Region:Global

Author(s):Rebecca

Product Code:KRAA1346

Pages:81

Published On:August 2025

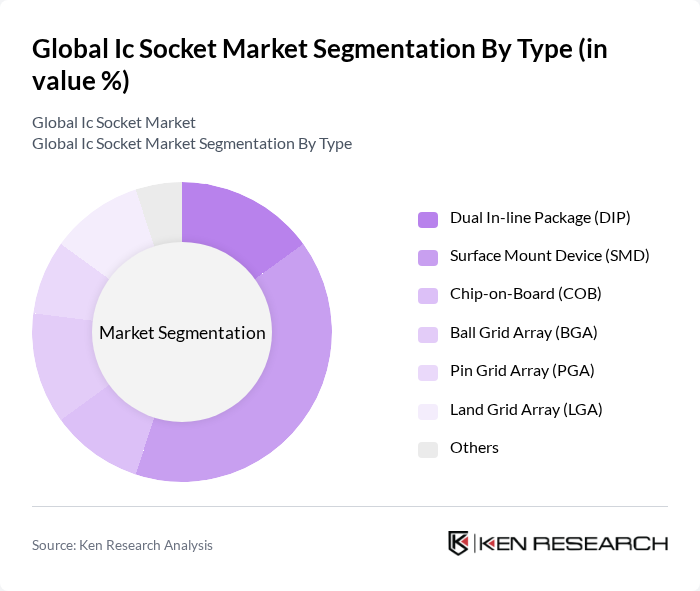

By Type:The IC socket market can be segmented into various types, including Dual In-line Package (DIP), Surface Mount Device (SMD), Chip-on-Board (COB), Ball Grid Array (BGA), Pin Grid Array (PGA), Land Grid Array (LGA), and others. Among these, the Surface Mount Device (SMD) segment is currently leading the market due to its compact size, high pin density, and ease of integration into modern electronic devices. The increasing trend towards miniaturization in electronics and the demand for high-performance, reliable connections have driven the adoption of SMD sockets, making them the preferred choice for manufacturers. Additionally, the expansion of the consumer electronics sector, which heavily relies on SMD technology, further solidifies its market leadership.

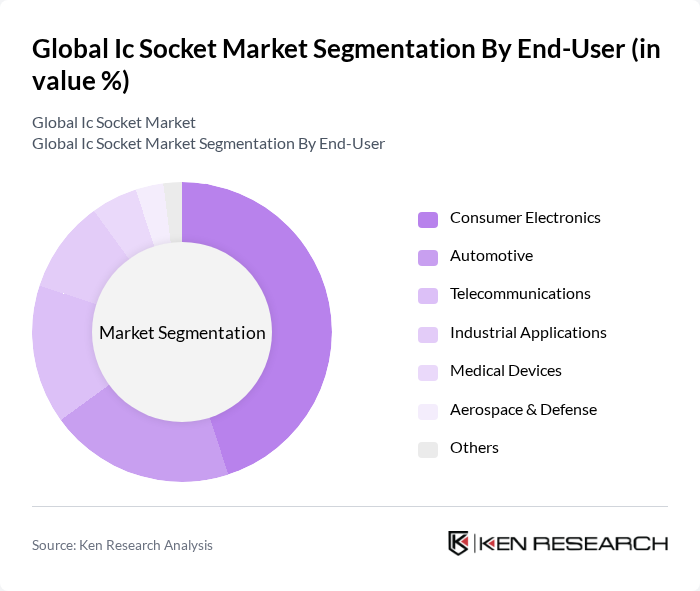

By End-User:The end-user segmentation of the IC socket market includes Consumer Electronics, Automotive, Telecommunications, Industrial Applications, Medical Devices, Aerospace & Defense, and others. The Consumer Electronics segment is the most significant contributor to the market, driven by the increasing demand for smartphones, tablets, and other electronic devices. Rapid technological advancements, the proliferation of smart devices, and the integration of advanced features in consumer electronics have led to a surge in the adoption of IC sockets in this sector. Additionally, the automotive industry's shift towards electric vehicles, advanced driver-assistance systems (ADAS), and increased electronic content per vehicle is also boosting the demand for IC sockets.

The Global IC Socket Market is characterized by a dynamic mix of regional and international players. Leading participants such as Yamaichi Electronics Co., Ltd., Enplas Corporation, 3M Company, TE Connectivity Ltd., Molex LLC, Plastronics Socket Company, Sensata Technologies, Inc. (including former Winchester Electronics), Foxconn Technology Group (Hon Hai Precision Industry Co., Ltd.), Samtec, Inc., Aries Electronics, Inc., Advanced Interconnect Inc., Andon Electronics Corporation, WinWay Technology Co., Ltd., Loranger International Corporation, Ironwood Electronics, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the IC socket market appears promising, driven by technological advancements and increasing demand for innovative electronic solutions. As manufacturers invest in sustainable practices and smart technologies, the integration of AI in production processes is expected to enhance efficiency and reduce costs. Additionally, the growth of electric vehicles will create new opportunities for specialized IC sockets, further expanding the market landscape and fostering innovation in product development.

| Segment | Sub-Segments |

|---|---|

| By Type | Dual In-line Package (DIP) Surface Mount Device (SMD) Chip-on-Board (COB) Ball Grid Array (BGA) Pin Grid Array (PGA) Land Grid Array (LGA) Others |

| By End-User | Consumer Electronics Automotive Telecommunications Industrial Applications Medical Devices Aerospace & Defense Others |

| By Application | Embedded Systems Power Management Signal Processing Data Storage Communication Devices Others |

| By Distribution Channel | Direct Sales Distributors Online Retail Wholesalers Others |

| By Material Type | Plastic Metal Ceramic Others |

| By Size | Small Medium Large Others |

| By Price Range | Low Medium High Others |

| By Geography | North America Europe Asia Pacific Middle East & Africa Latin America |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Electronics Manufacturers | 100 | Product Development Managers, Supply Chain Analysts |

| Automotive Electronics Suppliers | 80 | Engineering Managers, Procurement Specialists |

| Telecommunications Equipment Producers | 70 | R&D Engineers, Quality Assurance Managers |

| Industrial Automation Firms | 60 | Operations Managers, Technical Directors |

| Research Institutions and Universities | 40 | Academic Researchers, Industry Consultants |

The Global IC Socket Market is valued at approximately USD 1.9 billion, driven by the increasing demand for electronic devices, advancements in semiconductor technology, and the trend of miniaturization in electronics.