Region:Global

Author(s):Rebecca

Product Code:KRAB0198

Pages:91

Published On:August 2025

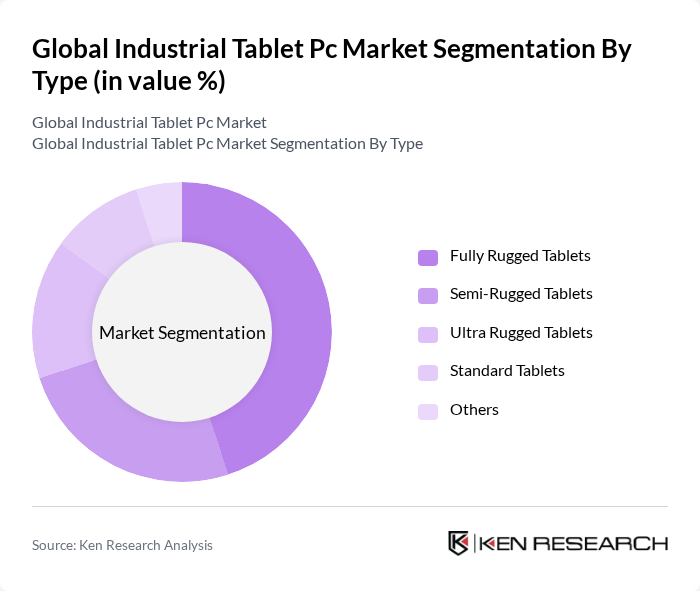

By Type:The market is segmented into Fully Rugged Tablets, Semi-Rugged Tablets, Ultra Rugged Tablets, Standard Tablets, and Others. Among these, Fully Rugged Tablets are leading the market due to their durability and ability to operate in extreme conditions, making them ideal for industries such as construction, manufacturing, and field services. The demand for these devices is driven by the need for reliable technology that can withstand drops, water, and dust, which is crucial for professionals working in challenging environments. Rugged tablets are increasingly favored for their integration of features such as barcode scanning, GPS, and wireless connectivity, supporting critical industrial workflows .

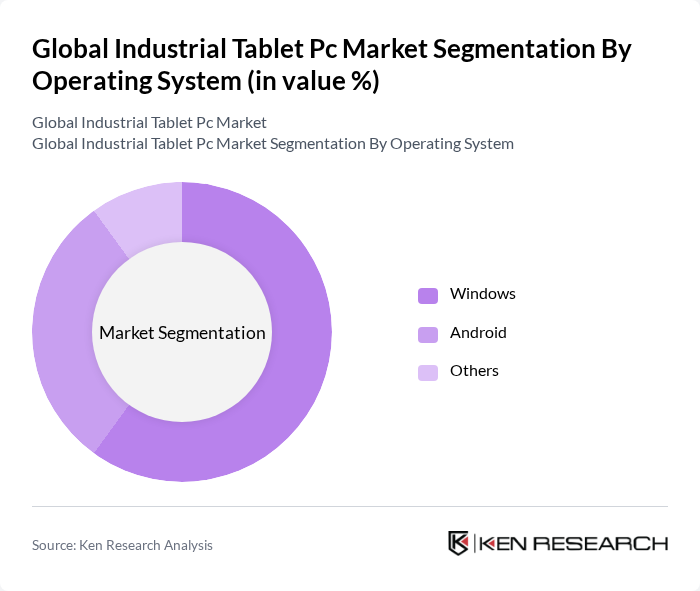

By Operating System:The market is categorized into Windows, Android, and Others. Windows-based industrial tablets are dominating the market due to their compatibility with enterprise applications and robust security features. The preference for Windows OS is driven by its widespread use in business environments, allowing seamless integration with existing systems and software, which is essential for operational efficiency in various industries. Android-based tablets are gaining traction for their flexibility and cost-effectiveness, especially in logistics and field service applications .

The Global Industrial Tablet PC Market is characterized by a dynamic mix of regional and international players. Leading participants such as Zebra Technologies Corporation, Panasonic Corporation, Getac Technology Corporation, Xplore Technologies Corp., MobileDemand LLC, Advantech Co., Ltd., Winmate Inc., Datalogic S.p.A., Honeywell International Inc., Samsung Electronics Co., Ltd., ASUS Computer International, Dell Technologies Inc., Microsoft Corporation, Lenovo Group Limited, Fujitsu Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the industrial tablet market is poised for transformative growth, driven by technological advancements and evolving operational needs. As industries increasingly adopt cloud-based solutions, the demand for tablets that support seamless integration with these platforms will rise. Additionally, the shift towards hybrid work environments will necessitate devices that facilitate remote access and collaboration. Companies that prioritize sustainability and energy efficiency in their product offerings will likely gain a competitive edge, aligning with global trends towards greener operations.

| Segment | Sub-Segments |

|---|---|

| By Type | Fully Rugged Tablets Semi-Rugged Tablets Ultra Rugged Tablets Standard Tablets Others |

| By Operating System | Windows Android Others |

| By End-User Industry | Manufacturing Energy and Power Oil and Gas Transportation and Logistics Automotive Agriculture and Farming Healthcare Retail Others |

| By Application | Field Service Management Inventory Management Quality Control Remote Monitoring Others |

| By Distribution Channel | Direct Sales Online Retail Distributors Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Low-End Tablets Mid-Range Tablets High-End Tablets |

| By Battery Life | Less than 8 Hours to 12 Hours More than 12 Hours |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturing Sector Tablet Usage | 120 | Production Managers, IT Directors |

| Healthcare Application of Tablets | 90 | Healthcare Administrators, Medical Device Managers |

| Logistics and Supply Chain Management | 100 | Logistics Coordinators, Warehouse Supervisors |

| Field Service Operations | 75 | Field Service Managers, Technical Support Leads |

| Retail Sector Tablet Integration | 50 | Retail Managers, IT Support Staff |

The Global Industrial Tablet PC Market is valued at approximately USD 1.1 billion, reflecting a significant growth trend driven by the increasing demand for mobile computing solutions across various sectors such as manufacturing, healthcare, and logistics.