Region:Global

Author(s):Geetanshi

Product Code:KRAA1284

Pages:81

Published On:August 2025

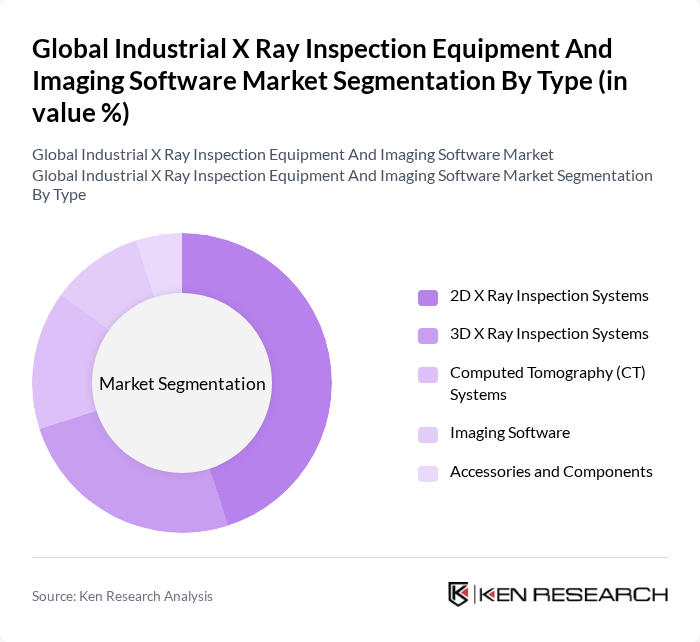

By Type:The market is segmented into various types of X-ray inspection systems and imaging software, each catering to specific industrial needs. The dominant sub-segment is the 2D X Ray Inspection Systems, which are widely used for their cost-effectiveness and efficiency in quality control processes. 3D X Ray Inspection Systems and Computed Tomography (CT) Systems are gaining traction due to their advanced imaging capabilities, while Imaging Software and Accessories and Components support the overall functionality of these systems.

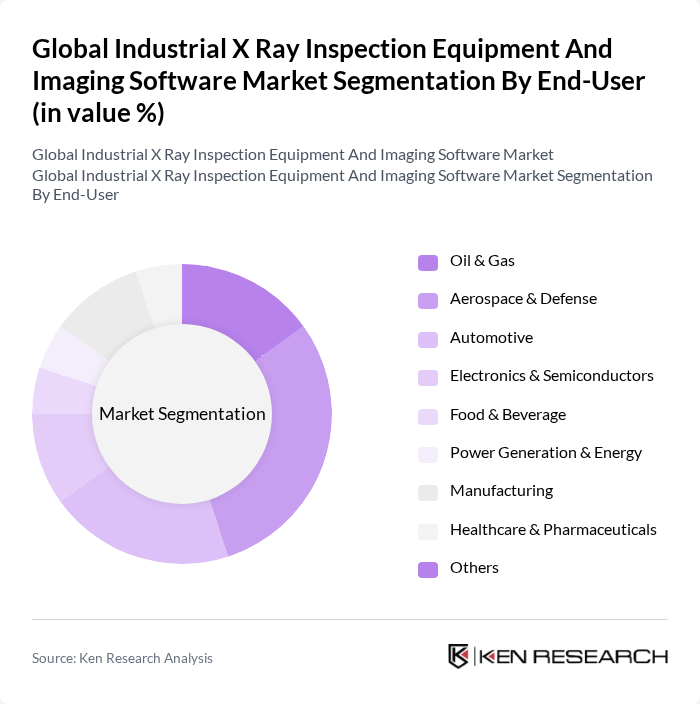

By End-User:The market is segmented by end-user industries, including oil & gas, aerospace & defense, automotive, electronics & semiconductors, food & beverage, power generation & energy, manufacturing, healthcare & pharmaceuticals, and others. The aerospace & defense sector is the leading segment due to stringent safety regulations and the need for high-quality assurance in critical applications. The automotive and healthcare sectors are also significant contributors, driven by the increasing focus on safety and quality control.

The Global Industrial X Ray Inspection Equipment And Imaging Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as GE Inspection Technologies (Baker Hughes Company), Nikon Metrology (Nikon Corporation), YXLON International (Comet Group), VJ Technologies, Inc., Rigaku Corporation, Teledyne Technologies Incorporated, Fujifilm Holdings Corporation, MISTRAS Group, Inc., Olympus Corporation, North Star Imaging, Inc. (Illinois Tool Works Inc.), 3DX-Ray Ltd., AMETEK, Inc., DÜRR NDT GmbH & Co. KG, Siemens AG, Carestream Health, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the industrial X-ray inspection equipment market appears promising, driven by technological advancements and increasing safety regulations. As industries continue to prioritize quality assurance, the integration of AI and machine learning into inspection processes is expected to enhance efficiency and accuracy. Furthermore, the growing trend towards automation and real-time data analysis will likely reshape inspection methodologies, making them more effective and responsive to industry needs, thereby fostering market growth.

| Segment | Sub-Segments |

|---|---|

| By Type | D X Ray Inspection Systems D X Ray Inspection Systems Computed Tomography (CT) Systems Imaging Software Accessories and Components |

| By End-User | Oil & Gas Aerospace & Defense Automotive Electronics & Semiconductors Food & Beverage Power Generation & Energy Manufacturing Healthcare & Pharmaceuticals Others |

| By Application | Quality Control & Assurance Flaw Detection & Failure Analysis Research and Development Maintenance and Repair Others |

| By Component | X Ray Tubes Detectors Software Solutions Generators Others |

| By Sales Channel | Direct Sales Distributors Online Sales Others |

| By Distribution Mode | Offline Distribution Online Distribution Others |

| By Price Range | Low Range Mid Range High Range Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Aerospace Quality Control | 100 | Quality Assurance Managers, Compliance Officers |

| Food Safety Inspections | 60 | Food Safety Inspectors, Production Managers |

| Automotive Manufacturing | 80 | Manufacturing Engineers, Process Improvement Specialists |

| Electronics Component Testing | 50 | Product Development Engineers, Quality Control Analysts |

| Security Screening Applications | 40 | Security Managers, Operations Directors |

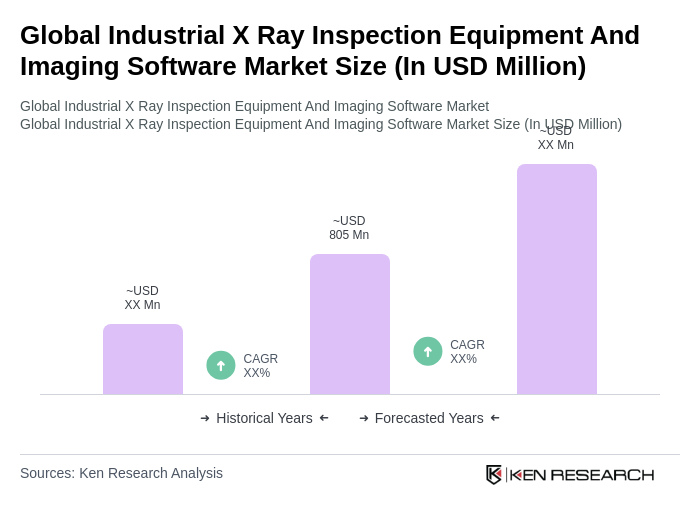

The Global Industrial X Ray Inspection Equipment and Imaging Software Market is valued at approximately USD 805 million, driven by the increasing demand for non-destructive testing across various industries such as aerospace, automotive, and healthcare.