Region:Global

Author(s):Dev

Product Code:KRAC0447

Pages:80

Published On:August 2025

By Type:The market is segmented into various types of industrial vacuum cleaners, each catering to specific cleaning needs and applications. The dominant sub-segment is the Wet/Dry Industrial Vacuums, which are versatile and can handle both liquid and solid waste, making them highly preferred in industries such as construction and manufacturing. Dry-only Industrial Vacuums also hold a significant share due to their effectiveness in dust collection, particularly in environments where moisture is not a concern. The demand for specialized vacuums, such as Explosion-Proof and Hazardous Class H models, is also on the rise due to increasing safety regulations and compliance to ATEX/IECEx and high-efficiency filtration (HEPA/ULPA) requirements in hazardous and hygiene-critical environments .

By End-User:The industrial vacuum cleaners market is segmented by end-user industries, including discrete manufacturing, process industries, and healthcare. The discrete manufacturing sector, particularly metalworking and electronics, is the largest end-user due to the high demand for efficient cleaning solutions to maintain production quality and safety. The healthcare sector is also witnessing significant growth, driven by stringent hygiene standards and the need for specialized cleaning equipment. Other sectors, such as food and beverage processing, pharmaceuticals, and construction, are increasingly adopting industrial vacuum cleaners to enhance operational efficiency and compliance with safety regulations; centralized systems and ATEX-compliant units are increasingly specified in chemicals, petrochemicals, and mining for combustible dust control .

The Global Industrial Vacuum Cleaners Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nilfisk A/S, Alfred Kärcher SE & Co. KG, Tennant Company, Delfin Industrial Vacuums, Hako Group, Dustcontrol AB, VAC-U-MAX, Eurovac, Ametek, Inc. (Lamb Motors), IPC (IPC Eagle / IPC Group), Ruwac Industriesauger GmbH, Tiger-Vac International Inc., Goodway Technologies, Kaeser Kompressoren SE (Pneumatic Vacuum Solutions), Depureco Industrial Vacuums contribute to innovation, geographic expansion, and service delivery in this space.

The future of the industrial vacuum cleaner market appears promising, driven by ongoing technological advancements and a growing emphasis on sustainability. As industries increasingly adopt eco-friendly practices, the demand for energy-efficient cleaning solutions is expected to rise. Additionally, the integration of smart technologies will likely enhance operational efficiency, making industrial vacuum cleaners more appealing. Companies that innovate and adapt to these trends will be well-positioned to capture market share and meet evolving customer needs in future.

| Segment | Sub-Segments |

|---|---|

| By Type | Dry-only Industrial Vacuums Wet/Dry Industrial Vacuums Central/Fixed Vacuum Systems Explosion-Proof (ATEX/IECEx) Vacuums Hazardous/Dust Class H (HEPA/ULPA) Vacuums Pneumatic/Air-powered Vacuums Battery/Electric Ride-on and Mobile Units Others |

| By End-User | Discrete Manufacturing (Metalworking, Electronics, Machinery) Process Industries (Chemicals, Petrochemicals, Mining) Food & Beverage Processing Pharmaceuticals & Biotechnology Automotive & Aerospace Construction & Cement Healthcare & Laboratories Warehousing & Logistics Others |

| By Application | Source Capture of Dust/Fumes (On-tool/Process) Hazardous Material Cleanup (Combustible Dust, Asbestos, Pharma) General Industrial Cleaning & Spill Recovery Surface Preparation & Floor Care Cleanroom and High-Purity Environments Others |

| By Sales Channel | Direct (Manufacturer to End User) Industrial Distributors/Dealers (MRO) Online B2B Marketplaces/E-commerce Rental & Leasing Providers Others |

| By Mode of Operation | Electric (Corded) Battery-powered (Cordless) Pneumatic (Compressed Air) Internal Combustion/Engine-driven Others |

| By Power & Capacity | Single-phase (Up to 2.5 kW) Three-phase (Above 2.5 kW) Tank Capacity (Up to 50L, 50–100L, Above 100L) Suction/CFM Bands (Up to 200 CFM, 200–500 CFM, Above 500 CFM) Others |

| By Region | North America Europe Asia Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturing Sector Cleaning Practices | 120 | Facility Managers, Operations Directors |

| Healthcare Facility Maintenance | 100 | Maintenance Supervisors, Infection Control Officers |

| Hospitality Industry Cleaning Equipment Usage | 80 | Housekeeping Managers, Procurement Officers |

| Retail Sector Cleaning Solutions | 70 | Store Managers, Facility Maintenance Heads |

| Construction Site Cleaning Equipment | 60 | Site Managers, Equipment Rental Coordinators |

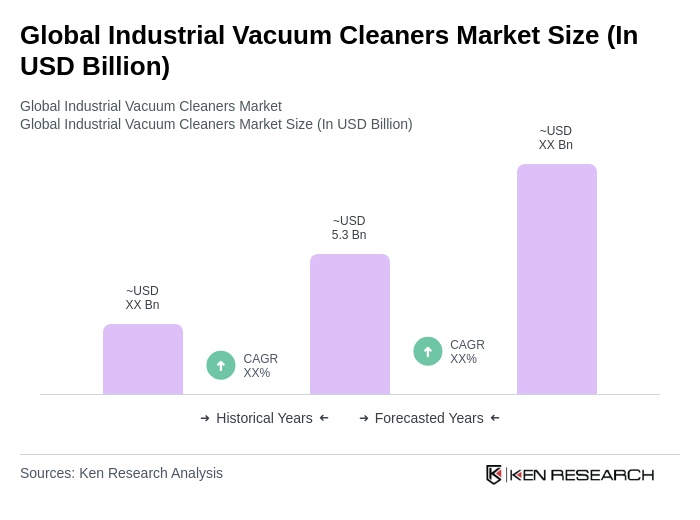

The Global Industrial Vacuum Cleaners Market is valued at approximately USD 5.3 billion, reflecting significant industrial adoption across various sectors such as manufacturing, pharmaceuticals, food processing, and construction.