Region:Global

Author(s):Rebecca

Product Code:KRAB0294

Pages:87

Published On:August 2025

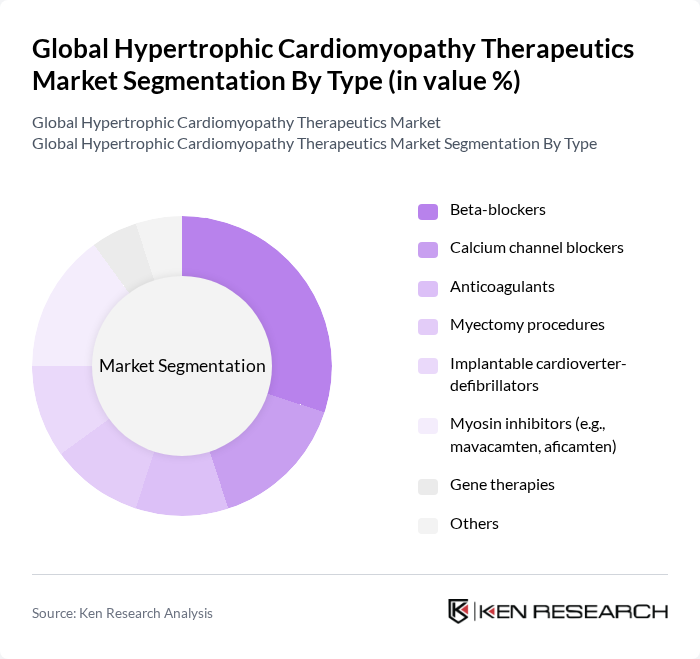

By Type:The market is segmented into various types of therapeutics, including beta-blockers, calcium channel blockers, anticoagulants, myectomy procedures, implantable cardioverter-defibrillators, myosin inhibitors, gene therapies, and others. Among these, beta-blockers and myosin inhibitors are particularly prominent due to their effectiveness in managing symptoms and improving patient quality of life. The increasing adoption of innovative therapies, such as gene therapies and targeted molecular treatments, is also gaining traction, reflecting a shift towards more personalized and disease-modifying treatment options .

By End-User:The end-user segmentation includes hospitals, specialty clinics, home healthcare, and research institutions. Hospitals are the leading end-users due to their capacity to provide comprehensive care and access to advanced treatment options. Specialty clinics are also gaining ground as they focus on specific cardiovascular conditions, offering tailored services that cater to the needs of HCM patients. Home healthcare and research institutions are expanding their roles, driven by the need for continuous patient monitoring and ongoing clinical research in HCM therapeutics .

The Global Hypertrophic Cardiomyopathy Therapeutics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bristol-Myers Squibb Company, Cytokinetics, Inc., MyoKardia, Inc. (a wholly owned subsidiary of Bristol-Myers Squibb), Novartis AG, Pfizer Inc., Sanofi S.A., Merck & Co., Inc., Eli Lilly and Company, AstraZeneca PLC, Gilead Sciences, Inc., Regeneron Pharmaceuticals, Inc., Takeda Pharmaceutical Company Limited, Roche Holding AG, Teva Pharmaceutical Industries Limited, Bayer AG contribute to innovation, geographic expansion, and service delivery in this space.

The future of the hypertrophic cardiomyopathy therapeutics market appears promising, driven by technological advancements and increased research funding. As telemedicine and remote monitoring become more prevalent, patient engagement and adherence to treatment protocols are expected to improve. Furthermore, the integration of artificial intelligence in drug development is likely to accelerate the discovery of novel therapeutics, enhancing treatment options. These trends will collectively shape a more robust market landscape in the None region, fostering innovation and improved patient care.

| Segment | Sub-Segments |

|---|---|

| By Type | Beta-blockers Calcium channel blockers Anticoagulants Myectomy procedures Implantable cardioverter-defibrillators Myosin inhibitors (e.g., mavacamten, aficamten) Gene therapies Others |

| By End-User | Hospitals Specialty clinics Home healthcare Research institutions |

| By Drug Class | Beta-blockers Calcium channel blockers Antiarrhythmic agents Anticoagulants Myosin inhibitors Biologics |

| By Distribution Channel | Retail pharmacies Online pharmacies Hospital pharmacies |

| By Treatment Approach | Pharmacological treatment Surgical intervention Lifestyle modification Device-based therapies |

| By Patient Demographics | Pediatric patients Adult patients Geriatric patients |

| By Geographic Distribution | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cardiologists Specializing in HCM | 60 | Cardiologists, Heart Failure Specialists |

| Pharmaceutical Executives in HCM | 40 | Product Managers, R&D Directors |

| Patients with Hypertrophic Cardiomyopathy | 100 | Patients, Caregivers |

| Healthcare Payers and Insurers | 40 | Policy Makers, Claims Analysts |

| Clinical Researchers in Cardiovascular Medicine | 50 | Clinical Trial Coordinators, Research Scientists |

The Global Hypertrophic Cardiomyopathy Therapeutics Market is valued at approximately USD 2.1 billion, reflecting a significant growth driven by the increasing prevalence of hypertrophic cardiomyopathy (HCM) and advancements in therapeutic options.