Region:Global

Author(s):Shubham

Product Code:KRAA1755

Pages:91

Published On:August 2025

By Type:The market is segmented into various types of pumps, including centrifugal pumps, positive displacement pumps, submersible pumps, slurry pumps, vacuum pumps, metering/dosing pumps, and others. Each type serves distinct applications across industries, with centrifugal pumps being the most widely used due to their efficiency and versatility.

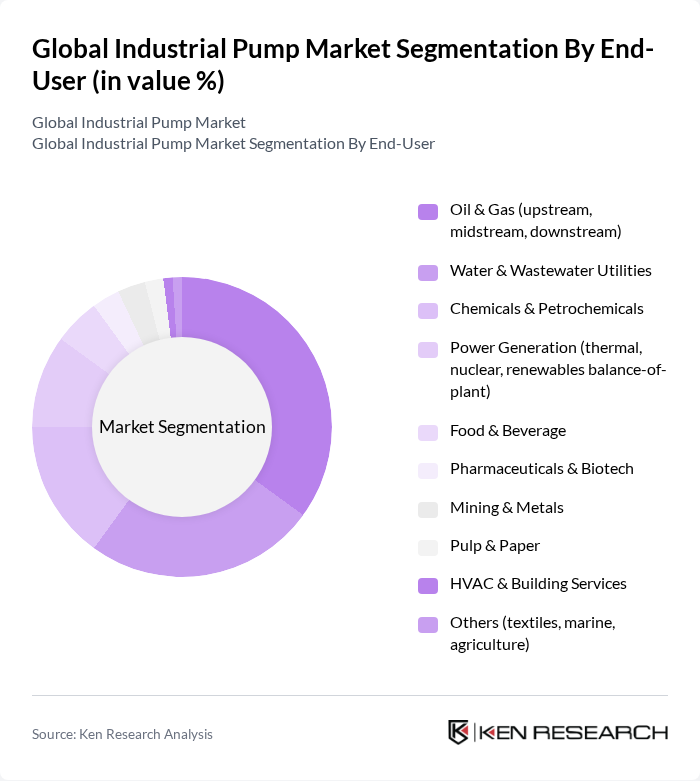

By End-User:The industrial pump market is further segmented by end-user industries, including oil and gas, water and wastewater utilities, chemicals and petrochemicals, power generation, food and beverage, pharmaceuticals and biotech, mining and metals, pulp and paper, HVAC and building services, and others. The oil and gas sector is a significant contributor due to its extensive use of pumps in various processes.

The Global Industrial Pump Market is characterized by a dynamic mix of regional and international players. Leading participants such as Flowserve Corporation, Grundfos Holding A/S, KSB SE & Co. KGaA, Sulzer Ltd, Xylem Inc., ITT Inc., Pentair plc, Ebara Corporation, The Weir Group PLC, Alfa Laval AB, Ingersoll Rand (ARO Fluid Management), Tsurumi Manufacturing Co., Ltd., Wilo SE, NOV Inc. (formerly National Oilwell Varco), SPX FLOW, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the industrial pump market appears promising, driven by technological advancements and increasing demand for sustainable solutions. As industries continue to adopt automation and IoT technologies, the integration of smart pumps will likely enhance operational efficiency. Additionally, the focus on renewable energy projects and water management solutions will create new avenues for growth, particularly in emerging markets where infrastructure investments are on the rise. Companies that adapt to these trends will be well-positioned for success.

| Segment | Sub-Segments |

|---|---|

| By Type | Centrifugal Pumps (single-stage, multi-stage, axial flow, radial flow, mixed flow) Positive Displacement Pumps (rotary: gear, screw, lobe; reciprocating: piston, plunger, diaphragm) Submersible Pumps Slurry Pumps Vacuum Pumps Metering/Dosing Pumps Others (peristaltic, magnetic drive, sump, jet) |

| By End-User | Oil & Gas (upstream, midstream, downstream) Water & Wastewater Utilities Chemicals & Petrochemicals Power Generation (thermal, nuclear, renewables balance-of-plant) Food & Beverage Pharmaceuticals & Biotech Mining & Metals Pulp & Paper HVAC & Building Services Others (textiles, marine, agriculture) |

| By Application | Transfer & Circulation Process Dosing & Metering Dewatering & Sludge Handling Boiler Feed & Condensate Fire Protection Systems Irrigation Others |

| By Distribution Channel | Direct Sales (OEM and key accounts) Distributors/Channel Partners EPC/Project Contractors Online & E-commerce Others (aftermarket service providers) |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Others |

| By Price Range | Low-End Pumps Mid-Range Pumps High-End Pumps |

| By Technology | Smart/Connected Pumps (with VFDs, sensors, remote monitoring) Energy-Efficient Pumps (IE4/IE5 motor-driven, optimized hydraulics) Conventional Pumps Severe-Duty Pumps (corrosion/abrasion resistant, API/ANSI compliant) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil & Gas Sector Pump Usage | 100 | Operations Managers, Field Engineers |

| Water Treatment Facilities | 80 | Plant Managers, Environmental Engineers |

| Chemical Processing Plants | 90 | Procurement Managers, Process Engineers |

| Food & Beverage Industry | 70 | Quality Control Managers, Production Supervisors |

| Mining and Mineral Processing | 60 | Site Managers, Equipment Maintenance Supervisors |

The Global Industrial Pump Market is valued at approximately USD 67 billion, reflecting a robust growth trajectory driven by increasing demand in sectors such as oil and gas, water management, and chemicals, alongside advancements in pump technology.