Region:Global

Author(s):Shubham

Product Code:KRAB0729

Pages:80

Published On:August 2025

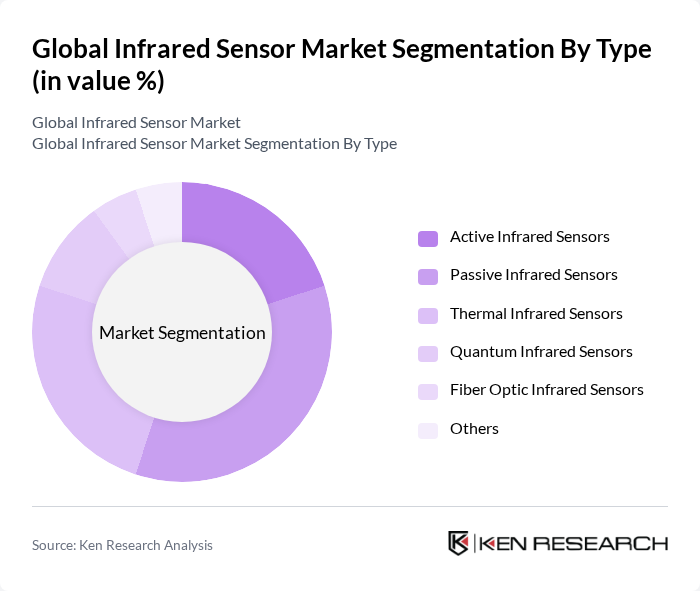

By Type:The market is segmented into Active Infrared Sensors, Passive Infrared Sensors, Thermal Infrared Sensors, Quantum Infrared Sensors, Fiber Optic Infrared Sensors, and Others. Passive Infrared Sensors lead the segment due to their extensive use in motion detection, security systems, and energy-efficient smart home applications. Active infrared sensors are widely adopted in industrial automation and safety systems, while thermal infrared sensors are prominent in healthcare and automotive safety .

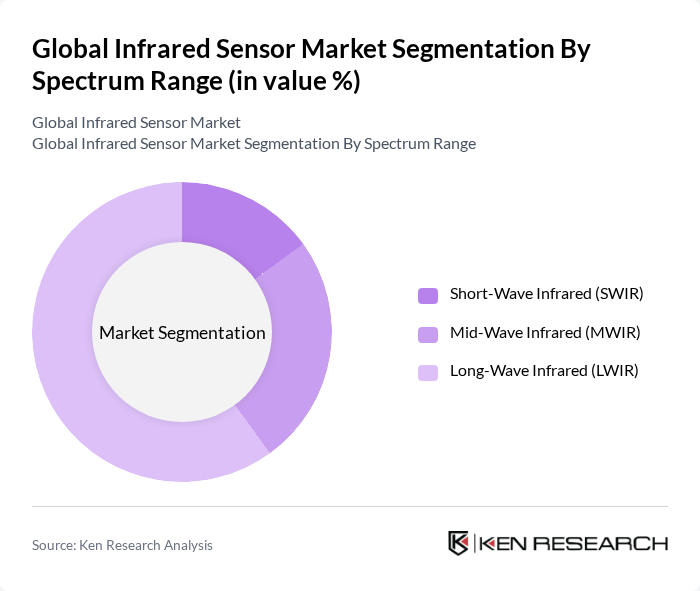

By Spectrum Range:The infrared sensor market is categorized by spectrum range: Short-Wave Infrared (SWIR), Mid-Wave Infrared (MWIR), and Long-Wave Infrared (LWIR). Long-Wave Infrared sensors dominate due to their extensive use in thermal imaging, surveillance, and industrial monitoring. SWIR sensors are gaining traction in material inspection and quality control, while MWIR sensors are preferred in scientific, aerospace, and defense applications .

The Global Infrared Sensor Market is characterized by a dynamic mix of regional and international players. Leading participants such as FLIR Systems, Inc., Honeywell International Inc., Texas Instruments Incorporated, Raytheon Technologies Corporation, Omron Corporation, Panasonic Corporation, Siemens AG, Teledyne Technologies Incorporated, Vishay Intertechnology, Inc., FLUKE Corporation, Microchip Technology Incorporated, Analog Devices, Inc., Broadcom Inc., STMicroelectronics N.V., Infineon Technologies AG, Murata Manufacturing Co., Ltd., Excelitas Technologies Corp., Mitsubishi Electric Corporation, Teledyne Imaging Inc. contribute to innovation, geographic expansion, and service delivery in this space .

The infrared sensor market is poised for significant evolution, driven by technological advancements and increasing integration with smart technologies. As industries prioritize automation and energy efficiency, the demand for sophisticated infrared sensors will likely rise. Furthermore, the growing emphasis on IoT connectivity will enhance sensor capabilities, enabling real-time data analysis and improved decision-making processes. This trend will foster innovation and create new applications, particularly in smart homes and healthcare, ensuring a dynamic market landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Active Infrared Sensors Passive Infrared Sensors Thermal Infrared Sensors Quantum Infrared Sensors Fiber Optic Infrared Sensors Others |

| By Spectrum Range | Short-Wave Infrared (SWIR) Mid-Wave Infrared (MWIR) Long-Wave Infrared (LWIR) |

| By Working Mechanism | Active Sensors Passive Sensors |

| By Detection Method | Uncooled Infrared Sensors Cooled Infrared Sensors |

| By End-User | Consumer Electronics Automotive Healthcare Industrial Automation Aerospace & Defense Commercial Oil & Gas Others |

| By Application | Security and Surveillance Temperature Measurement Gas Detection Fire Detection Smart Home Automation Others |

| By Region | North America Europe Asia-Pacific Rest of the World |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Infrared Sensors | 100 | Product Engineers, Automotive Designers |

| Healthcare Monitoring Devices | 70 | Medical Device Developers, Clinical Engineers |

| Industrial Automation Sensors | 80 | Manufacturing Managers, Automation Specialists |

| Consumer Electronics Applications | 60 | Product Managers, Electronics Engineers |

| Security and Surveillance Systems | 50 | Security System Designers, IT Managers |

The Global Infrared Sensor Market is valued at approximately USD 1.2 billion, driven by increasing demand for advanced sensing technologies in sectors such as automotive, healthcare, and industrial automation, along with the rise of smart home devices and security applications.