Region:Global

Author(s):Rebecca

Product Code:KRAB0283

Pages:80

Published On:August 2025

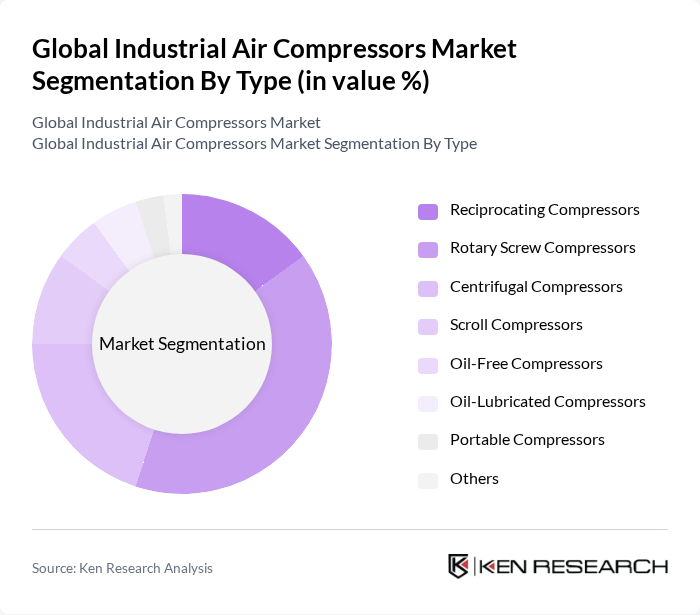

By Type:The market is segmented into various types of compressors, including reciprocating compressors, rotary screw compressors, centrifugal compressors, scroll compressors, oil-free compressors, oil-lubricated compressors, portable compressors, and others. Among these, rotary screw compressors are the most dominant due to their high efficiency, reliability in continuous operation, and widespread use in industrial applications. Positive displacement compressors, which include rotary screw and reciprocating types, collectively hold the largest market share due to their versatility and suitability for a broad range of industrial uses.

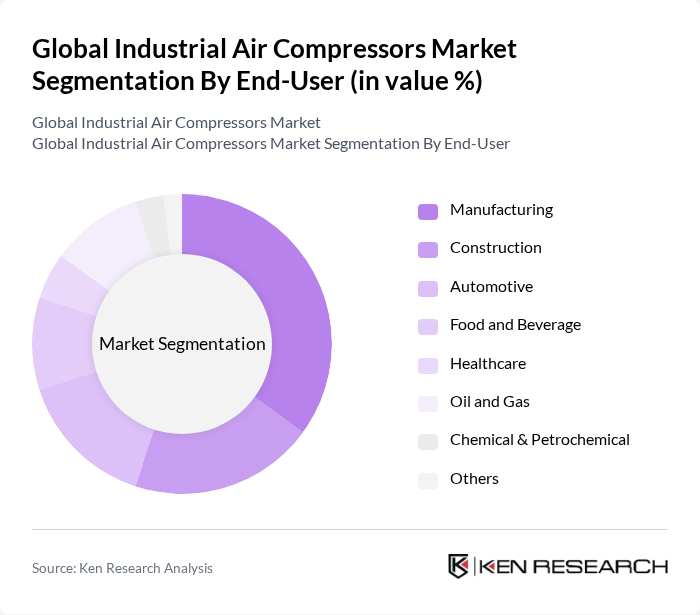

By End-User:The end-user segmentation includes manufacturing, construction, automotive, food and beverage, healthcare, oil and gas, chemical & petrochemical, and others. The manufacturing sector is the largest consumer of industrial air compressors, driven by the need for automation, efficient production processes, and the adoption of smart manufacturing practices that require reliable compressed air systems. The oil & gas, construction, and automotive sectors also represent significant demand due to their reliance on compressed air for various operational needs.

The Global Industrial Air Compressors Market is characterized by a dynamic mix of regional and international players. Leading participants such as Atlas Copco AB, Ingersoll Rand Inc., Siemens AG, Sullair LLC, Kaeser Kompressoren SE, Gardner Denver Holdings, Inc., BOGE Kompressoren GmbH & Co. KG, Hitachi Industrial Equipment Systems Co., Ltd., Quincy Compressor LLC, ELGi Equipments Limited, Fusheng Co., Ltd., Doosan Portable Power (Doosan Infracore), Chicago Pneumatic, CompAir (Gardner Denver), TMC Compressors of the Seas AS, Kobe Steel, Ltd. (Kobelco Compressors), Mitsubishi Heavy Industries, Ltd., Kirloskar Pneumatic Company Limited, Sulzer Ltd., Baker Hughes Company, Danfoss Group, Nardi Compressori Srl, Man Energy Solutions SE contribute to innovation, geographic expansion, and service delivery in this space.

The future of the industrial air compressors market appears promising, driven by ongoing technological advancements and increasing industrial automation. As industries continue to prioritize energy efficiency and sustainability, the demand for innovative compressor solutions is expected to rise. Additionally, the integration of IoT technologies will enhance operational efficiency, allowing for real-time monitoring and predictive maintenance. This trend is likely to reshape the market landscape, fostering a competitive environment focused on smart, energy-efficient solutions.

| Segment | Sub-Segments |

|---|---|

| By Type | Reciprocating Compressors Rotary Screw Compressors Centrifugal Compressors Scroll Compressors Oil-Free Compressors Oil-Lubricated Compressors Portable Compressors Others |

| By End-User | Manufacturing Construction Automotive Food and Beverage Healthcare Oil and Gas Chemical & Petrochemical Others |

| By Application | Pneumatic Tools Material Handling Process Control Spray Painting HVAC Systems Power Generation Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Outlets Others |

| By Region | North America (U.S., Canada, Mexico) Europe (Germany, UK, France, Italy, Spain) Asia-Pacific (China, India, Japan, South Korea, Australia) Latin America (Brazil, Argentina) Middle East & Africa (Saudi Arabia, South Africa) Others |

| By Price Range | Low Range Mid Range High Range Others |

| By Technology | Variable Speed Drive Fixed Speed Drive IoT-Enabled Compressors Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturing Sector Air Compressor Usage | 120 | Production Managers, Facility Engineers |

| Automotive Industry Compressed Air Systems | 90 | Maintenance Supervisors, Operations Directors |

| Food Processing Air Compression Needs | 60 | Quality Assurance Managers, Plant Managers |

| Construction Equipment Air Compressors | 50 | Site Managers, Equipment Procurement Officers |

| Energy Efficiency in Air Compressors | 55 | Energy Managers, Sustainability Officers |

The Global Industrial Air Compressors Market is valued at approximately USD 39 billion, driven by the increasing demand for energy-efficient and reliable air compression solutions across various industries such as manufacturing, automotive, and construction.