Region:Global

Author(s):Dev

Product Code:KRAA1511

Pages:92

Published On:August 2025

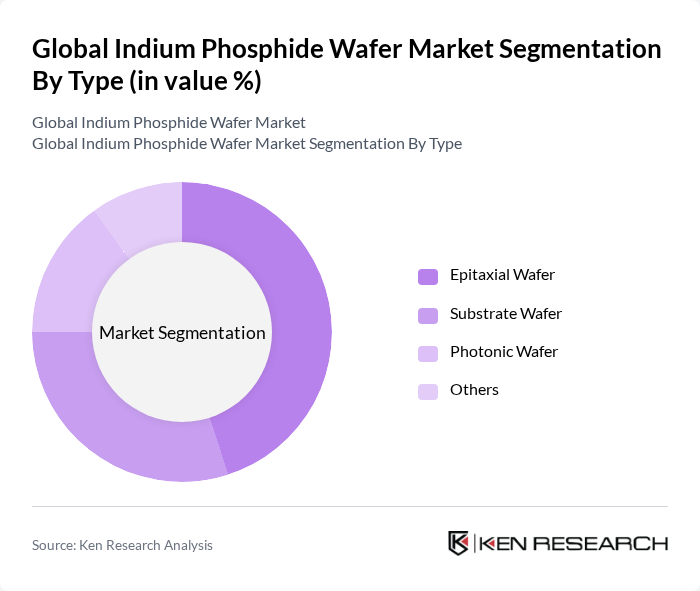

By Type:The market is segmented into various types of wafers, including Epitaxial Wafer, Substrate Wafer, Photonic Wafer, and Others. Among these, the Epitaxial Wafer segment is currently leading the market due to its extensive application in high-frequency electronics, laser diodes, and advanced photonic devices. The demand for Epitaxial Wafers is driven by their superior performance in telecommunications, data center applications, and next-generation optical networks, where high-speed data transmission and low energy consumption are critical. The Substrate Wafer segment follows closely, as it is essential for the fabrication of a broad range of electronic and optoelectronic devices .

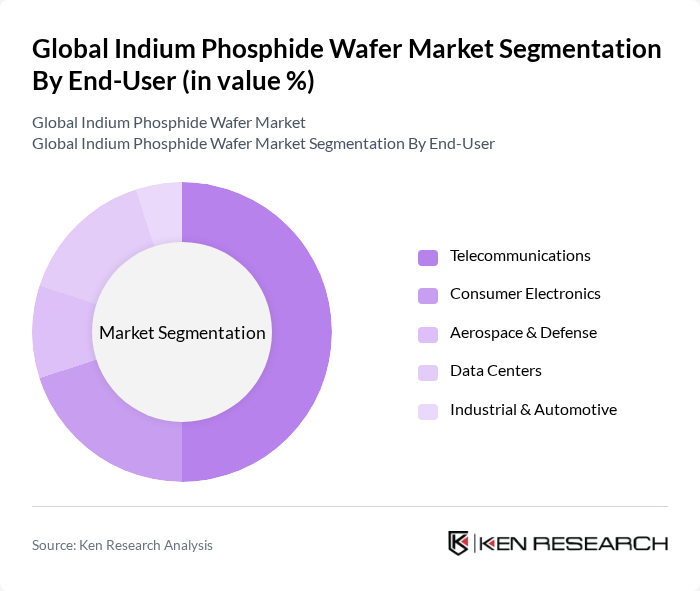

By End-User:The end-user segmentation includes Telecommunications, Consumer Electronics, Aerospace & Defense, Data Centers, and Industrial & Automotive. The Telecommunications sector is the dominant end-user, driven by the rapid deployment of 5G networks, expansion of fiber optic infrastructure, and increasing demand for high-speed data transmission. This sector's growth is supported by the need for advanced components that can handle higher frequencies and data rates, making indium phosphide wafers a preferred choice. The Data Centers segment is also growing significantly, as they require efficient and high-performance materials for optical interconnects and photonic integration in server and storage networks .

The Global Indium Phosphide Wafer Market is characterized by a dynamic mix of regional and international players. Leading participants such as II-VI Incorporated (now Coherent Corp.), AXT Inc., Sumitomo Electric Industries, Ltd., Wafer World Inc., NTT Advanced Technology Corporation, Xiamen Powerway Advanced Material Co., Ltd., JX Nippon Mining & Metals Corporation, Century Goldray Semiconductor Co., Ltd., Western Minmetals (SC) Corporation, Semiconductor Wafer Inc., Ding Ten Industrial Inc., Logitech Ltd., Broadcom Inc., Mitsubishi Electric Corporation, Intel Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the indium phosphide wafer market appears promising, driven by technological advancements and increasing applications in high-speed electronics and photonics. As industries continue to innovate, the demand for efficient and high-performance materials will rise. Additionally, the ongoing expansion of telecommunications infrastructure and the integration of AI in manufacturing processes are expected to create new opportunities for growth. Companies that adapt to these trends will likely gain a competitive edge in the evolving market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Epitaxial Wafer Substrate Wafer Photonic Wafer Others |

| By End-User | Telecommunications Consumer Electronics Aerospace & Defense Data Centers Industrial & Automotive |

| By Application | Laser Diodes Photodetectors High-Frequency Electronics Optical Transceivers Solar Cells Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | North America Europe Asia-Pacific Rest of the World |

| By Price Range | Premium Mid-Range Budget |

| By Technology | MBE (Molecular Beam Epitaxy) MOCVD (Metal-Organic Chemical Vapor Deposition) HVPE (Hydride Vapor Phase Epitaxy) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Telecommunications Applications | 100 | Product Managers, Technology Directors |

| Aerospace & Defense Sector | 60 | Engineering Managers, Procurement Specialists |

| Consumer Electronics Market | 80 | Supply Chain Managers, R&D Engineers |

| Industrial Applications | 50 | Operations Managers, Quality Assurance Leads |

| Research Institutions & Universities | 40 | Academic Researchers, Lab Directors |

The Global Indium Phosphide Wafer Market is valued at approximately USD 200 million, driven by the increasing demand for high-speed telecommunications and advanced electronic devices that require high-performance materials.