Region:Global

Author(s):Rebecca

Product Code:KRAC0262

Pages:81

Published On:August 2025

By Type:The market is segmented into various types of enzymes, including Carbohydrases, Proteases, Lipases, Polymerases & Nucleases, Phytases, Pectinases, and Others. Among these, Carbohydrases, which include Amylases, Cellulases, and Xylanases, are the most dominant due to their extensive use in food processing and biofuel production. The increasing demand for high-quality food products and the need for efficient biofuel production processes are driving the growth of this segment .

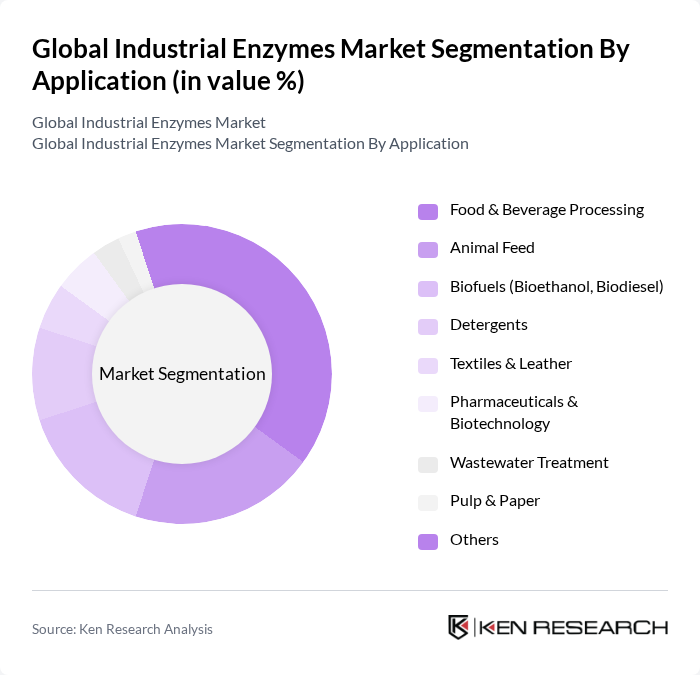

By Application:The applications of industrial enzymes span across various sectors, including Food & Beverage Processing, Animal Feed, Biofuels, Detergents, Textiles & Leather, Pharmaceuticals & Biotechnology, Wastewater Treatment, Pulp & Paper, and Others. The Food & Beverage Processing segment is the largest due to the increasing consumer demand for processed foods and beverages, which require enzymes for improved flavor, texture, and shelf life. Animal feed and biofuels are also significant segments, driven by the need for enhanced feed efficiency and sustainable energy solutions .

The Global Industrial Enzymes Market is characterized by a dynamic mix of regional and international players. Leading participants such as Novozymes A/S, BASF SE, DuPont de Nemours, Inc., DSM-Firmenich AG, AB Enzymes GmbH (Associated British Foods plc), Chr. Hansen Holding A/S, Kerry Group plc, Advanced Enzyme Technologies Ltd., Enzyme Development Corporation, Amano Enzyme Inc., Dyadic International, Inc., Aumgene Biosciences, Codexis, Inc., Biocatalysts Ltd. (Brain Biotech AG), Sunson Industry Group Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the industrial enzymes market appears promising, driven by increasing environmental awareness and the shift towards sustainable practices. As industries adopt green chemistry principles, the demand for eco-friendly enzymes is expected to rise. Additionally, advancements in biotechnology will likely lead to innovative enzyme applications across various sectors, including food, biofuels, and pharmaceuticals. This evolving landscape presents opportunities for companies to enhance their product offerings and expand their market presence.

| Segment | Sub-Segments |

|---|---|

| By Type | Carbohydrases (including Amylases, Cellulases, Xylanases) Proteases Lipases Polymerases & Nucleases Phytases Pectinases Others |

| By Application | Food & Beverage Processing Animal Feed Biofuels (Bioethanol, Biodiesel) Detergents Textiles & Leather Pharmaceuticals & Biotechnology Wastewater Treatment Pulp & Paper Others |

| By End-User | Food & Beverage Industry Animal Nutrition & Feed Industry Bioenergy Sector Textile & Leather Industry Detergent Manufacturers Pharmaceutical & Biotech Companies Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Product Form | Liquid Enzymes Powder Enzymes Granular Enzymes |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value-Based Pricing |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food & Beverage Enzyme Applications | 120 | Product Development Managers, Quality Assurance Specialists |

| Pharmaceutical Enzyme Utilization | 90 | Regulatory Affairs Managers, R&D Scientists |

| Industrial Enzymes in Biofuels | 60 | Process Engineers, Production Managers |

| Detergent Enzyme Market Insights | 50 | Marketing Directors, Product Managers |

| Animal Feed Enzyme Applications | 70 | Nutritionists, Feed Formulation Experts |

The Global Industrial Enzymes Market is valued at approximately USD 8.4 billion, reflecting a significant growth trend driven by increasing demand across various sectors such as food and beverage, biofuels, and pharmaceuticals.