Region:Global

Author(s):Rebecca

Product Code:KRAA2134

Pages:92

Published On:August 2025

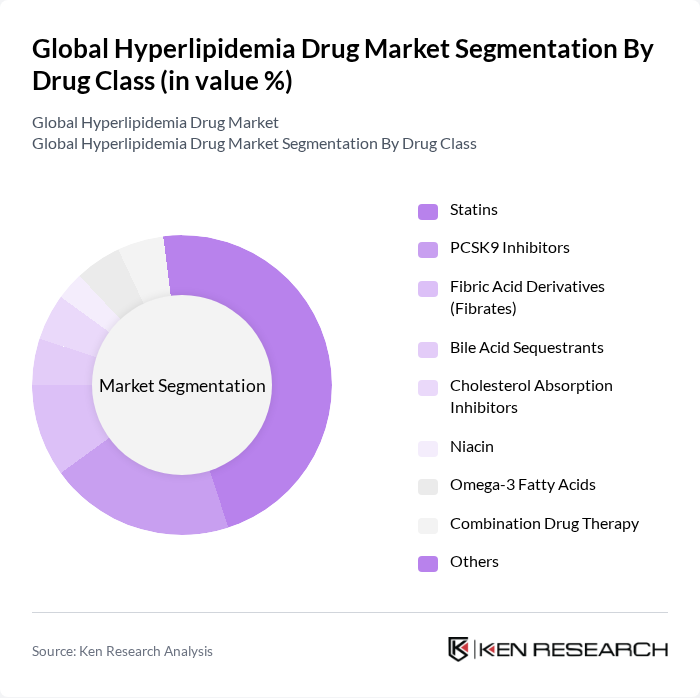

By Drug Class:The drug class segmentation includes various categories such as Statins, PCSK9 Inhibitors, Fibric Acid Derivatives (Fibrates), Bile Acid Sequestrants, Cholesterol Absorption Inhibitors, Niacin, Omega-3 Fatty Acids, Combination Drug Therapy, and Others. Statins remain the leading class due to their widespread use and proven efficacy in lowering cholesterol levels. The increasing prevalence of hyperlipidemia and the established safety profile of statins have driven demand for these medications, making them a cornerstone in lipid management. The market is also witnessing notable growth in PCSK9 inhibitors and combination therapies, reflecting a shift toward more targeted and effective lipid-lowering strategies .

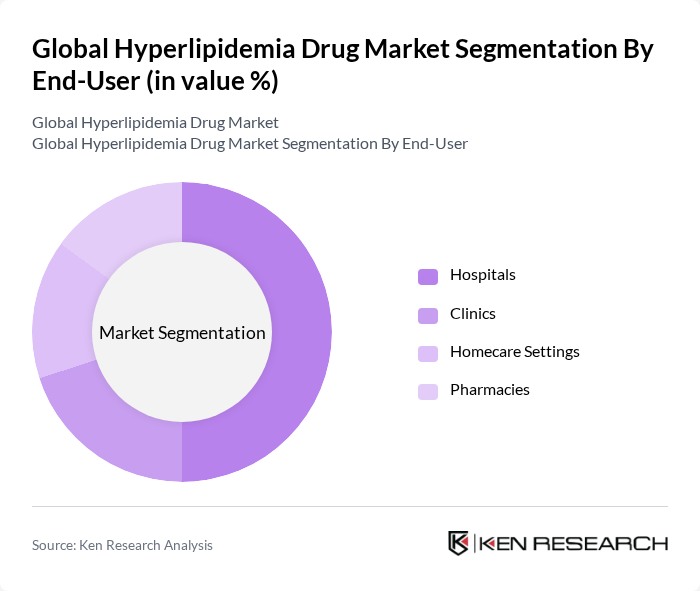

By End-User:The end-user segmentation includes Hospitals, Clinics, Homecare Settings, and Pharmacies. Hospitals are the leading end-user segment due to their capacity to provide comprehensive care and access to advanced treatment options. The increasing number of hospital admissions for cardiovascular diseases and the availability of specialized lipid clinics have further fueled the demand for hyperlipidemia drugs in these settings. Pharmacies and homecare settings are also gaining traction as patient-centric care models expand and medication adherence programs become more prevalent .

The Global Hyperlipidemia Drug Market is characterized by a dynamic mix of regional and international players. Leading participants such as Pfizer Inc., Merck & Co., Inc., Amgen Inc., Sanofi S.A., AstraZeneca PLC, Novartis AG, GlaxoSmithKline PLC, AbbVie Inc., Boehringer Ingelheim GmbH, Bayer AG, Takeda Pharmaceutical Company Limited, Eli Lilly and Company, Bristol-Myers Squibb Company, Daiichi Sankyo Company, Limited, Regeneron Pharmaceuticals, Inc., Esperion Therapeutics, Inc., Alnylam Pharmaceuticals, Inc., Ionis Pharmaceuticals, Inc., Kowa Company, Ltd., Mylan N.V. (Viatris Inc.) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the hyperlipidemia drug market appears promising, driven by ongoing innovations in drug development and a growing emphasis on personalized medicine. As healthcare systems increasingly adopt digital health solutions, the integration of telemedicine and remote monitoring will enhance patient engagement and adherence to treatment regimens. Furthermore, the expansion into emerging markets presents significant growth potential, as rising disposable incomes and healthcare access will likely increase demand for effective hyperlipidemia therapies.

| Segment | Sub-Segments |

|---|---|

| By Drug Class | Statins PCSK9 Inhibitors Fibric Acid Derivatives (Fibrates) Bile Acid Sequestrants Cholesterol Absorption Inhibitors Niacin Omega-3 Fatty Acids Combination Drug Therapy Others |

| By End-User | Hospitals Clinics Homecare Settings Pharmacies |

| By Route of Administration | Oral Injectable (Parenteral) Transdermal |

| By Distribution Channel | Retail Pharmacies Online Pharmacies Hospital Pharmacies |

| By Region | North America (United States, Canada, Mexico) Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe) Asia-Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Latin America (Brazil, Argentina, Rest of South America) Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa) |

| By Patient Demographics | Adults Elderly Pediatric |

| By Treatment Type | Monotherapy Combination Therapy Preventive Treatment |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cardiologists | 60 | Cardiologists, Interventional Cardiologists |

| Endocrinologists | 50 | Endocrinologists, Diabetes Specialists |

| Pharmacists | 40 | Community Pharmacists, Hospital Pharmacists |

| Patients on Hyperlipidemia Treatment | 100 | Patients currently prescribed lipid-lowering medications |

| Healthcare Policy Makers | 40 | Health Economists, Policy Advisors |

The Global Hyperlipidemia Drug Market is valued at approximately USD 23.8 billion, reflecting a significant growth driven by the increasing prevalence of hyperlipidemia and advancements in drug formulations aimed at managing lipid disorders.