Region:Global

Author(s):Shubham

Product Code:KRAB0562

Pages:92

Published On:August 2025

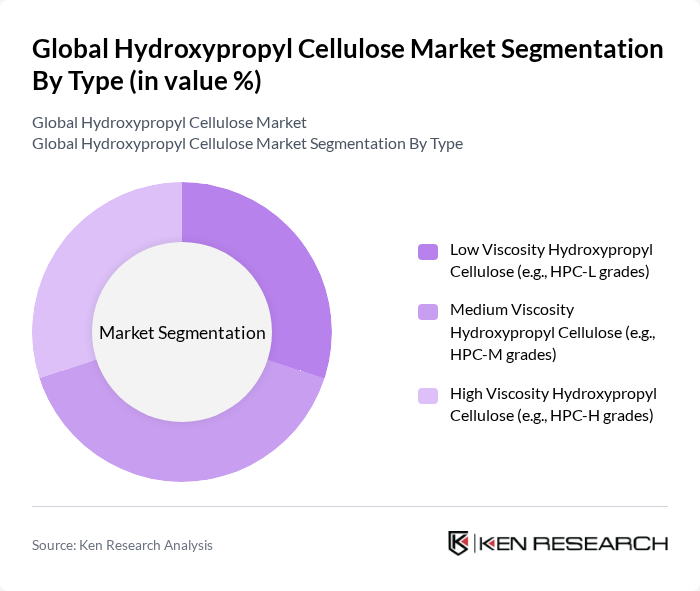

By Type:The hydroxypropyl cellulose market is segmented into three main types: Low Viscosity Hydroxypropyl Cellulose (e.g., HPC-L grades), Medium Viscosity Hydroxypropyl Cellulose (e.g., HPC-M grades), and High Viscosity Hydroxypropyl Cellulose (e.g., HPC-H grades). Each type serves different applications based on viscosity requirements .

The medium viscosity hydroxypropyl cellulose segment is currently dominating the market due to its versatility and wide range of applications, particularly in pharmaceuticals and personal care products. This type is favored for its ability to provide optimal thickening and binding properties, making it essential in formulations that require precise viscosity control. The growing trend towards high-quality, effective formulations in the pharmaceutical and cosmetic industries further drives the demand for medium viscosity grades .

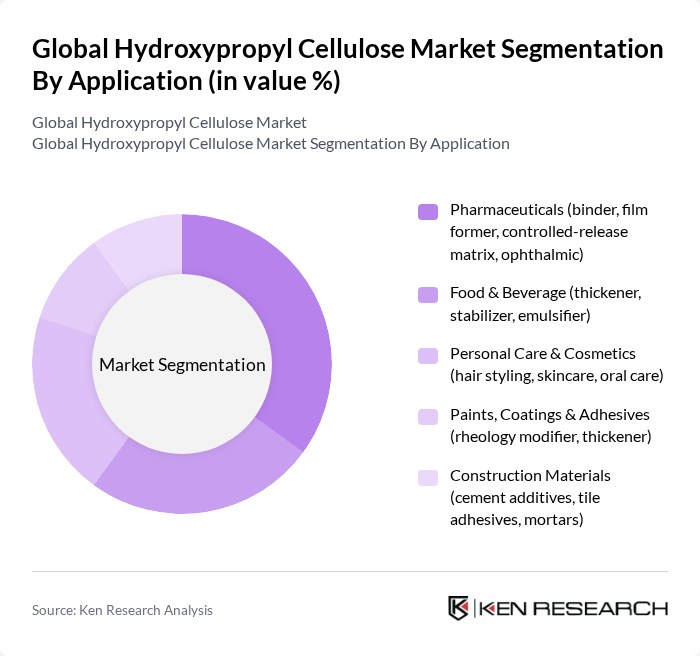

By Application:The hydroxypropyl cellulose market is segmented by application into Pharmaceuticals (binder, film former, controlled-release matrix, ophthalmic), Food & Beverage (thickener, stabilizer, emulsifier), Personal Care & Cosmetics (hair styling, skincare, oral care), Paints, Coatings & Adhesives (rheology modifier, thickener), and Construction Materials (cement additives, tile adhesives, mortars) .

The pharmaceuticals application segment leads the market due to the increasing demand for effective excipients in drug formulations. Hydroxypropyl cellulose is widely used as a binder and film former, essential for controlled-release formulations. The growing focus on innovative drug delivery systems and the rising prevalence of chronic diseases are propelling the demand for hydroxypropyl cellulose in the pharmaceutical sector .

The Global Hydroxypropyl Cellulose Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ashland Inc., Dow (The Dow Chemical Company), Shin-Etsu Chemical Co., Ltd., Merck KGaA (MilliporeSigma), Lotte Fine Chemical Co., Ltd., Shandong Head Co., Ltd., Shandong Heda Technology Co., Ltd. (HEAD), Huzhou Mizuda Hope Biosciences Co., Ltd., Lamberti S.p.A., CP Kelco U.S., Inc., Daicel Corporation, Hebei Jinhuzi Chemical Co., Ltd. (SinoCMC), Yixing Tongda Chemical Co., Ltd., Penn Carbose Inc., SEPPIC (Air Liquide Group) contribute to innovation, geographic expansion, and service delivery in this space.

The hydroxypropyl cellulose market is poised for significant growth, driven by increasing applications across various sectors, including pharmaceuticals, personal care, and food. Innovations in product formulations and a shift towards sustainable practices are expected to shape the market landscape. As consumer preferences evolve, manufacturers will need to adapt to these trends, focusing on eco-friendly and high-performance products to maintain competitiveness in a rapidly changing environment.

| Segment | Sub-Segments |

|---|---|

| By Type | Low Viscosity Hydroxypropyl Cellulose (e.g., HPC-L grades) Medium Viscosity Hydroxypropyl Cellulose (e.g., HPC-M grades) High Viscosity Hydroxypropyl Cellulose (e.g., HPC-H grades) |

| By Application | Pharmaceuticals (binder, film former, controlled-release matrix, ophthalmic) Food & Beverage (thickener, stabilizer, emulsifier) Personal Care & Cosmetics (hair styling, skincare, oral care) Paints, Coatings & Adhesives (rheology modifier, thickener) Construction Materials (cement additives, tile adhesives, mortars) |

| By End-User | Pharmaceutical Manufacturers Food & Beverage Processors Personal Care & Cosmetics Brands Industrial & Construction Products Manufacturers |

| By Distribution Channel | Direct Sales (producer to OEM/end user) Authorized Distributors & Chemical Traders Online/Marketplace Channels (B2B platforms) |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Pricing Strategy | Contract/Tiered Pricing with Large OEMs Spot/Transactional Pricing Value-Based Pricing for Specialty Grades |

| By Others | Specialty & High-Purity Grades (ophthalmic, pharma) Niche/Custom Grades (functionalized, co-processed) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Applications | 120 | R&D Managers, Quality Assurance Officers |

| Food Industry Usage | 90 | Product Development Specialists, Regulatory Affairs Managers |

| Cosmetics and Personal Care | 80 | Formulation Chemists, Brand Managers |

| Construction and Building Materials | 60 | Project Managers, Material Engineers |

| Textile and Coating Applications | 50 | Textile Technologists, Coating Specialists |

The Global Hydroxypropyl Cellulose Market is valued between USD 1.1 billion and USD 1.3 billion, with recent reports estimating it around USD 0.87 billion to USD 1.20 billion. Key demand drivers include pharmaceuticals, food and beverage, and personal care sectors.