Region:Global

Author(s):Dev

Product Code:KRAB0375

Pages:80

Published On:August 2025

By Type:The market is segmented into various types of chocolate products, including milk chocolate, dark chocolate, white chocolate, ruby chocolate, compound chocolate, and cocoa derivatives. Among these, milk chocolate is the most popular due to its creamy texture and widespread use in confectionery and baking. Dark chocolate is gaining traction due to its health benefits, while cocoa derivatives are essential for various applications in the food industry.

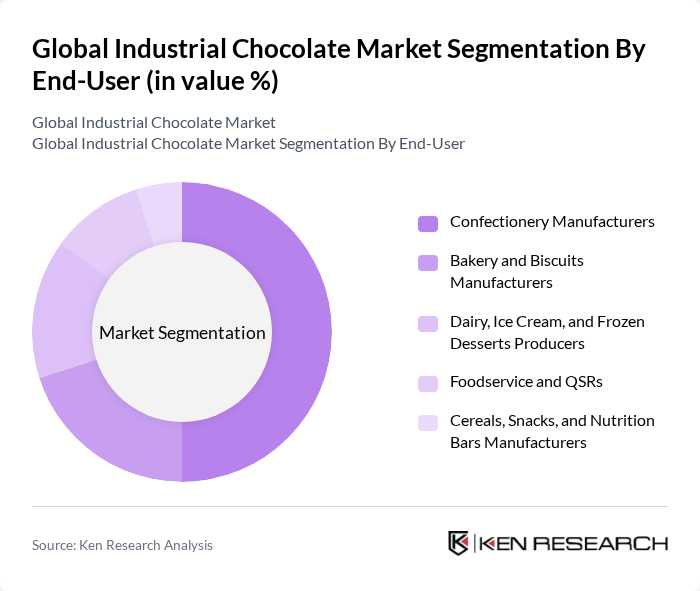

By End-User:The industrial chocolate market serves various end-users, including confectionery manufacturers, bakery and biscuits manufacturers, dairy, ice cream, and frozen desserts producers, foodservice and quick-service restaurants (QSRs), and cereals, snacks, and nutrition bars manufacturers. Confectionery manufacturers are the largest consumers of industrial chocolate, driven by the high demand for chocolate bars, candies, and other sweet treats.

The Global Industrial Chocolate Market is characterized by a dynamic mix of regional and international players. Leading participants such as Barry Callebaut AG, Cargill, Incorporated, Mondelez International, Inc., Mars, Incorporated, Ferrero International S.A., Nestlé S.A., Chocoladefabriken Lindt & Sprüngli AG, ofi (Olam Food Ingredients, a member of Olam Group), Blommer Chocolate Company (a Fuji Oil Holdings subsidiary), Fuji Oil Holdings Inc., Puratos Group, Cémoi Group, Guittard Chocolate Company, TCHO Chocolate, The Hershey Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of the industrial chocolate market in None appears promising, driven by evolving consumer preferences and a focus on sustainability. As health-conscious trends continue to shape purchasing decisions, manufacturers are likely to invest in healthier formulations and sustainable sourcing practices. Additionally, the rise of e-commerce platforms is expected to enhance market accessibility, allowing brands to reach a broader audience. Innovations in product development will further stimulate growth, ensuring the market remains dynamic and responsive to consumer demands.

| Segment | Sub-Segments |

|---|---|

| By Type | Milk Chocolate (Industrial couverture/compound) Dark Chocolate (including high-cocoa and sugar-reduced) White Chocolate Ruby Chocolate Compound Chocolate (cocoa butter equivalents/replacers) Cocoa Derivatives (cocoa liquor/mass, cocoa butter, cocoa powder) |

| By End-User | Confectionery Manufacturers Bakery and Biscuits Manufacturers Dairy, Ice Cream, and Frozen Desserts Producers Foodservice and QSRs Cereals, Snacks, and Nutrition Bars Manufacturers |

| By Application | Moulding, Enrobing, and Panning Fillings, Inclusions, and Decorations Bakery Coatings and Icings Beverages and Dairy Mixes Functional/Better-for-you (sugar-free, protein-added) |

| By Distribution Channel | Direct B2B (contract manufacturing, industrial sales) Distributors and Ingredients Traders Online B2B Platforms |

| By Packaging Type | Bulk Packaging (blocks, chips/drops, callets, chips, chunks) Liquid Tankers and IBC Totes Bag-in-Box and Sacks Sustainable/Eco-Friendly Packaging |

| By Price Range | Premium/Single-Origin Mid-Range/Standard Economy/Private Label |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Chocolate Manufacturers | 100 | Production Managers, Quality Control Supervisors |

| Retail Chocolate Sales | 80 | Store Managers, Category Buyers |

| Chocolate Ingredient Suppliers | 60 | Procurement Managers, Supply Chain Coordinators |

| Consumer Preferences in Chocolate | 120 | End Consumers, Market Research Participants |

| Chocolate Exporters | 70 | Export Managers, Trade Compliance Officers |

The Global Industrial Chocolate Market is valued at approximately USD 61 billion, reflecting a robust growth trajectory driven by increasing demand across various sectors, including confectionery, bakery, and dairy products.