Region:Global

Author(s):Shubham

Product Code:KRAC0747

Pages:94

Published On:August 2025

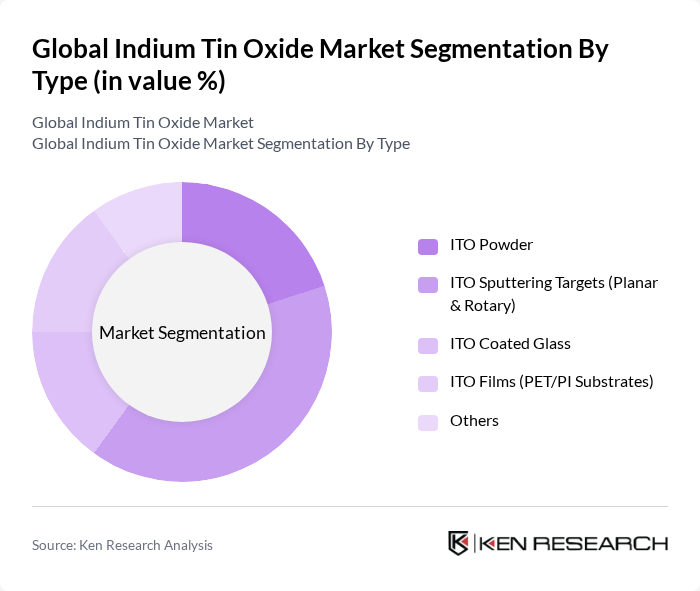

By Type:The market is segmented into various types, including ITO Powder, ITO Sputtering Targets (Planar & Rotary), ITO Coated Glass, ITO Films (PET/PI Substrates), and Others. Among these, ITO Sputtering Targets are leading the market due to their extensive use in the manufacturing of flat panel displays and photovoltaic cells, driven by the increasing demand for high-quality displays in consumer electronics.

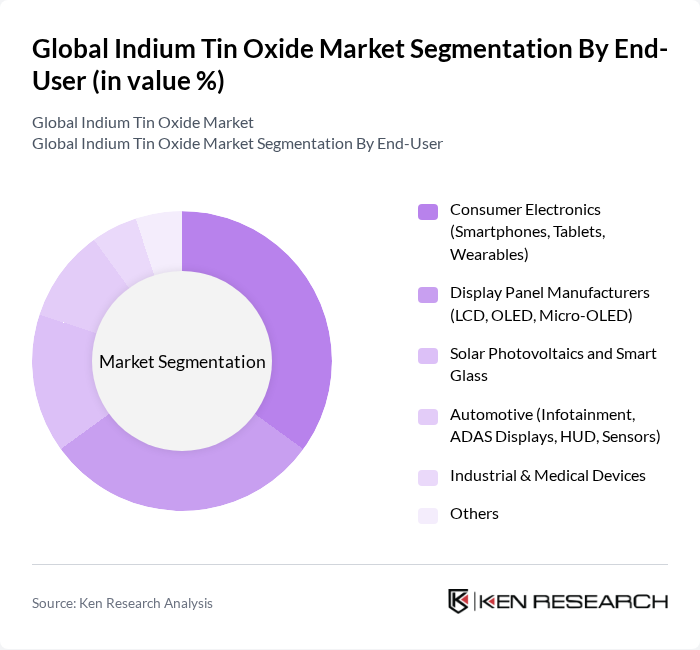

By End-User:The end-user segmentation includes Consumer Electronics (Smartphones, Tablets, Wearables), Display Panel Manufacturers (LCD, OLED, Micro-OLED), Solar Photovoltaics and Smart Glass, Automotive (Infotainment, ADAS Displays, HUD, Sensors), Industrial & Medical Devices, and Others. The Consumer Electronics segment is the most significant contributor, driven by the rapid growth of smartphones and tablets, which require advanced display technologies.

The Global Indium Tin Oxide Market is characterized by a dynamic mix of regional and international players. Leading participants such as JX Nippon Mining & Metals Corporation, Mitsui Mining & Smelting Co., Ltd., Tosoh SMD, Inc., Umicore, Indium Corporation, Materion Corporation, Vital Materials Co., Ltd., Samsung Corning Advanced Glass, ULVAC, Inc., Advanced Nano Products Co., Ltd., Daejoo Electronic Materials Co., Ltd., Heraeus Group, LG Chem, Nitto Denko Corporation, Mitsubishi Materials Corporation, Kanto Chemical Co., Inc., LT Metal Co., Ltd., Nanjing Jinmeixin Technology Co., Ltd., Soleras Advanced Coatings, Aimcore Technology Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the indium tin oxide market appears promising, driven by technological advancements and increasing applications across various sectors. The shift towards sustainable materials and the integration of IoT in manufacturing processes are expected to enhance efficiency and reduce costs. Additionally, the rise of flexible electronics and smart glass applications will likely create new avenues for growth, positioning ITO as a critical component in the evolving technological landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | ITO Powder ITO Sputtering Targets (Planar & Rotary) ITO Coated Glass ITO Films (PET/PI Substrates) Others |

| By End-User | Consumer Electronics (Smartphones, Tablets, Wearables) Display Panel Manufacturers (LCD, OLED, Micro?OLED) Solar Photovoltaics and Smart Glass Automotive (Infotainment, ADAS Displays, HUD, Sensors) Industrial & Medical Devices Others |

| By Application | Touch Panels & Sensors Flat Panel Displays (LCD/OLED) Photovoltaics & Transparent Electrodes Electrochromic/Smart Windows Antistatic and EMI Shielding Coatings Others |

| By Distribution Channel | Direct Sales to OEMs/Panel Fabs Distributors/Value-Added Resellers Online/Inside Sales Others |

| By Region | North America Europe Asia-Pacific Middle East & Africa Latin America |

| By Pricing Strategy | Long-Term Offtake/Contract Pricing Spot/Index-Linked Pricing Value-Based Pricing (Purity, Sheet Resistance Specs) Others |

| By Product Form | ITO Powder (Different Indium:Tin Ratios) ITO Sputtering Targets (Planar, Rotary) ITO-Coated Substrates (Glass/Polymer) ITO Inks and Pastes Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Display Manufacturing Sector | 120 | Production Managers, Supply Chain Managers |

| Photovoltaic Applications | 80 | Research Scientists, Product Development Engineers |

| Touchscreen Technology | 90 | Technical Directors, Quality Assurance Managers |

| Consumer Electronics | 70 | Market Analysts, Procurement Specialists |

| Emerging Applications in Optoelectronics | 60 | Innovation Managers, Business Development Executives |

The Global Indium Tin Oxide Market is valued at approximately USD 1.9 billion, driven by the increasing adoption of touch screen devices and advancements in photovoltaic technologies that require high-performance materials like ITO for efficient energy conversion and display functionality.