Region:Global

Author(s):Shubham

Product Code:KRAA1926

Pages:89

Published On:August 2025

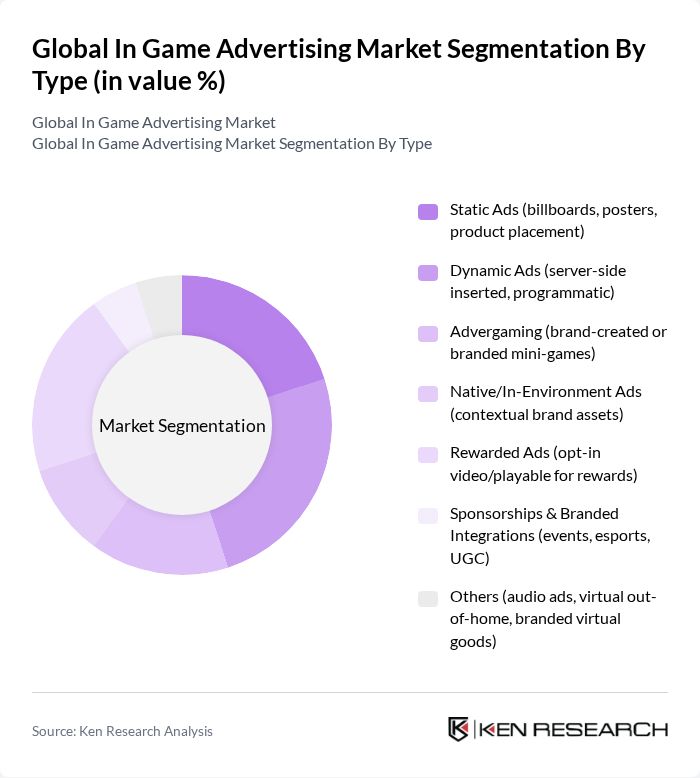

By Type:The segmentation by type includes various forms of in-game advertising, each catering to different marketing strategies and consumer engagement levels. The subsegments are as follows:

The dynamic ads segment is currently dominating the market due to its ability to deliver personalized and targeted advertising experiences. This subsegment leverages programmatic technology to insert ads in real-time, allowing advertisers to optimize their campaigns based on user behavior and preferences. The increasing demand for data-driven marketing strategies and the effectiveness of dynamic ads in engaging users have made this subsegment a preferred choice among advertisers.

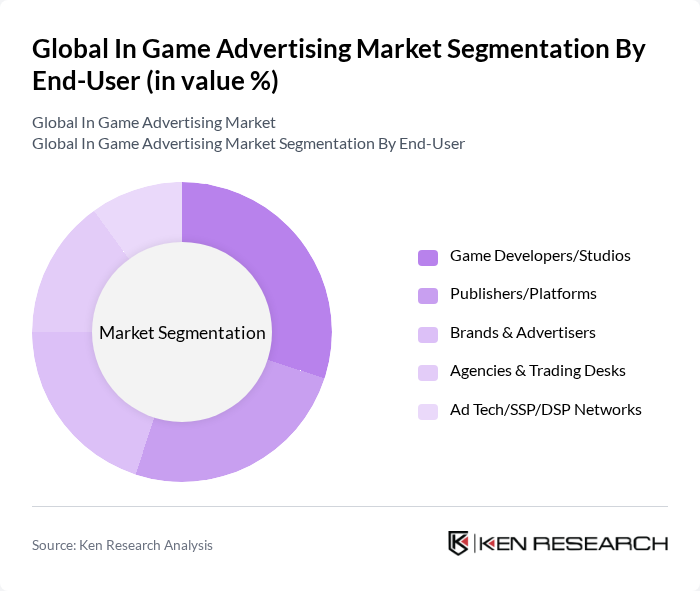

By End-User:The segmentation by end-user includes various stakeholders involved in the in-game advertising ecosystem. The subsegments are as follows:

The game developers/studios segment is leading the market as they are the primary creators of gaming content and have the most significant influence over the integration of advertising within their games. Their ability to create engaging experiences that seamlessly incorporate ads enhances user engagement and retention, making them essential partners for advertisers looking to reach targeted audiences effectively.

The Global In Game Advertising Market is characterized by a dynamic mix of regional and international players. Leading participants such as Unity Ads (Unity Technologies), AppLovin, Digital Turbine (including Fyber), ironSource (Unity LevelPlay), Vungle (Liftoff), Chartboost, InMobi, AdColony (Digital Turbine), Mintegral, Moloco, Anzu.io, Bidstack, Admix (Landvault), Adverty, Playwire, Activision Blizzard Media, Electronic Arts (EA Advertising), Zynga (Chartboost/SSP integrations), Roblox Advertising, Niantic contribute to innovation, geographic expansion, and service delivery in this space.

The future of in-game advertising is poised for significant transformation, driven by technological advancements and evolving consumer preferences. As mobile gaming continues to dominate, advertisers will increasingly adopt programmatic advertising strategies to enhance targeting and efficiency. Additionally, the integration of augmented reality (AR) and virtual reality (VR) in gaming will create immersive advertising experiences, fostering deeper engagement. Brands will also focus on developing interactive ad formats that resonate with players, ensuring a more seamless integration of advertising within the gaming experience.

| Segment | Sub-Segments |

|---|---|

| By Type | Static Ads (billboards, posters, product placement) Dynamic Ads (server-side inserted, programmatic) Advergaming (brand-created or branded mini-games) Native/In-Environment Ads (contextual brand assets) Rewarded Ads (opt-in video/playable for rewards) Sponsorships & Branded Integrations (events, esports, UGC) Others (audio ads, virtual out-of-home, branded virtual goods) |

| By End-User | Game Developers/Studios Publishers/Platforms Brands & Advertisers Agencies & Trading Desks Ad Tech/SSP/DSP Networks |

| By Platform | Mobile (iOS, Android) PC (client and browser) Console (PlayStation, Xbox, Nintendo) Cloud/Streaming (game streaming services) XR/Immersive (AR/VR/MR) |

| By Advertising Format | Display & Static Placements Video & Rewarded Video Playable & Interactive In-Environment/Intrinsic (3D in-scene) Audio Ads |

| By Game Genre | Action/Adventure Sports & Racing Role-Playing Games (RPG) Simulation & Strategy Casual/Hyper-casual & Puzzle |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Pricing Model | Cost Per Mille/Thousand (CPM) Cost Per Click (CPC) Cost Per Action/Acquisition (CPA) Cost Per Completed View (CPCV) / Viewability-Based Performance/Outcome-Based & Hybrid |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Mobile Game Developers | 100 | Product Managers, Marketing Directors |

| Console Game Publishers | 80 | Business Development Managers, Advertising Executives |

| PC Game Studios | 70 | Creative Directors, Monetization Specialists |

| Advertising Agencies Specializing in Gaming | 60 | Account Managers, Strategy Planners |

| Gamers (Diverse Demographics) | 140 | Casual Gamers, Competitive Gamers, Influencers |

The Global In Game Advertising Market is valued at approximately USD 8.6 billion, reflecting significant growth driven by mobile gaming, esports, and the acceptance of in-game advertising as a viable marketing channel.