Region:Global

Author(s):Dev

Product Code:KRAA2196

Pages:85

Published On:August 2025

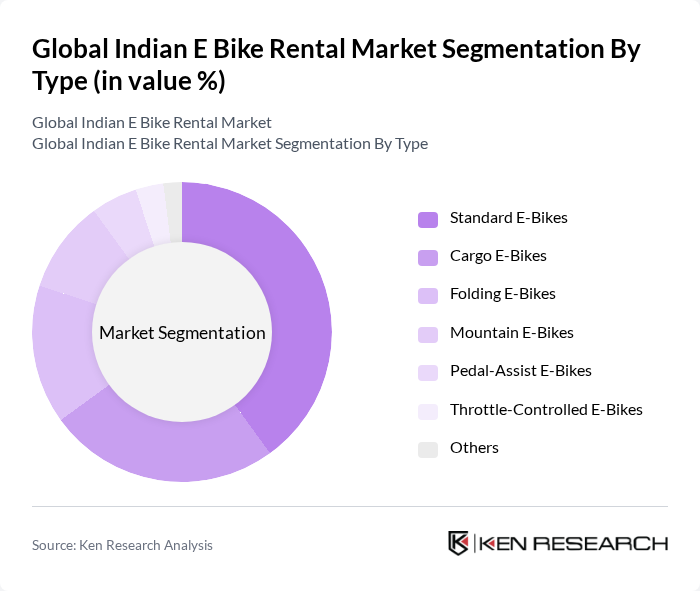

By Type:The e-bike rental market is segmented into various types, including Standard E-Bikes, Cargo E-Bikes, Folding E-Bikes, Mountain E-Bikes, Pedal-Assist E-Bikes, Throttle-Controlled E-Bikes, and Others. Among these, Standard E-Bikes are the most popular due to their versatility and ease of use, appealing to a broad range of consumers. Cargo E-Bikes are gaining traction for delivery services, while Folding E-Bikes are favored for their portability in urban settings. The growing trend towards sustainable transportation, coupled with the integration of smart features and mobile app connectivity, is driving the demand for all types of e-bikes .

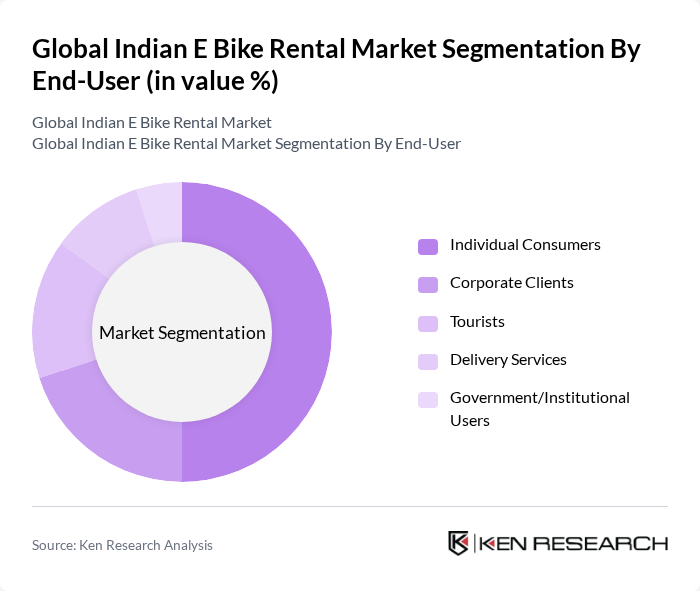

By End-User:The market is segmented by end-users, including Individual Consumers, Corporate Clients, Tourists, Delivery Services, and Government/Institutional Users. Individual Consumers dominate the market, driven by the increasing trend of personal mobility solutions and the convenience offered by e-bike rentals. Delivery Services are also a significant segment, as businesses seek efficient and eco-friendly options for last-mile delivery. The growing interest in sustainable travel among tourists, along with the adoption of e-bikes for institutional and government use in smart city initiatives, further enhances the market's potential .

