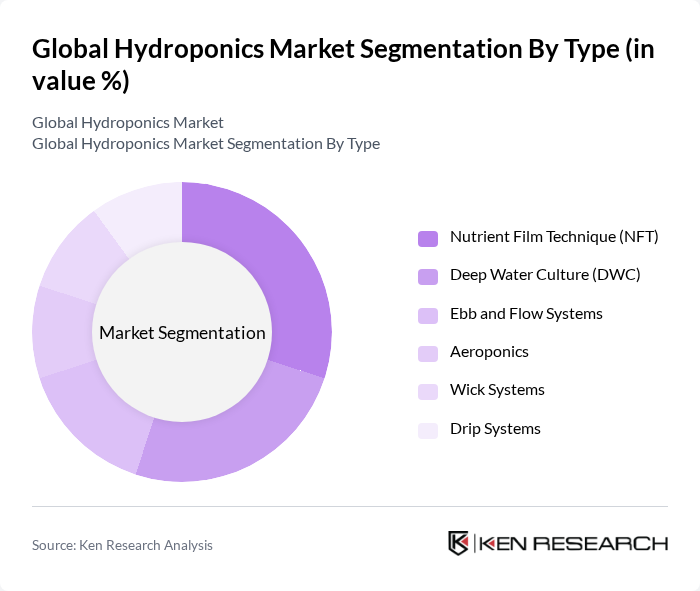

By Type:The hydroponics market can be segmented into various types, including Nutrient Film Technique (NFT), Deep Water Culture (DWC), Ebb and Flow Systems, Aeroponics, Wick Systems, and Drip Systems. Among these, the Nutrient Film Technique (NFT) is gaining traction due to its efficient nutrient delivery and low media requirement, supporting rapid growth and high yields. Deep Water Culture (DWC) remains popular for simplicity and robust leafy green production. Ebb and Flow Systems are valued for versatility across crop types, while Aeroponics is emerging for high-density propagation and faster growth cycles with reduced water use; Drip Systems are widely used in commercial CEA for precise fertigation control .

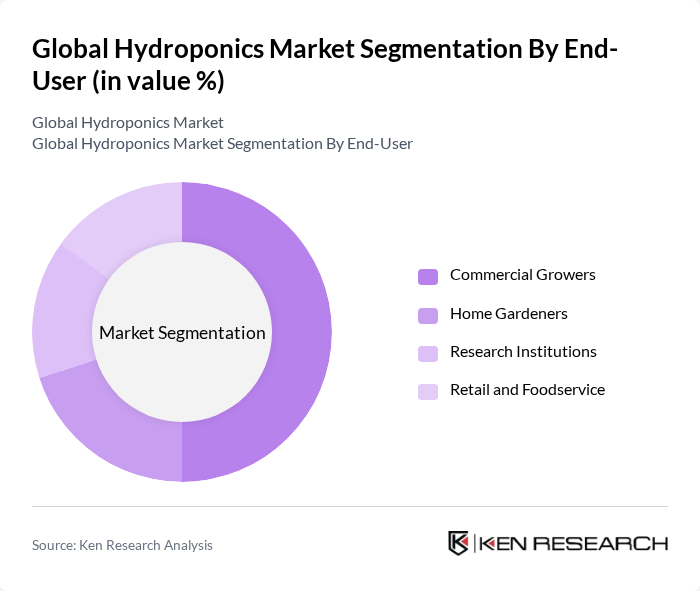

By End-User:The hydroponics market is segmented by end-users, including Commercial Growers, Home Gardeners, Research Institutions, and Retail and Foodservice. Commercial Growers dominate due to scale, year?round production, and cost control in controlled environments. Rising urban and indoor gardening drives Home Gardeners, while Research Institutions advance crop science and system optimization. Retail and Foodservice increasingly engage hydroponic supply to secure consistent, local, and pesticide?free produce .

The Global Hydroponics Market is characterized by a dynamic mix of regional and international players. Leading participants such as AeroFarms, BrightFarms, Freight Farms, Gotham Greens, Plenty Unlimited, Bowery Farming, Crop One Holdings, Infarm, AmHydro (American Hydroponics), General Hydroponics (Hawthorne Gardening/ScottsMiracle-Gro), Hydrofarm Holdings Group, GrowGeneration, Signify (Philips Horticulture LED), Heliospectra AB, and Priva contribute to innovation, geographic expansion, and service delivery in this space .

The hydroponics market is poised for transformative growth, driven by increasing urbanization and the need for sustainable food production. As cities expand, the demand for local, fresh produce will rise, prompting innovations in vertical farming and automated systems. Additionally, the integration of IoT technologies will enhance operational efficiency, allowing growers to monitor and optimize conditions in real-time. This convergence of technology and sustainability will redefine agricultural practices, making hydroponics a cornerstone of future food systems.

| Segment | Sub-Segments |

|---|---|

| By Type | Nutrient Film Technique (NFT) Deep Water Culture (DWC) Ebb and Flow Systems Aeroponics Wick Systems Drip Systems |

| By End-User | Commercial Growers Home Gardeners Research Institutions Retail and Foodservice (Private Label, CEA Supply) |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Technology | Hydroponic Systems & Substrates (Aggregate and Liquid) LED Grow Lights Climate Control Systems (HVAC, Dehumidifiers) Sensors & Monitoring/Automation (pH/EC, IoT) |

| By Application | Leafy Greens (Lettuce, Spinach, Kale) Herbs (Basil, Mint, Parsley) Fruits (Tomato, Strawberry, Cucumber) Flowers & Ornamentals |

| By Investment Source | Private Investments (VC/PE, Corporate) Government Grants and Subsidies Crowdfunding and Community Financing |

| By Policy Support | Research & Innovation Grants Tax Incentives and Depreciation Benefits Equipment and Energy Subsidies |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Hydroponic Farms | 120 | Farm Owners, Operations Managers |

| Hydroponics Equipment Suppliers | 90 | Sales Managers, Product Development Leads |

| Research Institutions in Agriculture | 60 | Research Scientists, Agricultural Economists |

| Urban Agriculture Initiatives | 50 | Project Managers, Community Organizers |

| Retailers of Hydroponic Produce | 70 | Category Managers, Supply Chain Coordinators |

The Global Hydroponics Market is valued at approximately USD 12.6 billion, reflecting a significant adoption of soilless cultivation methods aimed at improving yield and aligning with sustainability and food security objectives in urban settings.