Region:Global

Author(s):Geetanshi

Product Code:KRAD0065

Pages:86

Published On:August 2025

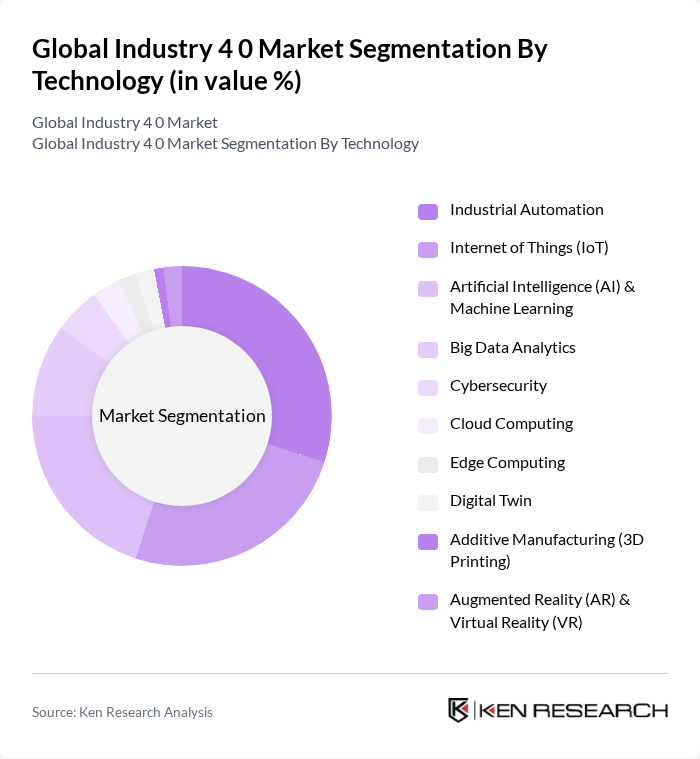

By Technology:

The technology segment of the Industry 4.0 market includes various sub-segments such as Industrial Automation, Internet of Things (IoT), Artificial Intelligence (AI) & Machine Learning, Big Data Analytics, Cybersecurity, Cloud Computing, Edge Computing, Digital Twin, Additive Manufacturing (3D Printing), and Augmented Reality (AR) & Virtual Reality (VR). Among these, Industrial Automation is the leading sub-segment, driven by the need for increased efficiency and productivity in manufacturing processes. The growing trend of smart factories and the integration of robotics and automation technologies are key factors contributing to its dominance .

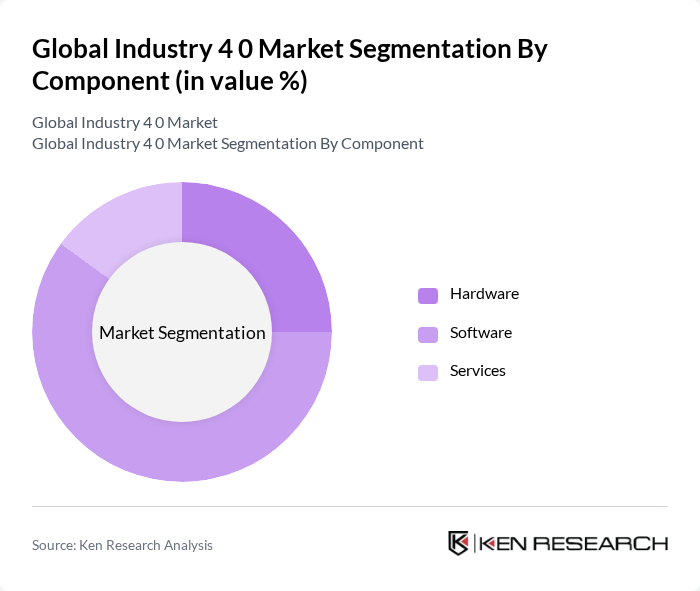

By Component:

The component segment encompasses Hardware, Software, and Services. Among these, Software is the dominant sub-segment, driven by the increasing need for advanced analytics, machine learning algorithms, and integrated software solutions that facilitate seamless communication between devices. The rise of cloud-based solutions and subscription models has further propelled the software segment, making it essential for businesses looking to implement Industry 4.0 technologies effectively .

The Global Industry 4 0 Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens AG, General Electric Company, ABB Ltd., Honeywell International Inc., Rockwell Automation, Inc., Schneider Electric SE, Bosch Rexroth AG, Mitsubishi Electric Corporation, Emerson Electric Co., Fanuc Corporation, Yokogawa Electric Corporation, Cisco Systems, Inc., PTC Inc., Dassault Systèmes SE, Siemens Digital Industries Software, SAP SE, Intel Corporation, IBM Corporation, Oracle Corporation, Schneider Electric Automation GmbH contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Industry 4.0 market is poised for transformative growth, driven by technological advancements and evolving consumer demands. As companies increasingly adopt automation and IoT solutions, the focus will shift towards integrating artificial intelligence and machine learning to enhance decision-making processes. Additionally, sustainability will play a crucial role, with manufacturers seeking eco-friendly practices. The collaboration between established firms and tech startups will foster innovation, creating a dynamic landscape that prioritizes efficiency and resilience in operations.

| Segment | Sub-Segments |

|---|---|

| By Technology | Industrial Automation Internet of Things (IoT) Artificial Intelligence (AI) & Machine Learning Big Data Analytics Cybersecurity Cloud Computing Edge Computing Digital Twin Additive Manufacturing (3D Printing) Augmented Reality (AR) & Virtual Reality (VR) |

| By Component | Hardware Software Services |

| By Enterprise Size | Large Enterprises Small & Medium Enterprises (SMEs) |

| By End-User Industry | Manufacturing Automotive Electronics & Semiconductors Healthcare & Pharmaceuticals Aerospace & Defense Energy & Utilities Oil & Gas Food & Beverage Others |

| By Application | Predictive Maintenance Quality Control Supply Chain & Logistics Management Production Planning & Scheduling Inventory Management Remote Monitoring Asset Tracking Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturing Automation | 120 | Plant Managers, Automation Engineers |

| IoT Integration in Production | 90 | IT Managers, Systems Integrators |

| AI in Supply Chain Management | 60 | Supply Chain Analysts, Data Scientists |

| Robotics in Assembly Lines | 50 | Operations Managers, Robotics Engineers |

| Smart Factory Solutions | 70 | Chief Technology Officers, Innovation Managers |

The Global Industry 4.0 Market is valued at approximately USD 165 billion, driven by the increasing adoption of automation technologies, IoT, and advancements in artificial intelligence, reflecting significant investments in digital transformation across various industries.