Region:Global

Author(s):Dev

Product Code:KRAD0499

Pages:80

Published On:August 2025

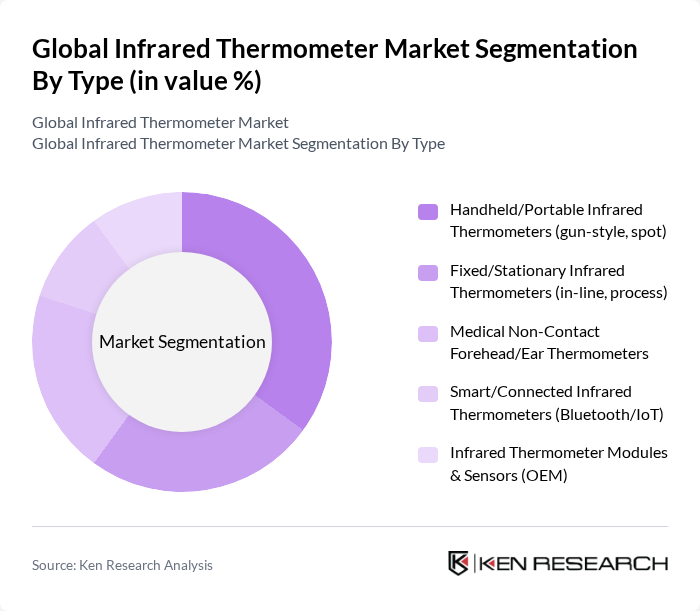

By Type:The market is segmented into various types of infrared thermometers, including handheld/portable, fixed/stationary, medical non-contact, smart/connected, and infrared thermometer modules & sensors. Each type serves different applications and user needs, contributing to the overall market dynamics.

The handheld/portable infrared thermometers dominate the market due to their versatility and ease of use in various settings, including healthcare, industrial, and home applications. Their compact design and quick response time make them ideal for on-the-go temperature measurements. The increasing consumer preference for non-contact solutions, especially in the wake of health crises, has further solidified their market leadership. Additionally, advancements in technology have led to the development of more accurate and user-friendly handheld models, enhancing their appeal.

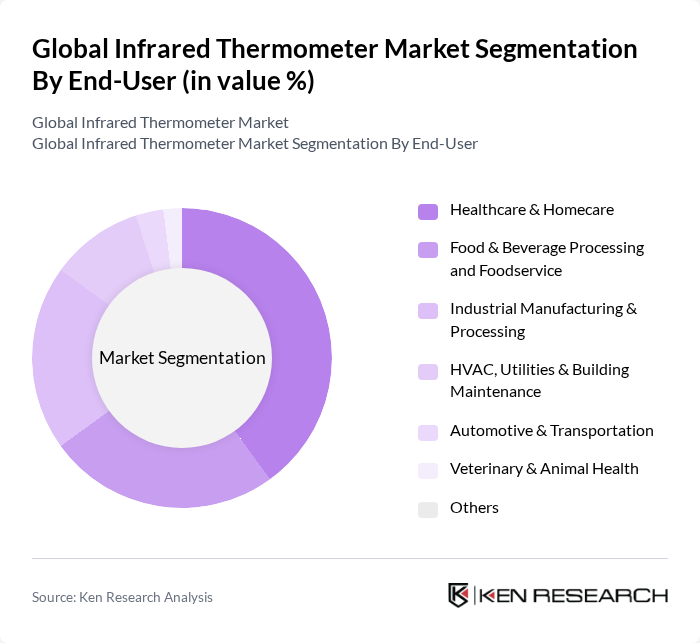

By End-User:The market is segmented based on end-users, including healthcare & homecare, food & beverage processing, industrial manufacturing, HVAC, automotive, veterinary, and others. Each segment has unique requirements and applications for infrared thermometers.

The healthcare and homecare segment leads the market due to the heightened focus on health and safety, particularly in clinical settings. The demand for non-contact thermometers has surged in hospitals and clinics, driven by the need for quick and accurate temperature assessments. Additionally, the growing trend of home healthcare has further propelled the adoption of infrared thermometers among consumers, making this segment a significant contributor to market growth.

The Global Infrared Thermometer Market is characterized by a dynamic mix of regional and international players. Leading participants such as Fluke Corporation, OMRON Healthcare Co., Ltd., Braun GmbH (Braun Health Care, a P&G brand), Exergen Corporation, ThermoWorks, Inc., Omega Engineering, Inc., PCE Instruments (PCE Holding GmbH), Testo SE & Co. KGaA, Klein Tools, Inc., Milwaukee Tool (Techtronic Industries), Acurite (Chaney Instrument Co.), BTMETER, Hti-Xintai (Xintai Instrument), Seek Thermal, Inc., CEM Instruments (Shenzhen Everbest Machinery Industry Co., Ltd.) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the infrared thermometer market appears promising, driven by ongoing technological advancements and increasing health awareness among consumers. As industries continue to prioritize safety and efficiency, the integration of smart technologies and IoT capabilities is expected to enhance product functionality. Furthermore, the expansion into emerging markets will provide new growth avenues, as these regions increasingly adopt advanced healthcare solutions and safety measures, fostering a robust demand for infrared thermometers.

| Segment | Sub-Segments |

|---|---|

| By Type | Handheld/Portable Infrared Thermometers (gun-style, spot) Fixed/Stationary Infrared Thermometers (in-line, process) Medical Non-Contact Forehead/Ear Thermometers Smart/Connected Infrared Thermometers (Bluetooth/IoT) Infrared Thermometer Modules & Sensors (OEM) |

| By End-User | Healthcare & Homecare Food & Beverage Processing and Foodservice Industrial Manufacturing & Processing HVAC, Utilities & Building Maintenance Automotive & Transportation Veterinary & Animal Health Others |

| By Application | Clinical Screening & Medical Diagnostics Predictive Maintenance & Industrial Monitoring Food Safety & HACCP Compliance HVAC/R Inspection and Energy Audits Electronics and Thermal Process Control Others |

| By Distribution Channel | Online Retail & Marketplaces Offline Retail (Pharmacies, Electronics, Industrial) Direct/B2B Sales (enterprise, OEM, tenders) Distributor/Wholesaler Networks |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Budget (sub-USD 30, consumer) Mid-Range (USD 30–150, prosumer/pro) Premium (USD 150+, professional/medical/industrial) |

| By Brand | Established Brands Emerging Brands Private Labels Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Sector Usage | 120 | Healthcare Practitioners, Hospital Administrators |

| Industrial Applications | 100 | Quality Control Managers, Safety Officers |

| Consumer Market Insights | 80 | Retail Buyers, Product Managers |

| Research & Development Feedback | 60 | R&D Engineers, Product Development Specialists |

| Distribution Channel Analysis | 90 | Supply Chain Managers, Logistics Coordinators |

The Global Infrared Thermometer Market is valued at approximately USD 3.0 billion, reflecting significant growth driven by the increasing demand for non-contact temperature measurement solutions across healthcare, industrial, and food safety applications.