Region:Global

Author(s):Rebecca

Product Code:KRAA1414

Pages:95

Published On:August 2025

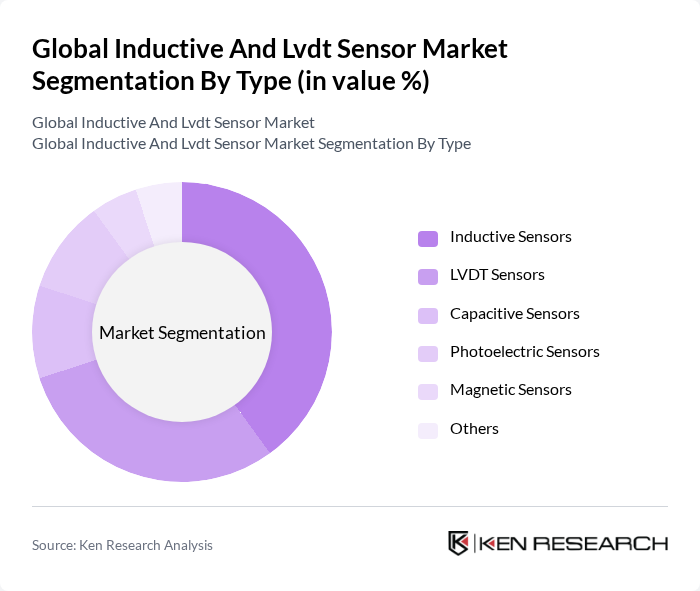

By Type:The market is segmented into various types of sensors, including Inductive Sensors, LVDT Sensors, Capacitive Sensors, Photoelectric Sensors, Magnetic Sensors, and Others. Among these, Inductive Sensors and LVDT Sensors are the most prominent due to their widespread application in industrial automation, robotics, and precision measurement. Inductive Sensors are favored for their robustness, non-contact operation, and reliability in harsh environments, while LVDT Sensors are preferred for their high linearity, accuracy, and suitability for displacement measurement in critical applications .

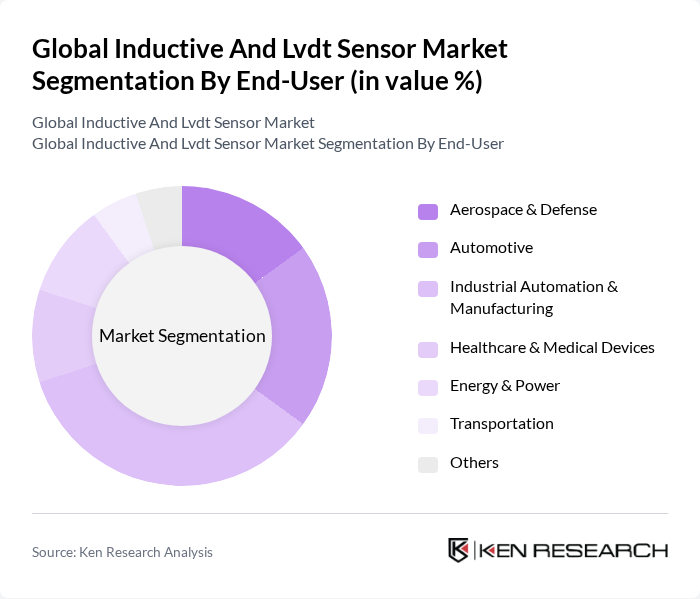

By End-User:The end-user segmentation includes Aerospace & Defense, Automotive, Industrial Automation & Manufacturing, Healthcare & Medical Devices, Energy & Power, Transportation, and Others. The Industrial Automation & Manufacturing sector leads the market due to the increasing need for automation, predictive maintenance, and precision in production processes. The automotive industry also significantly contributes to the demand for sensors, driven by the rise of electric vehicles, advanced driver-assistance systems (ADAS), and the integration of sensors in safety-critical applications .

The Global Inductive And Lvdt Sensor Market is characterized by a dynamic mix of regional and international players. Leading participants such as Honeywell International Inc., Siemens AG, TE Connectivity Ltd., Vishay Precision Group, Inc., National Instruments Corporation, Omega Engineering, Inc., Analog Devices, Inc., Microchip Technology Inc., Renishaw plc, Bourns, Inc., Kistler Instrumente AG, AMETEK, Inc., Endress+Hauser AG, IFM Electronic GmbH, SICK AG, Keyence Corporation, RDP Electrosense Inc., Balluff GmbH, Turck GmbH & Co. KG, Pepperl+Fuchs SE contribute to innovation, geographic expansion, and service delivery in this space.

The future of the inductive and LVDT sensor market appears promising, driven by technological advancements and increasing automation across various sectors. As industries continue to embrace Industry 4.0, the integration of smart technologies and IoT will enhance sensor capabilities, leading to more precise measurements and data analytics. Furthermore, the growing emphasis on sustainability will push manufacturers to develop eco-friendly sensor solutions, aligning with global environmental goals. This evolving landscape presents significant opportunities for innovation and market expansion.

| Segment | Sub-Segments |

|---|---|

| By Type | Inductive Sensors LVDT Sensors Capacitive Sensors Photoelectric Sensors Magnetic Sensors Others |

| By End-User | Aerospace & Defense Automotive Industrial Automation & Manufacturing Healthcare & Medical Devices Energy & Power Transportation Others |

| By Application | Position Sensing Displacement Measurement Pressure Measurement Force Measurement Vibration Monitoring Quality Control & Testing Others |

| By Component | Sensor Element Signal Conditioning Electronics Transmitters Controllers Others |

| By Sales Channel | Direct Sales Distributors Online Sales System Integrators Others |

| By Distribution Mode | Retail Wholesale E-commerce Others |

| By Price Range | Low Range Mid Range High Range Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Sensor Applications | 100 | Automotive Engineers, R&D Managers |

| Aerospace Measurement Systems | 80 | Aerospace Engineers, Quality Assurance Managers |

| Industrial Automation Solutions | 120 | Plant Managers, Automation Specialists |

| Consumer Electronics Integration | 70 | Product Development Engineers, Electronics Designers |

| Research and Development in Sensor Technology | 90 | Research Scientists, Technical Directors |

The Global Inductive and LVDT Sensor Market is valued at approximately USD 1.6 billion, driven by increasing automation demands and advancements in sensor technology that enhance precision and reliability across various industries.