Region:Global

Author(s):Geetanshi

Product Code:KRAD0103

Pages:91

Published On:August 2025

By Offering:This segmentation includes Hardware, Software, and Services. The hardware segment is currently leading the market due to the increasing adoption of advanced measuring instruments and devices, particularly in high-precision manufacturing environments. Software solutions are gaining traction as industries seek to integrate data analytics, automation, and digital twins into their measurement processes. Services, including calibration, training, and maintenance, are essential for ensuring the accuracy, reliability, and regulatory compliance of metrology equipment.

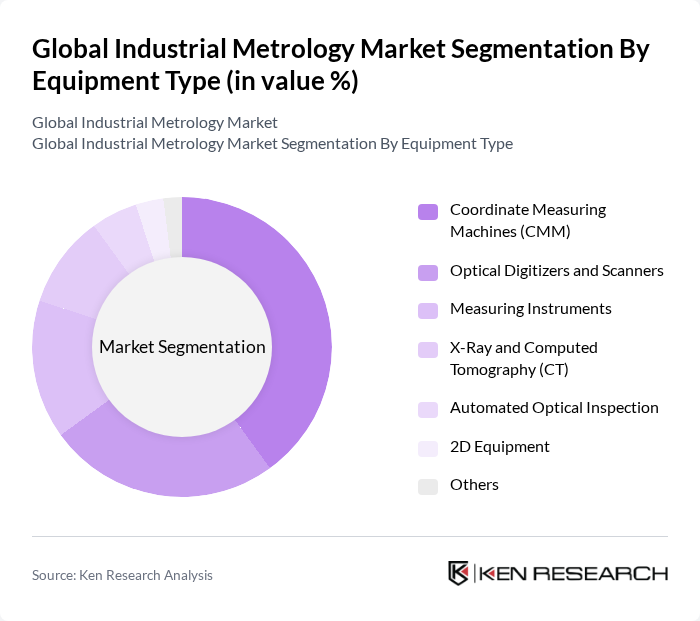

By Equipment Type:This segmentation encompasses Coordinate Measuring Machines (CMM), Optical Digitizers and Scanners, Measuring Instruments, X-Ray and Computed Tomography (CT), Automated Optical Inspection, 2D Equipment, and Others. The Coordinate Measuring Machines (CMM) segment is the most dominant due to their versatility and precision in measuring complex geometries, making them indispensable in automotive and aerospace applications. Optical digitizers and scanners are increasingly adopted for their ability to capture detailed 3D data, supporting digital twin and reverse engineering initiatives. X-Ray and CT technologies are gaining traction for non-destructive testing and quality control, especially in electronics and medical device manufacturing.

The Global Industrial Metrology Market is characterized by a dynamic mix of regional and international players. Leading participants such as Hexagon AB, Carl Zeiss AG, Mitutoyo Corporation, Nikon Metrology NV, Renishaw plc, FARO Technologies, Inc., Keyence Corporation, KLA Corporation, Perceptron, Inc., Creaform Inc., Mahr GmbH, TESA Technology (Hexagon), AMETEK, Inc., Jenoptik AG, WENZEL Group GmbH & Co. KG contribute to innovation, geographic expansion, and service delivery in this space.

The future of the industrial metrology market appears promising, driven by ongoing technological advancements and increasing automation across industries. As companies embrace Industry 4.0, the integration of smart metrology solutions will enhance data accuracy and operational efficiency. Furthermore, the growing emphasis on sustainability will push manufacturers to adopt eco-friendly measurement practices, aligning with global environmental goals. These trends indicate a robust demand for innovative metrology solutions that cater to evolving industry needs and regulatory requirements.

| Segment | Sub-Segments |

|---|---|

| By Offering | Hardware Software Services |

| By Equipment Type | Coordinate Measuring Machines (CMM) Optical Digitizers and Scanners Measuring Instruments X-Ray and Computed Tomography (CT) Automated Optical Inspection D Equipment Others |

| By Application | Quality Control & Inspection Reverse Engineering Mapping and Modelling Other Applications |

| By End-User | Automotive Aerospace & Defense Manufacturing Semiconductor Electronics Medical Devices Heavy Machinery Others |

| By Region | North America (U.S., Canada, Mexico) Europe (UK, Germany, France, Italy, Spain, Rest of Europe) Asia Pacific (China, Japan, South Korea, India, Rest of APAC) Middle East & Africa South America |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Metrology Applications | 100 | Quality Control Managers, Production Engineers |

| Aerospace Measurement Standards | 80 | Compliance Officers, Aerospace Engineers |

| Pharmaceutical Calibration Services | 60 | Laboratory Managers, Regulatory Affairs Specialists |

| Industrial Equipment Calibration | 90 | Maintenance Supervisors, Equipment Managers |

| Precision Measurement Technologies | 50 | R&D Managers, Product Development Engineers |

The Global Industrial Metrology Market is valued at approximately USD 14.0 billion, reflecting a significant growth trend driven by the increasing demand for precision measurement across various industries, including automotive, aerospace, and electronics.