Region:Global

Author(s):Geetanshi

Product Code:KRAA1186

Pages:80

Published On:August 2025

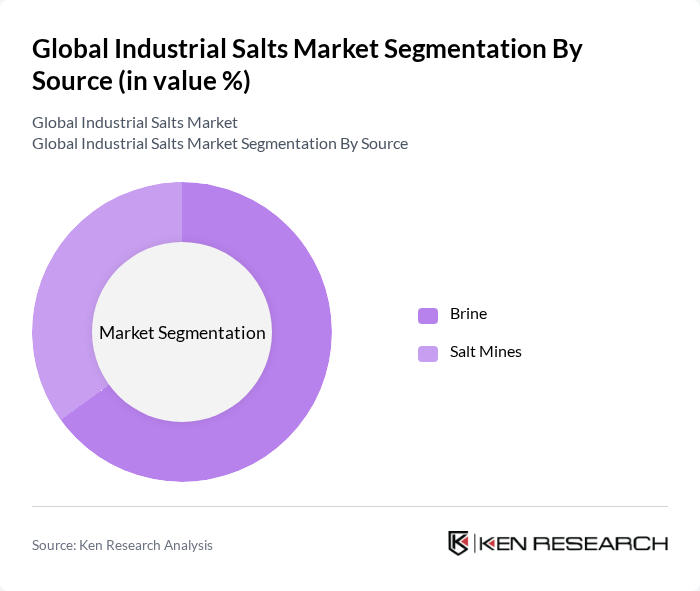

By Source:The market is segmented into two primary sources: Brine and Salt Mines. Brine remains the leading source due to its cost-effectiveness and efficiency in salt extraction, making it a preferred choice for large-scale production. Salt mines, while significant, are often limited by geographical constraints and higher operational costs. The demand for brine is driven by its versatility in various applications, particularly in chemical processing, de-icing, and water treatment.

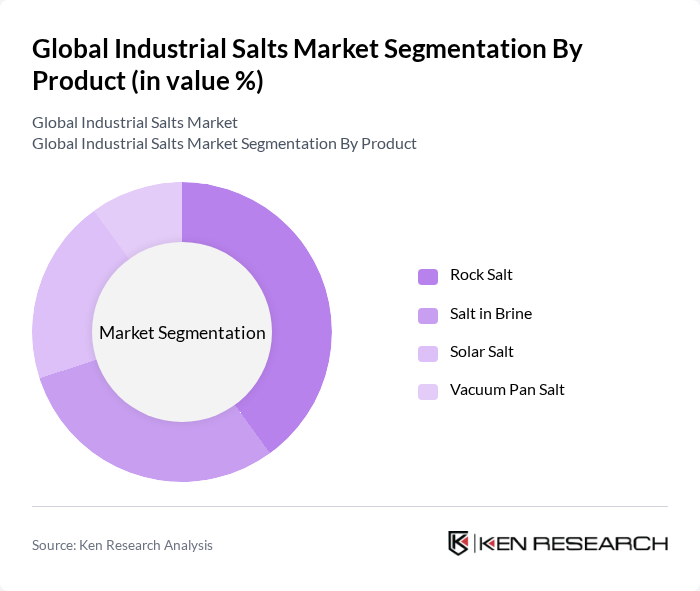

By Product:The product segmentation includes Rock Salt, Salt in Brine, Solar Salt, and Vacuum Pan Salt. Rock Salt dominates the market due to its widespread use in de-icing and chemical applications. Salt in Brine follows closely, favored for its application in various industrial processes. Solar Salt and Vacuum Pan Salt, while important, cater to more specialized applications, thus holding a smaller market share. The versatility and availability of Rock Salt make it the leading product in the market.

The Global Industrial Salts Market is characterized by a dynamic mix of regional and international players. Leading participants such as Compass Minerals International, Inc., Cargill, Incorporated, K+S Aktiengesellschaft, Tata Chemicals Limited, INEOS Group Limited, and China National Salt Industry Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the industrial salts market appears promising, driven by increasing demand across various sectors, including chemicals and water treatment. Innovations in production techniques are expected to enhance efficiency and reduce environmental impact. Additionally, the growing focus on sustainability will likely lead to the development of eco-friendly alternatives, further expanding market opportunities. As industries adapt to changing regulations and consumer preferences, the market is poised for significant growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Source | Brine Salt Mines |

| By Product | Rock Salt Salt in Brine Solar Salt Vacuum Pan Salt |

| By Application | Chemical Processing De-Icing Water Treatment Oil & Gas Agriculture Other Applications |

| By Manufacturing Process | Conventional Mining Vacuum Evaporation Solar Evaporation |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Chemical Manufacturing Sector | 100 | Procurement Managers, Production Supervisors |

| Food Processing Industry | 60 | Quality Control Managers, Operations Directors |

| Water Treatment Facilities | 50 | Plant Managers, Environmental Compliance Officers |

| De-icing and Road Maintenance | 40 | Logistics Coordinators, Municipal Operations Managers |

| Pharmaceutical Applications | 40 | Research Scientists, Regulatory Affairs Specialists |

The Global Industrial Salts Market is valued at approximately USD 17.5 billion, driven by increasing demand across various industrial applications such as chemical processing, de-icing, water treatment, and pharmaceuticals.