The Global Indian E Bike Rental Market is characterized by a dynamic mix of regional and international players. Leading participants such as Yulu Bikes Pvt. Ltd., Bounce (Wicked Ride Adventure Services Pvt. Ltd.), Ola Electric Mobility Pvt. Ltd., Zypp Electric (BycyShare Technologies Pvt. Ltd.), eBikeGo Pvt. Ltd., Vogo Automotive Pvt. Ltd., Drivezy (JustRide Touring Pvt. Ltd.), ONN Bikes (Motorcruizer Technologies India Pvt. Ltd.), Wheelstreet (Bikes4Everything Pvt. Ltd.), Rentomojo (Edunetwork Pvt. Ltd.), Voltium, EXA Mobility (EXA Ride), Motoride Scooter Rentals, Giant Bikes, SmartE contribute to innovation, geographic expansion, and service delivery in this space .

The future of the e-bike rental market in India appears promising, driven by increasing urbanization and government support for electric mobility. As cities expand, the demand for sustainable transport solutions will likely rise. Additionally, technological advancements in battery life and charging efficiency will enhance the appeal of e-bikes. The integration of e-bike rentals into smart city initiatives will further facilitate their adoption, making them a vital component of urban transportation networks in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Standard E-Bikes Cargo E-Bikes Folding E-Bikes Mountain E-Bikes Pedal-Assist E-Bikes Throttle-Controlled E-Bikes Others |

| By End-User | Individual Consumers Corporate Clients Tourists Delivery Services Government/Institutional Users |

| By Region | North India South India East India West India Central India |

| By Rental Model | Hourly Rentals Daily Rentals Weekly Rentals Monthly Subscriptions Long-term Rentals |

| By Payment Method | Online Payments Cash Payments Mobile Wallets UPI/QR Code Payments |

| By Service Type | Self-Service Kiosks Mobile App-Based Rentals Station-Based Rentals Dockless Rentals |

| By Customer Segment | Students Professionals Families Tourists Delivery Personnel |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Urban Commuters | 100 | Daily commuters, college students, working professionals |

| E-bike Rental Operators | 60 | Business owners, fleet managers, operational staff |

| Government Officials | 40 | Transport policy makers, urban planners, sustainability officers |

| Environmental Advocates | 40 | NGO representatives, sustainability consultants, researchers |

| Potential Users | 80 | Individuals considering e-bike rentals, tech-savvy users, eco-conscious consumers |

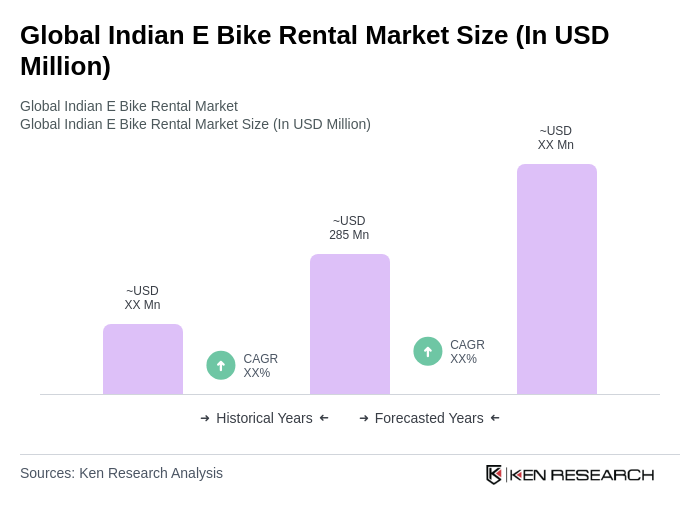

The Global Indian E Bike Rental Market is valued at approximately USD 285 million, driven by the increasing demand for eco-friendly transportation solutions and the popularity of shared mobility services in urban areas.