Region:Global

Author(s):Shubham

Product Code:KRAC0768

Pages:84

Published On:August 2025

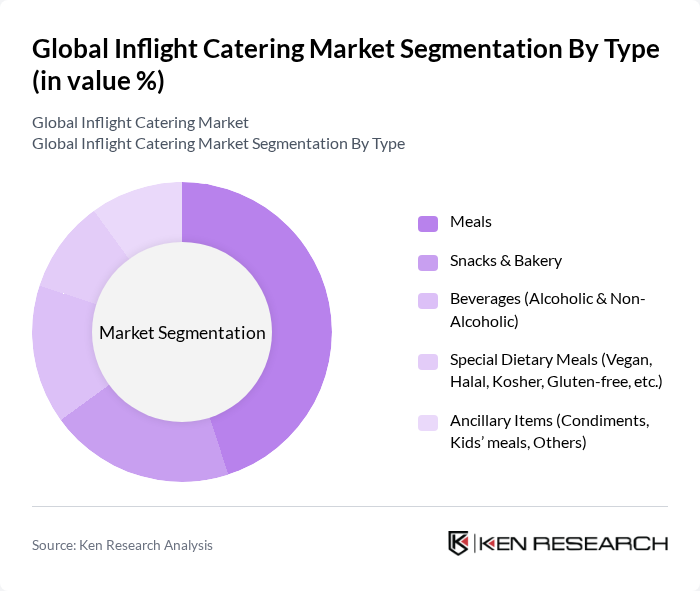

By Type:This segmentation includes various categories of inflight catering services, focusing on the types of food and beverages offered to passengers. The subsegments are Meals, Snacks & Bakery, Beverages (Alcoholic & Non-Alcoholic), Special Dietary Meals (Vegan, Halal, Kosher, Gluten-free, etc.), and Ancillary Items (Condiments, Kids’ meals, Others). Among these, Meals dominate the market due to the essential nature of providing substantial food options during flights, especially on medium- and long-haul routes, and the continued expansion of pre-order and customized meal programs by airlines.

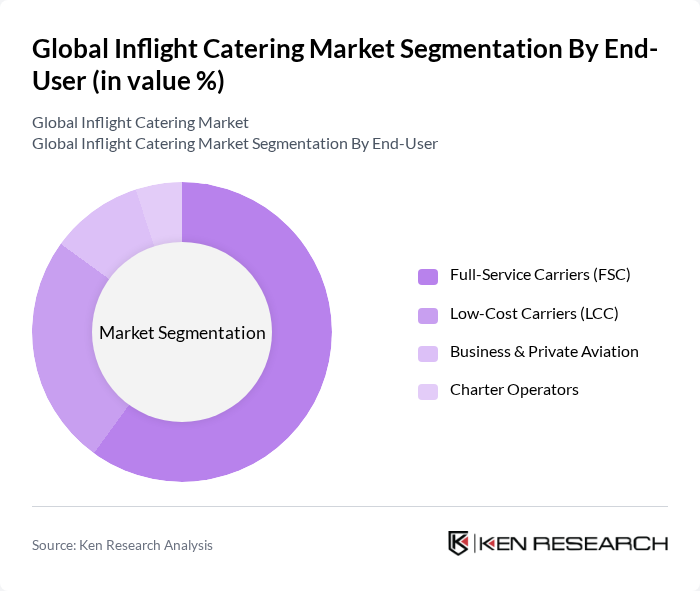

By End-User:This segmentation focuses on the different types of airlines and aviation services that utilize inflight catering. The subsegments include Full-Service Carriers (FSC), Low-Cost Carriers (LCC), Business & Private Aviation, and Charter Operators. Full-Service Carriers dominate this segment as they typically offer comprehensive inflight services, including meals, which are integral to their customer experience strategy; LCCs increasingly drive volume through buy-on-board and pre-order programs.

The Global Inflight Catering Market is characterized by a dynamic mix of regional and international players. Leading participants such as Gategroup (Gate Gourmet), LSG Group (LSG Sky Chefs), DO & CO Aktiengesellschaft, Flying Food Group, Newrest, Servair (Groupe ADP), Emirates Flight Catering, dnata Catering, SATS Ltd., Cathay Pacific Catering Services (H.K.) Ltd., Saudi Airlines Catering Company, Sky Café/Alpha Flight Services (dnata/Alpha legacy), ANA Catering Service Co., Ltd., KLM Catering Services Schiphol, IGS Catering Services contribute to innovation, geographic expansion, and service delivery in this space.

The inflight catering market is poised for significant transformation as airlines adapt to changing consumer preferences and economic conditions. With a focus on sustainability and health-conscious options, airlines are likely to enhance their catering services by incorporating local ingredients and innovative meal personalization. Additionally, advancements in logistics technology will streamline operations, improving efficiency and reducing waste. As the market evolves, partnerships with local suppliers will become increasingly vital, fostering a more sustainable and diverse inflight dining experience.

| Segment | Sub-Segments |

|---|---|

| By Type | Meals Snacks & Bakery Beverages (Alcoholic & Non-Alcoholic) Special Dietary Meals (Vegan, Halal, Kosher, Gluten?free, etc.) Ancillary Items (Condiments, Kids’ meals, Others) |

| By End-User | Full-Service Carriers (FSC) Low-Cost Carriers (LCC) Business & Private Aviation Charter Operators |

| By Service Type | Onboard Catering (Hot/Cold Meals) Buy-on-Board & Pre?Order Trolley & Commissary Services Lounge & Airport Catering Support |

| By Flight Duration | Short?Haul Medium?Haul Long?Haul |

| By Distribution/Contract Model | Direct Contracts with Airlines Third?Party/Outsourced Caterers Hybrid/JV Models |

| By Class of Service | Economy Premium Economy Business First |

| By Packaging & Sustainability | Single?Use/Disposable Reusable/Returnable Eco?Friendly/Compostable Waste Reduction & Logistics Solutions |

| By Region | North America Europe Asia?Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Major Airlines Inflight Catering | 120 | Catering Managers, Airline Executives |

| Regional Airlines Catering Services | 85 | Operations Managers, Procurement Officers |

| Inflight Meal Suppliers | 70 | Product Development Managers, Sales Directors |

| Airport Ground Services | 55 | Logistics Coordinators, Service Managers |

| Inflight Catering Technology Providers | 45 | Technology Officers, Business Development Managers |

The Global Inflight Catering Market is valued at approximately USD 2022 billion, driven by increasing air travel, rising disposable incomes, and a growing demand for premium inflight services. Airlines are expanding menu options to enhance the onboard experience.