Region:Global

Author(s):Rebecca

Product Code:KRAA2181

Pages:92

Published On:August 2025

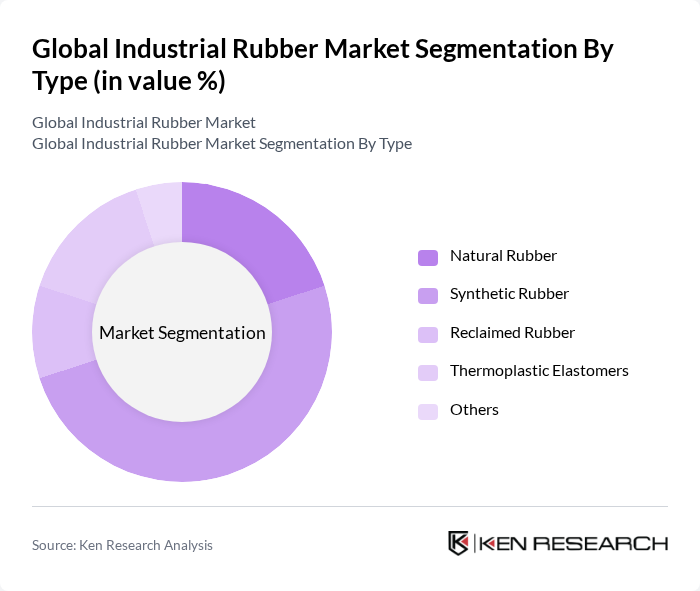

By Type:The industrial rubber market is segmented into Natural Rubber, Synthetic Rubber, Reclaimed Rubber, Thermoplastic Elastomers, and Others. Among these, Synthetic Rubber is the dominant segment due to its versatility and superior performance characteristics, making it the preferred choice in applications such as tires and industrial products. The increasing demand for high-performance materials in automotive and construction sectors continues to drive the growth of synthetic rubber. Recent developments in synthetic rubber focus on enhancing heat resistance, durability, and sustainability through advanced polymer technologies .

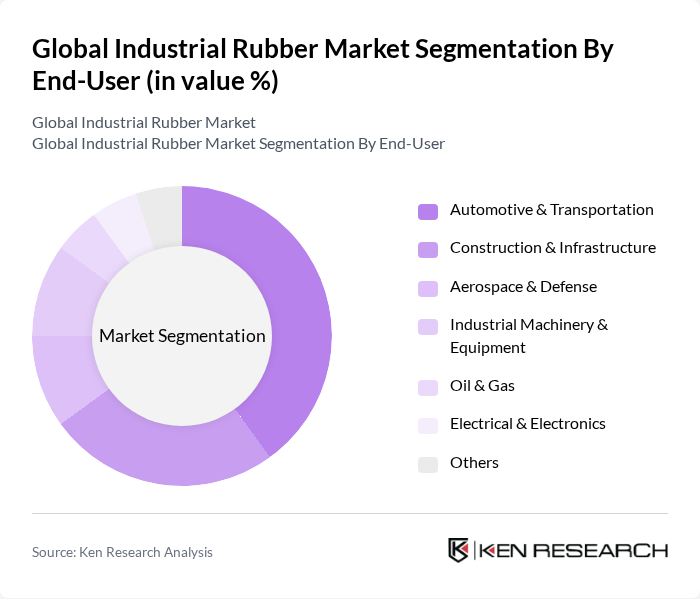

By End-User:The market is also segmented by end-user industries, including Automotive & Transportation, Construction & Infrastructure, Aerospace & Defense, Industrial Machinery & Equipment, Oil & Gas, Electrical & Electronics, and Others. The Automotive & Transportation segment holds the largest share, driven by the continuous demand for tires and other rubber components in vehicles. The rise in electric vehicle production and advancements in automotive technology further enhance the demand for high-quality rubber products. The construction sector’s focus on insulation and durability also contributes significantly to market growth .

The Global Industrial Rubber Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bridgestone Corporation, Michelin Group, Continental AG, Goodyear Tire & Rubber Company, Pirelli & C. S.p.A., Yokohama Rubber Company, Ltd., Sumitomo Rubber Industries, Ltd., Cooper Tire & Rubber Company, Trelleborg AB, Hexpol AB, Kraton Corporation, Lanxess AG, Dow Inc., BASF SE, Solvay S.A., Exxon Mobil Corporation, ARLANXEO, Synthos S.A., SIBUR, Dynasol Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the industrial rubber market in None appears promising, driven by increasing investments in sustainable practices and technological advancements. The shift towards eco-friendly products is expected to gain momentum, with a projected 45% of new rubber products being developed with sustainable materials in future. Additionally, the digital transformation in supply chain management will enhance operational efficiency, allowing companies to respond swiftly to market demands and optimize resource allocation.

| Segment | Sub-Segments |

|---|---|

| By Type | Natural Rubber Synthetic Rubber Reclaimed Rubber Thermoplastic Elastomers Others |

| By End-User | Automotive & Transportation Construction & Infrastructure Aerospace & Defense Industrial Machinery & Equipment Oil & Gas Electrical & Electronics Others |

| By Application | Tires Seals and Gaskets Hoses Belts Vibration Isolation & Dampening Conveyor Belts Rubber Linings Others |

| By Distribution Channel | Direct Sales Distributors/Dealers Online Retail Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Low Medium High |

| By Product Form | Sheets Molds Granules Powders Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Rubber Components | 100 | Product Managers, Quality Assurance Engineers |

| Industrial Rubber Products | 90 | Procurement Managers, Operations Directors |

| Consumer Rubber Goods | 70 | Marketing Managers, Retail Buyers |

| Construction Rubber Applications | 60 | Project Managers, Supply Chain Coordinators |

| Medical Rubber Products | 50 | Regulatory Affairs Specialists, Product Development Managers |

The Global Industrial Rubber Market is valued at approximately USD 36 billion, reflecting a robust growth trajectory driven by demand from sectors like automotive, construction, and manufacturing, alongside advancements in rubber processing and recycling technologies.