Region:Global

Author(s):Shubham

Product Code:KRAA2648

Pages:84

Published On:August 2025

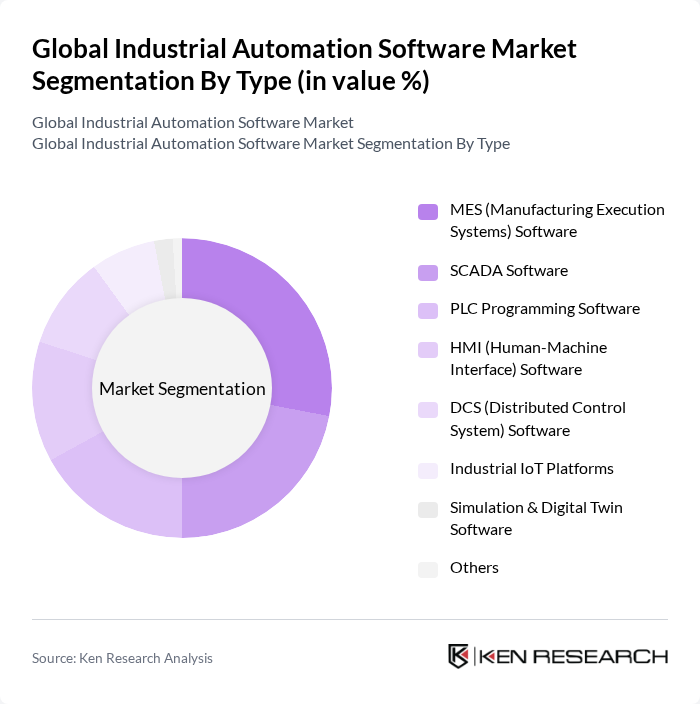

By Type:The market is segmented into various types of software, including SCADA Software, PLC Programming Software, HMI (Human-Machine Interface) Software, MES (Manufacturing Execution Systems) Software, DCS (Distributed Control System) Software, Industrial IoT Platforms, Simulation & Digital Twin Software, and Others.MES Softwarecurrently holds the largest share due to its critical role in enabling real-time monitoring, quality control, and process optimization across diverse industries. SCADA and HMI software remain essential for operational efficiency and real-time data analysis, while Industrial IoT platforms are rapidly gaining adoption for their ability to connect and manage smart devices in industrial environments .

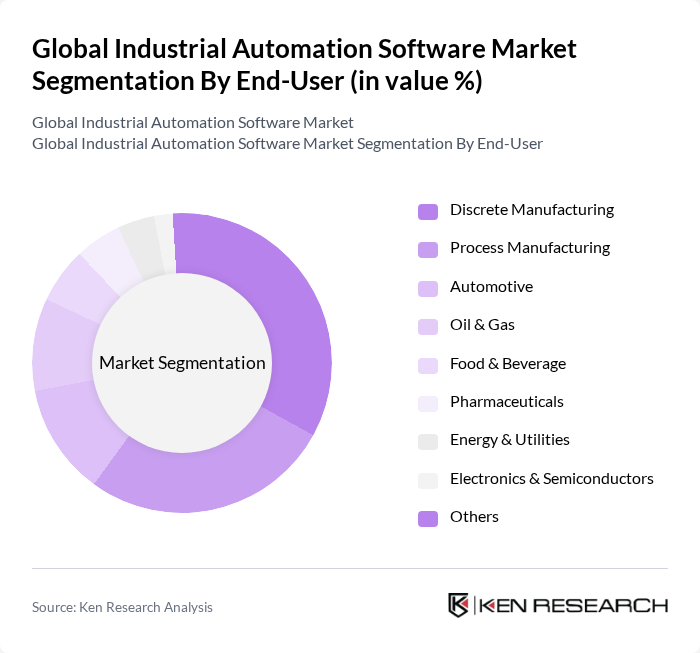

By End-User:The end-user segmentation includes Discrete Manufacturing, Process Manufacturing, Oil & Gas, Automotive, Food & Beverage, Pharmaceuticals, Energy & Utilities, Electronics & Semiconductors, and Others.Discrete Manufacturingremains the leading segment, driven by the increasing need for automation in production lines to enhance productivity, reduce operational costs, and improve product quality. Process manufacturing and the automotive sector are also significant adopters, leveraging automation software for efficiency, compliance, and digital transformation .

The Global Industrial Automation Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens AG, Rockwell Automation, Inc., Schneider Electric SE, ABB Ltd., Honeywell International Inc., Mitsubishi Electric Corporation, Emerson Electric Co., Yokogawa Electric Corporation, Bosch Rexroth AG, General Electric Company, PTC Inc., Dassault Systèmes SE, Siemens Digital Industries Software, Ansys, Inc., Altair Engineering, Inc., SAP SE, Oracle Corporation, Aspen Technology, Inc., Aveva Group plc, Fanuc Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the industrial automation software market appears promising, driven by technological advancements and increasing demand for efficiency. As industries continue to embrace digital transformation, the integration of AI and machine learning will enhance predictive maintenance capabilities. Furthermore, the rise of cloud-based solutions will facilitate easier access to automation tools, enabling companies to scale operations effectively. These trends indicate a robust growth trajectory, positioning the market for significant advancements in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | SCADA Software PLC Programming Software HMI (Human-Machine Interface) Software MES (Manufacturing Execution Systems) Software DCS (Distributed Control System) Software Industrial IoT Platforms Simulation & Digital Twin Software Others |

| By End-User | Discrete Manufacturing Process Manufacturing Oil & Gas Automotive Food & Beverage Pharmaceuticals Energy & Utilities Electronics & Semiconductors Others |

| By Application | Process Automation Discrete Automation Robotics Integration Quality Control & Inspection Supply Chain & Logistics Management Predictive Maintenance Others |

| By Deployment Model | On-Premises Cloud-Based Hybrid |

| By Industry Vertical | Aerospace & Defense Chemicals Electronics Utilities Metals & Mining Pulp & Paper Others |

| By Sales Channel | Direct Sales Distributors & System Integrators Online Sales Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturing Automation Software | 60 | IT Managers, Production Supervisors |

| Process Automation Solutions | 45 | Operations Directors, Process Engineers |

| Industrial IoT Platforms | 40 | Data Analysts, IoT Specialists |

| Robotics Process Automation | 42 | Automation Engineers, Project Managers |

| Control Systems Software | 50 | Control Engineers, System Integrators |

The Global Industrial Automation Software Market is valued at approximately USD 22 billion, driven by the increasing demand for automation in manufacturing processes and the rise of Industry 4.0, which emphasizes operational efficiency across various sectors.