Region:Global

Author(s):Shubham

Product Code:KRAA1887

Pages:98

Published On:August 2025

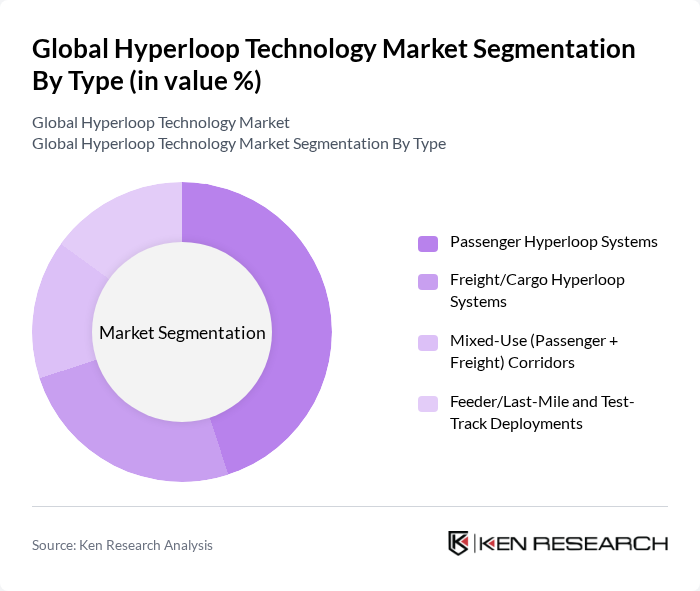

By Type:The segmentation of the market by type includes various systems designed for different purposes. The subsegments are Passenger Hyperloop Systems, Freight/Cargo Hyperloop Systems, Mixed-Use (Passenger + Freight) Corridors, and Feeder/Last-Mile and Test-Track Deployments. Among these, Passenger Hyperloop Systems are currently leading the market due to the increasing demand for rapid intercity travel solutions. The focus on reducing travel time and enhancing passenger experience drives investments in this subsegment .

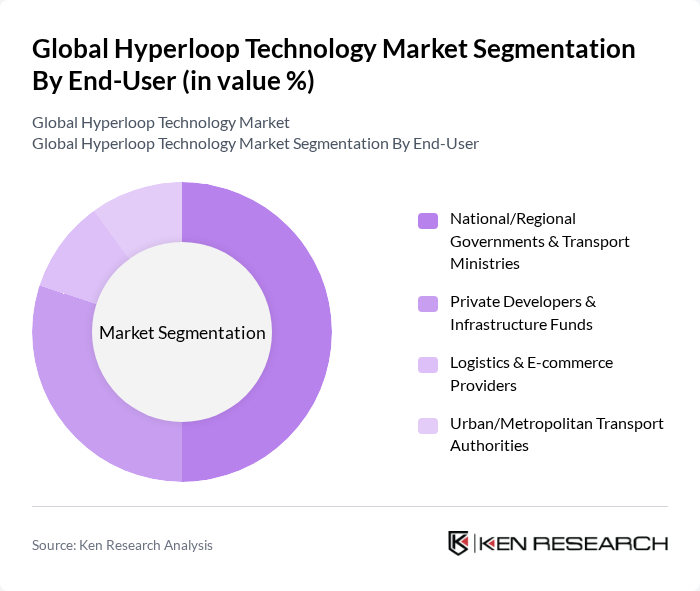

By End-User:The market is segmented by end-user, which includes National/Regional Governments & Transport Ministries, Private Developers & Infrastructure Funds, Logistics & E-commerce Providers, and Urban/Metropolitan Transport Authorities. National/Regional Governments & Transport Ministries dominate this segment as they are the primary investors in infrastructure projects and are responsible for regulatory frameworks that support the development of hyperloop systems. Their commitment to enhancing public transportation options significantly influences market dynamics .

The Global Hyperloop Technology Market is characterized by a dynamic mix of regional and international players. Leading participants such as Hyperloop Transportation Technologies (HTT), Hardt Hyperloop (Hardt Global Mobility), TransPod Inc., Zeleros Hyperloop, TUM Hyperloop, Swisspod Technologies, Nevomo (formerly Hyper Poland), The Boring Company, AECOM, Siemens AG, Alstom SA, Thales Group, Bechtel Corporation, Virgin Hyperloop One (legacy; now DP World Cargospeed), TCDD Ta??mac?l?k A.?. contribute to innovation, geographic expansion, and service delivery in this space .

The future of hyperloop technology appears promising, driven by increasing investments in infrastructure and a growing focus on sustainability. As governments and private entities collaborate on projects, the integration of smart technologies will enhance operational efficiency. Additionally, public-private partnerships are expected to play a crucial role in overcoming funding challenges, facilitating the development of hyperloop systems. With ongoing advancements in technology and a supportive regulatory environment, the hyperloop market is poised for significant growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Passenger Hyperloop Systems Freight/Cargo Hyperloop Systems Mixed-Use (Passenger + Freight) Corridors Feeder/Last-Mile and Test-Track Deployments |

| By End-User | National/Regional Governments & Transport Ministries Private Developers & Infrastructure Funds Logistics & E-commerce Providers Urban/Metropolitan Transport Authorities |

| By Application | Intercity and Interregional Travel (200–1,000 km) Cross-Border/International Corridors Dedicated Freight Lanes (Ports, Dry Ports, Airports) R&D, Prototyping, and Pilot Demonstrations |

| By Component | Pods/Capsules Guideway/Tubes & Civil Infrastructure Propulsion & Levitation (Linear Motors, Maglev, EDS/EMS) Power, Vacuum, and Control Systems (Pumps, SCADA, Signaling) |

| By Investment Source | Private Venture & Growth Equity Government Grants & Sovereign Funding Public-Private Partnerships (PPP/Concession) Corporate & Strategic Investments |

| By Policy Support | Pilot Exemptions & Regulatory Sandboxes Tax Incentives & Accelerated Depreciation Safety Certification & Standards Frameworks Land Acquisition & Right-of-Way Facilitation |

| By Market Maturity | Concept & Feasibility (Pre-commercial) Prototype & Test Track (TRL 4–6) Pilot Corridor Development (TRL 7–8) Early Commercial Deployment (TRL 9) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Passenger Transport Systems | 120 | Transportation Engineers, Urban Planners |

| Freight Transport Solutions | 100 | Logistics Managers, Supply Chain Analysts |

| Infrastructure Development Projects | 80 | Project Managers, Civil Engineers |

| Government Policy Makers | 70 | Transportation Policy Experts, Regulatory Officials |

| Investment and Funding Agencies | 60 | Venture Capitalists, Infrastructure Investors |

The Global Hyperloop Technology Market is valued at approximately USD 2 billion, driven by advancements in transportation technology, infrastructure investments, and the demand for energy-efficient mobility solutions.