Region:Global

Author(s):Rebecca

Product Code:KRAD0271

Pages:94

Published On:August 2025

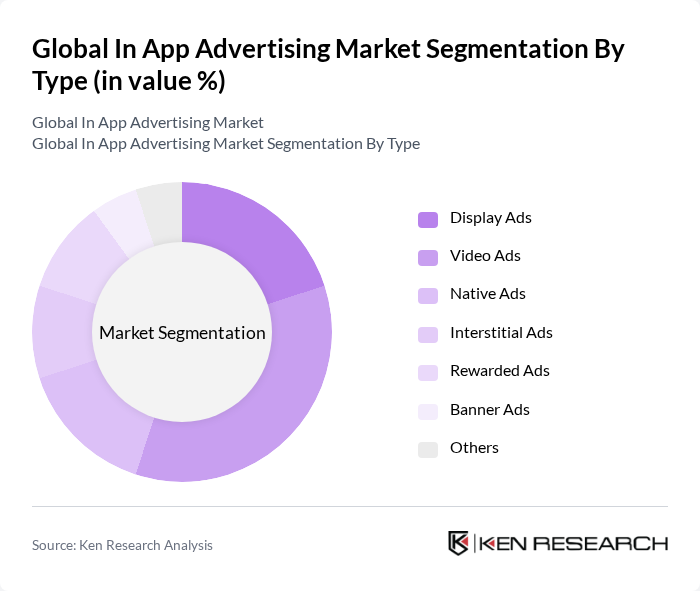

By Type:The in-app advertising market can be segmented into various types, including Display Ads, Video Ads, Native Ads, Interstitial Ads, Rewarded Ads, Banner Ads, and Others. Among these, Video Ads have gained significant traction due to their engaging nature, high conversion rates, and ability to convey messages effectively. Display Ads and Native Ads also play crucial roles, with brands leveraging their visual appeal and seamless integration into app content. The adoption of programmatic advertising and real-time bidding has further enhanced the efficiency and targeting of these ad formats.

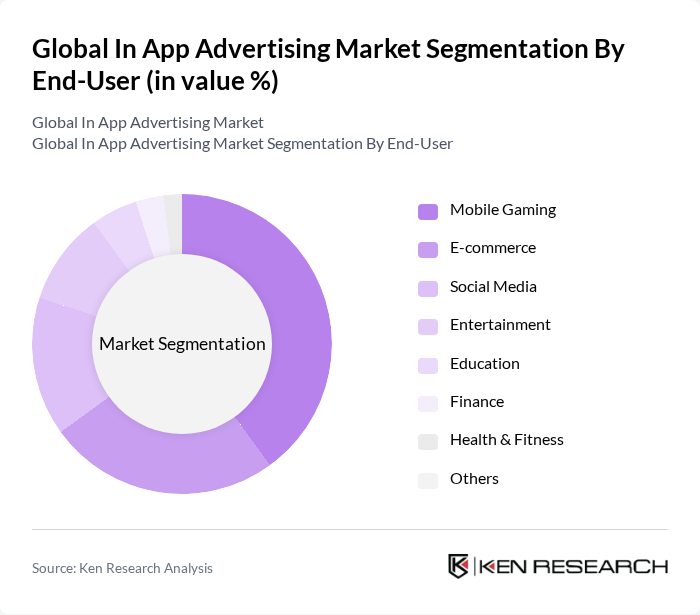

By End-User:The end-user segmentation includes Mobile Gaming, E-commerce, Social Media, Entertainment, Education, Finance, Health & Fitness, and Others. Mobile Gaming is the leading segment, driven by the increasing popularity of mobile games and the effectiveness of in-game advertising. E-commerce and Social Media also represent significant portions of the market, as brands seek to engage users where they spend most of their time. The entertainment and education segments are also experiencing growth as app-based content consumption rises.

The Global In App Advertising Market is characterized by a dynamic mix of regional and international players. Leading participants such as Google LLC (AdMob), Meta Platforms, Inc. (Facebook Audience Network), Amazon Ads, Apple Inc. (Apple Search Ads), Unity Technologies, AppLovin Corporation, ironSource Ltd., Vungle, Inc., Chartboost, InMobi, Digital Turbine, Inc., Snap Inc., TikTok For Business (ByteDance Ltd.), Taboola, AdColony (now part of Digital Turbine, Inc.) contribute to innovation, geographic expansion, and service delivery in this space.

The future of in-app advertising is poised for transformation, driven by technological advancements and evolving consumer preferences. As mobile device usage continues to rise, advertisers will increasingly leverage data analytics and artificial intelligence to enhance targeting and personalization. Additionally, the integration of immersive technologies, such as augmented reality, will create new advertising formats that engage users more effectively. These trends indicate a dynamic landscape where innovation will be key to capturing audience attention and driving revenue growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Display Ads Video Ads Native Ads Interstitial Ads Rewarded Ads Banner Ads Others |

| By End-User | Mobile Gaming E-commerce Social Media Entertainment Education Finance Health & Fitness Others |

| By Platform | Android iOS Windows Others |

| By Ad Format | Rich Media Ads Text Ads Image Ads Video Ads Playable Ads Others |

| By Campaign Type | Brand Awareness Lead Generation Customer Retention App Install Campaigns Engagement Campaigns Others |

| By Geographic Targeting | Local Targeting National Targeting Regional Targeting Global Targeting Others |

| By Pricing Model | Cost Per Click (CPC) Cost Per Impression (CPM) Cost Per Acquisition (CPA) Cost Per Install (CPI) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Mobile Gaming Apps | 100 | Product Managers, Marketing Directors |

| Social Media Platforms | 60 | Advertising Strategists, User Experience Designers |

| Utility and Productivity Apps | 40 | Business Development Managers, Data Analysts |

| eCommerce Mobile Applications | 80 | Digital Marketing Managers, Customer Engagement Leads |

| Health and Fitness Apps | 50 | Content Managers, Brand Strategists |

The Global In App Advertising Market is valued at approximately USD 182 billion, reflecting significant growth driven by smartphone penetration, mobile applications, and personalized advertising demand. This trend indicates a shift in advertising budgets from traditional media to in-app platforms.