Region:Global

Author(s):Rebecca

Product Code:KRAA2131

Pages:97

Published On:August 2025

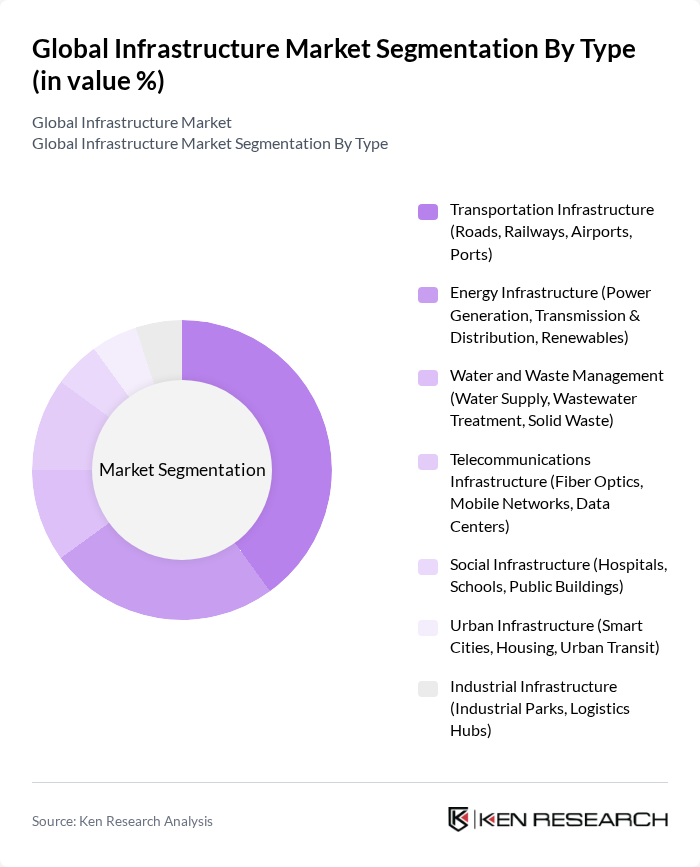

By Type:The infrastructure market can be segmented into various types, including transportation, energy, water and waste management, telecommunications, social, urban, and industrial infrastructure. Each of these segments plays a crucial role in supporting economic activities and improving the quality of life for citizens. Among these, transportation infrastructure is currently the most dominant segment, driven by the increasing need for efficient logistics, urban connectivity, and the expansion of global trade routes. The energy segment is also witnessing robust growth due to the global shift towards renewable energy and grid modernization.

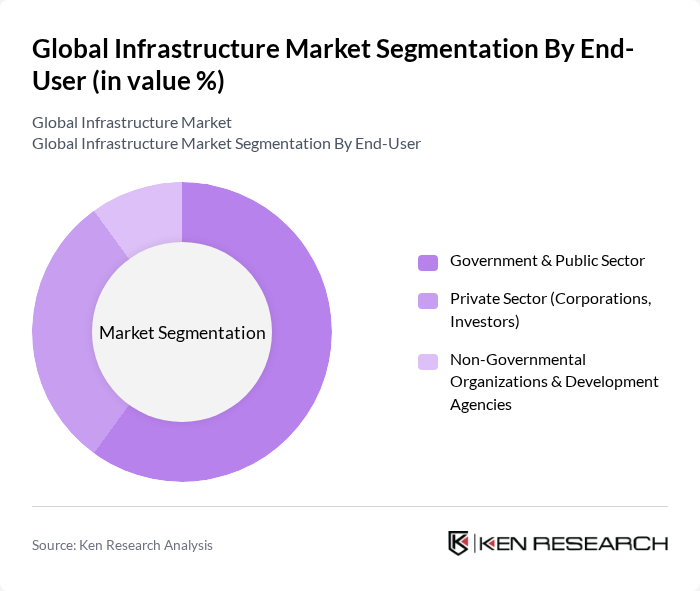

By End-User:The end-user segmentation of the infrastructure market includes government and public sector, private sector, and non-governmental organizations and development agencies. The government and public sector are the largest end-users, primarily due to their significant investments in public infrastructure projects aimed at enhancing national development and public welfare. The private sector is also increasingly involved, driven by the need for improved infrastructure to support business operations and the growing role of public-private partnerships.

The Global Infrastructure Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bechtel Corporation, Fluor Corporation, Jacobs Engineering Group, Kiewit Corporation, Skanska AB, Turner Construction Company, AECOM, Balfour Beatty plc, SNC-Lavalin Group Inc., Vinci SA, PCL Construction Enterprises, Inc., Walsh Group, HDR, Inc., Black & Veatch, Tetra Tech, Inc., China State Construction Engineering Corporation Ltd., Bouygues Group, Hochtief AG, Ferrovial S.A., TCDD Ta??mac?l?k A.?. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the infrastructure market is poised for transformative growth, driven by technological innovations and sustainability initiatives. As urban populations continue to rise, cities will increasingly adopt smart technologies to enhance efficiency and resilience. Furthermore, the emphasis on green infrastructure will lead to a surge in projects focused on renewable energy and sustainable practices. In future, these trends are expected to reshape the infrastructure landscape, fostering a more integrated and environmentally friendly approach to development.

| Segment | Sub-Segments |

|---|---|

| By Type | Transportation Infrastructure (Roads, Railways, Airports, Ports) Energy Infrastructure (Power Generation, Transmission & Distribution, Renewables) Water and Waste Management (Water Supply, Wastewater Treatment, Solid Waste) Telecommunications Infrastructure (Fiber Optics, Mobile Networks, Data Centers) Social Infrastructure (Hospitals, Schools, Public Buildings) Urban Infrastructure (Smart Cities, Housing, Urban Transit) Industrial Infrastructure (Industrial Parks, Logistics Hubs) |

| By End-User | Government & Public Sector Private Sector (Corporations, Investors) Non-Governmental Organizations & Development Agencies |

| By Investment Source | Public Funding (National, State, Municipal) Private Investment (Equity, Debt, Infrastructure Funds) International Aid & Multilateral Agencies Public-Private Partnerships (PPP) |

| By Application | Urban Development (Smart Cities, Metropolitan Upgrades) Rural Development (Connectivity, Utilities) Infrastructure Rehabilitation & Modernization |

| By Financing Model | Traditional Financing (Government Bonds, Bank Loans) Innovative Financing (Green Bonds, Infrastructure REITs) Blended Financing (Combination of Public, Private, and Aid) |

| By Project Size | Large Scale Projects (Mega Infrastructure, National Initiatives) Medium Scale Projects (Regional, City-Level) Small Scale Projects (Community, Local) |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Transportation Infrastructure Projects | 120 | Project Managers, Civil Engineers |

| Energy Sector Investments | 90 | Energy Analysts, Regulatory Affairs Managers |

| Urban Development Initiatives | 60 | Urban Planners, Local Government Officials |

| Public-Private Partnerships | 50 | PPP Coordinators, Financial Analysts |

| Infrastructure Financing Models | 55 | Investment Bankers, Infrastructure Fund Managers |

The Global Infrastructure Market is valued at approximately USD 2.7 trillion, driven by factors such as urbanization, digital transformation, and government investments in infrastructure projects. This market encompasses essential sectors like transportation, energy, and telecommunications.