Region:Global

Author(s):Dev

Product Code:KRAC0362

Pages:98

Published On:August 2025

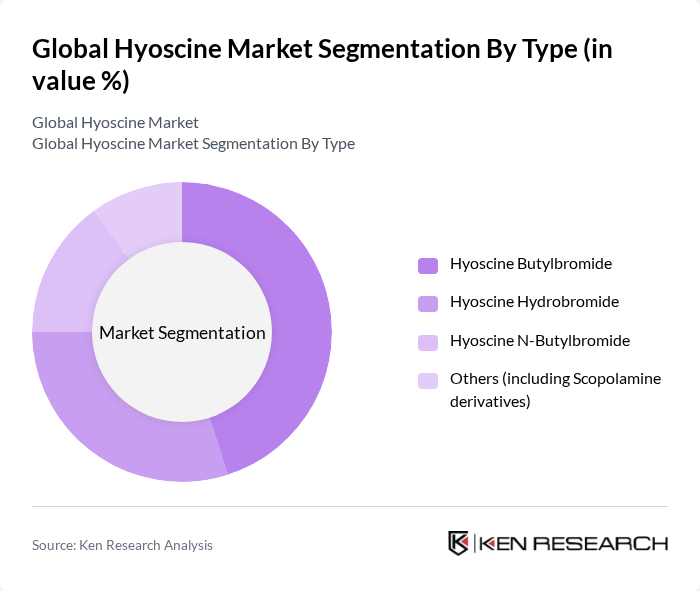

By Type:The market is segmented into four main types: Hyoscine Butylbromide, Hyoscine Hydrobromide, Hyoscine N-Butylbromide, and Others (including Scopolamine derivatives). Among these, Hyoscine Butylbromide is the leading sub-segment due to its widespread use in treating gastrointestinal spasms and its favorable safety profile. The increasing awareness of motion sickness treatments has also contributed to the growth of Hyoscine Hydrobromide. Scopolamine derivatives, particularly transdermal patches, are gaining traction for motion sickness prevention and postoperative nausea management .

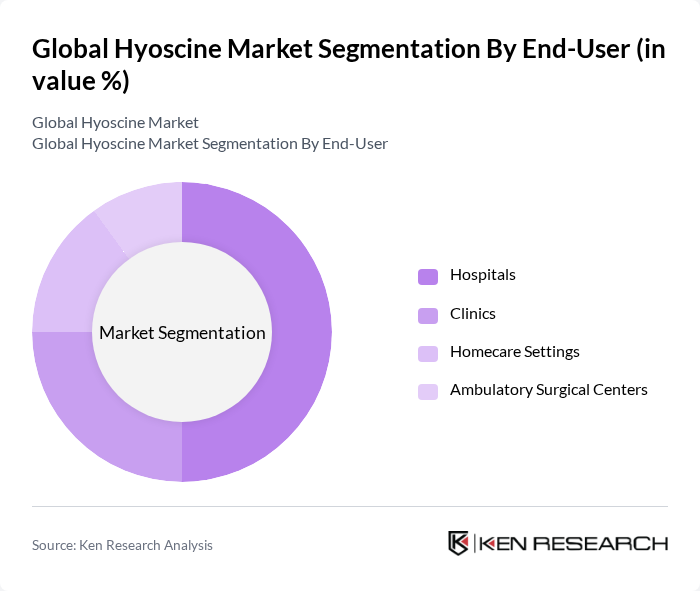

By End-User:The end-user segmentation includes Hospitals, Clinics, Homecare Settings, and Ambulatory Surgical Centers. Hospitals are the dominant end-user segment, primarily due to the high volume of surgical procedures and the need for effective anesthesia adjuncts. Clinics and homecare settings are also growing, driven by the increasing preference for outpatient care and self-medication. Ambulatory Surgical Centers are expanding their use of hyoscine for short-stay procedures and rapid patient turnover .

The Global Hyoscine Market is characterized by a dynamic mix of regional and international players. Leading participants such as Boehringer Ingelheim, Merck KGaA, Viatris Inc. (formerly Mylan N.V.), Teva Pharmaceutical Industries Ltd., Sandoz (Novartis AG), Hikma Pharmaceuticals PLC, Aurobindo Pharma Ltd., Sun Pharmaceutical Industries Ltd., Fresenius Kabi AG, Apotex Inc., Zydus Lifesciences Ltd. (formerly Zydus Cadila), Glenmark Pharmaceuticals Ltd., Cipla Ltd., Alvogen, Indoco Remedies Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the hyoscine market appears promising, driven by increasing consumer awareness and the growing prevalence of motion sickness and gastrointestinal disorders. Innovations in drug formulations and delivery methods are expected to enhance product efficacy and patient compliance. Additionally, the integration of digital health technologies will facilitate better patient management and education, further expanding the market. As healthcare systems evolve, the demand for effective antiemetic solutions like hyoscine will likely continue to rise, presenting significant growth opportunities.

| Segment | Sub-Segments |

|---|---|

| By Type | Hyoscine Butylbromide Hyoscine Hydrobromide Hyoscine N-Butylbromide Others (including Scopolamine derivatives) |

| By End-User | Hospitals Clinics Homecare Settings Ambulatory Surgical Centers |

| By Application | Motion Sickness Treatment Gastrointestinal Disorders (e.g., IBS, cramps) Anesthesia Adjunct (preoperative use) Palliative Care (management of secretions) Others |

| By Distribution Channel | Hospital Pharmacies Retail Pharmacies Online Pharmacies Others (e.g., direct sales, wholesalers) |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value-Based Pricing |

| By Packaging Type | Blister Packs Bottles Sachets Transdermal Patches Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Manufacturers | 100 | Product Managers, R&D Directors |

| Healthcare Providers | 70 | Physicians, Pharmacists |

| Regulatory Bodies | 40 | Regulatory Affairs Specialists, Compliance Officers |

| Market Research Analysts | 50 | Market Analysts, Business Development Managers |

| End-Users (Patients) | 60 | Patients using hyoscine for various conditions |

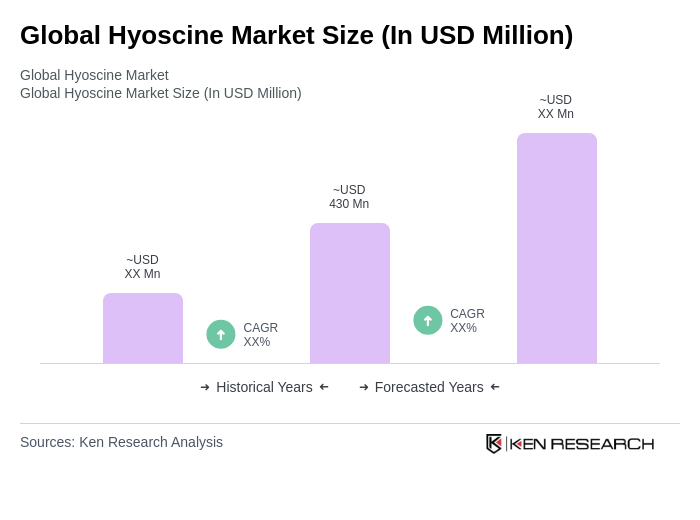

The Global Hyoscine Market is valued at approximately USD 430 million, driven by the increasing prevalence of gastrointestinal disorders and motion sickness, along with the rising demand for effective antiemetic medications.