Region:Global

Author(s):Dev

Product Code:KRAA1612

Pages:81

Published On:August 2025

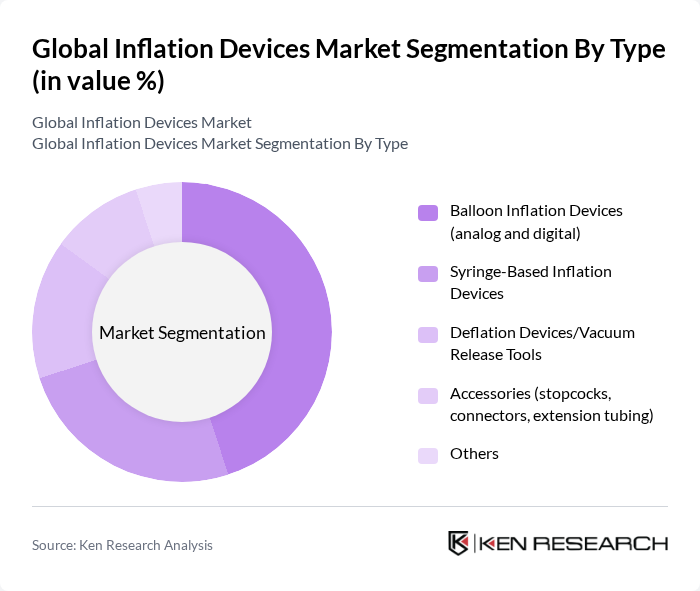

By Type:The inflation devices market is segmented into various types, including balloon inflation devices, syringe-based inflation devices, deflation devices, accessories, and others. Among these, balloon inflation devices, both analog and digital, are the most widely used due to their critical role in interventional cardiology and vascular procedures. The increasing adoption of minimally invasive techniques has further propelled the demand for these devices, as they offer precision and reliability in various medical applications.

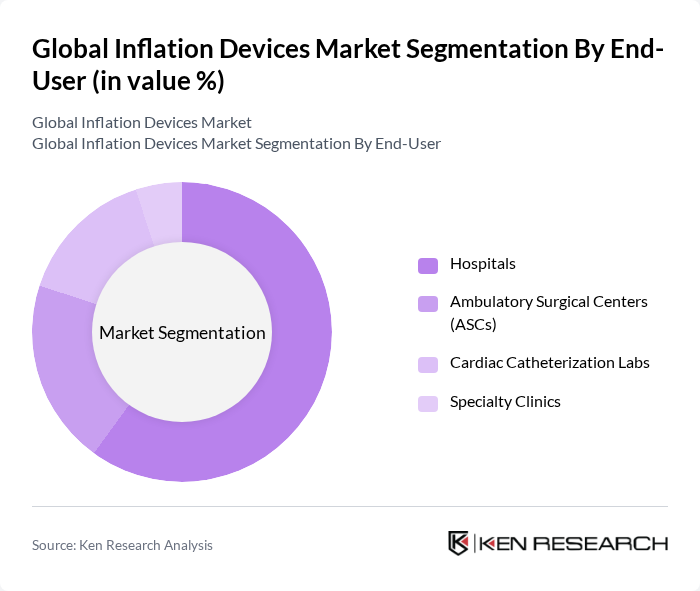

By End-User:The end-user segmentation includes hospitals, ambulatory surgical centers (ASCs), cardiac catheterization labs, and specialty clinics. Hospitals are the leading end-users of inflation devices, driven by the high volume of surgical procedures and interventional cardiology cases handled in inpatient settings. Growth in catheter-based interventions, expansion of cath labs, and broader use in interventional radiology sustain higher utilization in hospitals compared with ASCs and clinics.

The Global Inflation Devices Market is characterized by a dynamic mix of regional and international players. Leading participants such as Medtronic plc, Abbott Laboratories, Boston Scientific Corporation, Merit Medical Systems, Inc., Terumo Corporation, Teleflex Incorporated, Cardinal Health, Inc., Cook Medical LLC, B. Braun Melsungen AG, Olympus Corporation, CONMED Corporation, Shenzhen SCW Medicath Ltd., Nipro Corporation, Acclarent, Inc. (a Johnson & Johnson MedTech company), AndraTec GmbH contribute to innovation, geographic expansion, and service delivery in this space.

The future of the inflation devices market appears promising, driven by technological innovations and an increasing focus on patient-centered care. The integration of IoT technologies is expected to enhance device functionality, allowing for real-time monitoring and data collection. Additionally, the expansion of telehealth services will likely create new avenues for inflation device applications, particularly in remote patient management, thereby increasing market penetration and accessibility across diverse healthcare settings.

| Segment | Sub-Segments |

|---|---|

| By Type | Balloon Inflation Devices (analog and digital) Syringe-Based Inflation Devices Deflation Devices/Vacuum Release Tools Accessories (stopcocks, connectors, extension tubing) Others |

| By End-User | Hospitals Ambulatory Surgical Centers (ASCs) Cardiac Catheterization Labs Specialty Clinics |

| By Application | Interventional Cardiology (PCI, balloon angioplasty) Interventional Radiology Peripheral Vascular Interventions Urology and Gastroenterology Procedures |

| By Distribution Channel | Direct Sales (tenders and enterprise contracts) Medical Supply Distributors Online/Procurement Platforms Others |

| By Region | North America Europe Asia-Pacific Latin America |

| By Capacity (Volume) | –20 mL mL mL |

| By Pressure/Function | Standard-Pressure Devices High-Pressure Devices Analog (Mechanical) vs Digital (Manometer-integrated) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Electronics Inflation Impact | 100 | Product Managers, Pricing Analysts |

| Food and Beverage Sector Analysis | 80 | Supply Chain Managers, Procurement Officers |

| Construction Materials Pricing | 70 | Project Managers, Financial Controllers |

| Healthcare Equipment Costs | 60 | Operations Directors, Financial Analysts |

| Transportation and Logistics Sector | 90 | Logistics Coordinators, Business Development Managers |

The Global Inflation Devices Market is valued at approximately USD 1.05 billion, driven by the increasing prevalence of cardiovascular diseases and advancements in medical technology, particularly in interventional procedures.