Region:Global

Author(s):Dev

Product Code:KRAA1570

Pages:80

Published On:August 2025

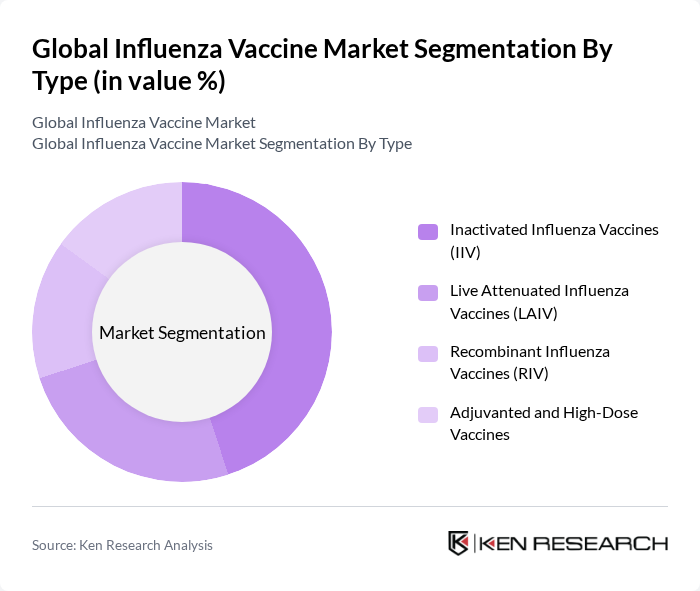

By Type:The market is segmented into various types of influenza vaccines, including Inactivated Influenza Vaccines (IIV), Live Attenuated Influenza Vaccines (LAIV), Recombinant Influenza Vaccines (RIV), and Adjuvanted and High-Dose Vaccines. Among these, Inactivated Influenza Vaccines (IIV) dominate the market due to their widespread acceptance and proven efficacy in preventing influenza. The preference for IIV is driven by their safety profile and the ability to be administered to a broader population, including pregnant women and individuals with compromised immune systems.

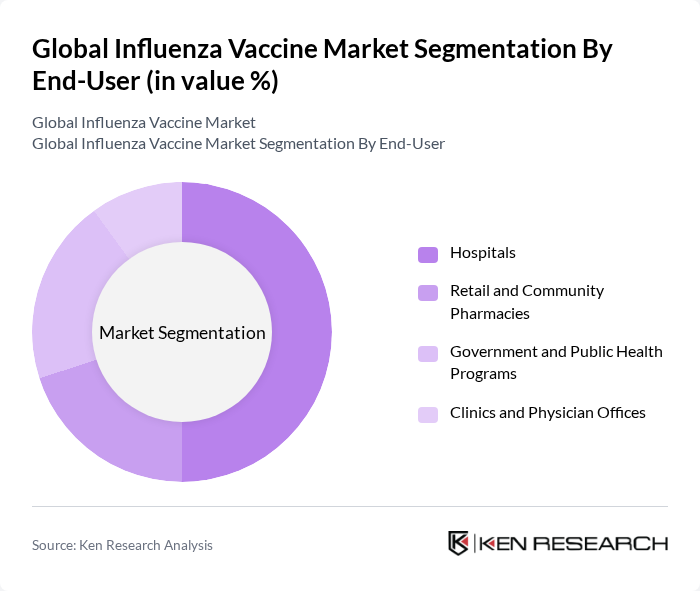

By End-User:The end-user segmentation includes Hospitals, Retail and Community Pharmacies, Government and Public Health Programs, and Clinics and Physician Offices. Hospitals are the leading end-users, primarily due to their capacity to administer vaccines to large populations and their role in managing influenza outbreaks. The growing role of retail pharmacies and public health clinics in mass immunization campaigns also drives significant volumes, with many countries leveraging pharmacies for accessible seasonal flu vaccination.

The Global Influenza Vaccine Market is characterized by a dynamic mix of regional and international players. Leading participants such as Sanofi, GSK plc, CSL Seqirus, AstraZeneca, Moderna, Inc., Pfizer Inc., Novavax, Inc., Sinovac Biotech Ltd., Daiichi Sankyo Company, Limited, Serum Institute of India Pvt. Ltd., Bharat Biotech International Ltd., Hualan Biological Engineering Inc., KM Biologics Co., Ltd., GC Biopharma (Green Cross Corporation), Abbott Laboratories contribute to innovation, geographic expansion, and service delivery in this space.

The future of the influenza vaccine market appears promising, driven by ongoing advancements in vaccine technology and increasing global health initiatives. As personalized vaccines gain traction, tailored immunization strategies are expected to enhance efficacy and acceptance. Furthermore, the integration of digital health solutions will facilitate better tracking and management of vaccination programs. With a focus on preventive healthcare, the market is poised for growth, supported by collaborative efforts between public and private sectors to improve vaccine accessibility and distribution.

| Segment | Sub-Segments |

|---|---|

| By Type | Inactivated Influenza Vaccines (IIV) Live Attenuated Influenza Vaccines (LAIV) Recombinant Influenza Vaccines (RIV) Adjuvanted and High-Dose Vaccines |

| By End-User | Hospitals Retail and Community Pharmacies Government and Public Health Programs Clinics and Physician Offices |

| By Distribution Channel | Public Procurement (e.g., national immunization programs) Private Channel (pharmacies, providers, employers) Wholesalers and Distributors Online/Telehealth-Enabled Scheduling and Fulfillment |

| By Age Group | Pediatric (6 months–17 years) Adults (18–64 years) Older Adults (65+ years) |

| By Geography | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Vaccine Formulation | Trivalent Quadrivalent Cell-based Egg-based Recombinant |

| By Pricing Tier | Standard-Dose (Private and Public Pricing) High-Dose and Adjuvanted (Premium) Pediatric and Public Tender (Budget) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Vaccine Manufacturers | 90 | Production Managers, R&D Directors |

| Healthcare Providers | 140 | Physicians, Nurses, Public Health Officials |

| Regulatory Bodies | 50 | Regulatory Affairs Specialists, Policy Makers |

| Pharmacy Chains | 80 | Pharmacy Managers, Supply Chain Coordinators |

| Patient Advocacy Groups | 60 | Advocacy Leaders, Community Health Workers |

The Global Influenza Vaccine Market is valued at approximately USD 7.1 billion, driven by increasing influenza outbreaks, heightened vaccination awareness, and government initiatives promoting immunization programs. This market is expected to grow further due to ongoing public health efforts.