Region:Global

Author(s):Geetanshi

Product Code:KRAD0074

Pages:87

Published On:August 2025

By Type:The market is segmented into various types of pumps, each serving distinct applications and industries. The dominant sub-segment is centrifugal pumps, which are widely used due to their efficiency, versatility, and ability to handle large volumes of fluids at relatively low operational costs. Positive displacement pumps, including reciprocating and rotary types, are also significant, catering to specialized applications such as high-viscosity fluids or precise dosing. The adoption of smart and energy-efficient pump variants is accelerating across all segments .

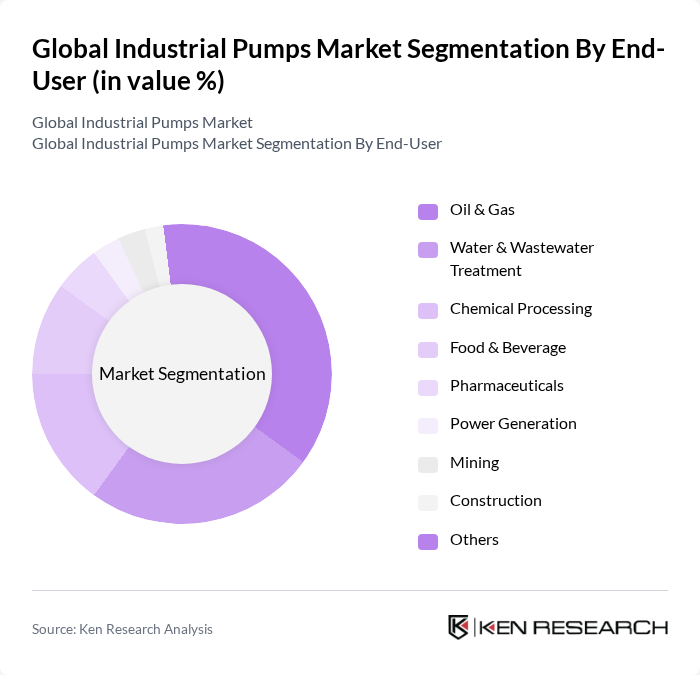

By End-User:The industrial pumps market is segmented by end-user industries, with oil and gas, water and wastewater treatment, and chemical processing being the leading sectors. The oil and gas industry remains the largest consumer of industrial pumps due to the need for efficient fluid transfer and management in exploration, production, and refining. Water and wastewater treatment is a significant segment, driven by stricter environmental regulations and the need for sustainable water management. Chemical processing, food and beverage, and pharmaceuticals are also key end-users, with increasing adoption of specialized pumps for process optimization and hygiene compliance .

The Global Industrial Pumps Market is characterized by a dynamic mix of regional and international players. Leading participants such as Flowserve Corporation, Grundfos Holding A/S, KSB SE & Co. KGaA, Sulzer AG, Xylem Inc., ITT Inc., Pentair plc, Ebara Corporation, Weir Group PLC, Alfa Laval AB, ARO Fluid Management (Ingersoll Rand Inc.), Tsurumi Manufacturing Co., Ltd., Wilo SE, National Oilwell Varco, Inc., and Tuthill Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The industrial pumps market is poised for significant transformation, driven by technological advancements and sustainability initiatives. As industries increasingly adopt smart technologies, the integration of IoT and automation in pump systems will enhance operational efficiency and reduce energy consumption. Furthermore, the shift towards renewable energy sources will create new opportunities for pump manufacturers to innovate and develop solutions tailored to this evolving landscape, ensuring long-term growth and sustainability in the market.

| Segment | Sub-Segments |

|---|---|

| By Type | Centrifugal Pumps Axial Flow Pumps Radial Flow Pumps Mixed Flow Pumps Positive Displacement Pumps Reciprocating Pumps Rotary Pumps Diaphragm Pumps Gear Pumps Screw Pumps Peristaltic Pumps Others |

| By End-User | Oil & Gas Water & Wastewater Treatment Chemical Processing Food & Beverage Pharmaceuticals Power Generation Mining Construction Others |

| By Application | Industrial Processes HVAC Systems Fire Protection Systems Irrigation Mining Slurry Handling Dosing and Metering Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Others |

| By Price Range | Low Range Mid Range High Range |

| By Technology | Electric Pumps Hydraulic Pumps Pneumatic Pumps Smart Pumps Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil & Gas Sector Pumps | 100 | Procurement Managers, Operations Directors |

| Water Treatment Applications | 80 | Plant Managers, Environmental Engineers |

| Chemical Processing Pumps | 70 | Process Engineers, Safety Officers |

| Food & Beverage Industry Pumps | 50 | Quality Control Managers, Production Supervisors |

| Mining and Minerals Processing | 40 | Site Managers, Equipment Maintenance Managers |

The Global Industrial Pumps Market is valued at approximately USD 67 billion, driven by increasing demand in sectors such as oil and gas, water treatment, and chemical processing, along with advancements in smart pump technology and IoT integration.