Region:Global

Author(s):Dev

Product Code:KRAA1476

Pages:95

Published On:August 2025

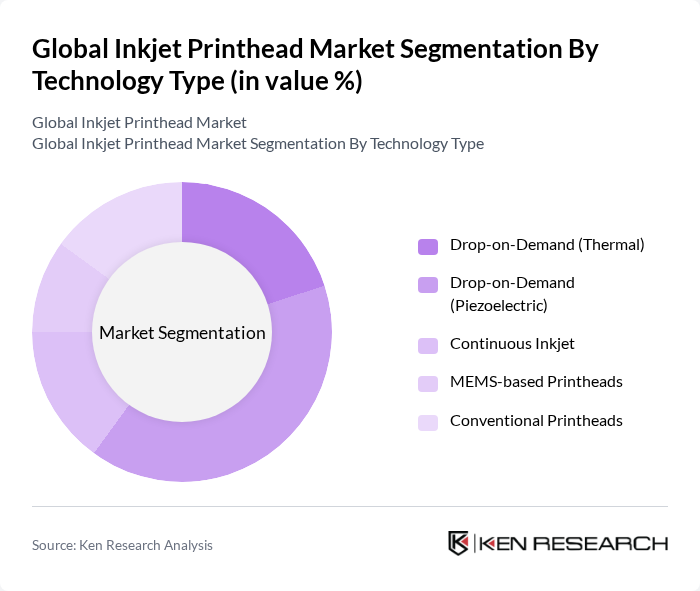

By Technology Type:The technology type segmentation includes various printhead technologies tailored to diverse printing needs. The dominant sub-segment is Drop-on-Demand (Piezoelectric) printheads, favored for their precision and versatility in industrial and graphic printing. The demand for high-quality prints and compatibility with a wide range of inks has made this technology the preferred choice among manufacturers.

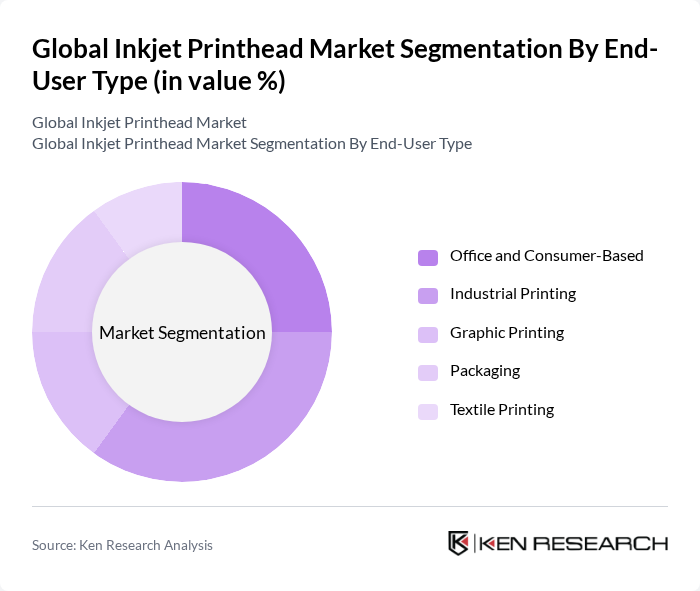

By End-User Type:The end-user segmentation highlights sectors utilizing inkjet printheads. The industrial printing sub-segment leads the market, driven by rising demand for high-volume production and customization in packaging and textiles. Advancements in printhead technology enable faster and more efficient printing, supporting manufacturers’ productivity goals. Industrial printing commands approximately 41% market share, with packaging and textiles as key growth areas.

The Global Inkjet Printhead Market is characterized by a dynamic mix of regional and international players. Leading participants such as HP Inc., Canon Inc., Seiko Epson Corporation, Ricoh Company, Ltd., Lexmark International, Inc., Brother Industries, Ltd., FUJIFILM Holdings Corporation, Xaar plc, Konica Minolta, Inc., Memjet Technology Pty Ltd., Durst Group AG, Seiko Instruments Inc., Toshiba Tec Corporation, Kyocera Corporation, Printhead Technologies Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the inkjet printhead market appears promising, driven by ongoing technological advancements and a shift towards sustainable practices. As industries increasingly adopt eco-friendly inks and digital printing solutions, the demand for innovative printheads is expected to rise. Additionally, the integration of IoT technologies in printing processes will enhance operational efficiency and customization capabilities, positioning the market for robust growth. Companies that adapt to these trends will likely gain a competitive edge in the evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Technology Type | Drop-on-Demand (Thermal) Drop-on-Demand (Piezoelectric) Continuous Inkjet MEMS-based Printheads Conventional Printheads |

| By End-User Type | Office and Consumer-Based Industrial Printing Graphic Printing Packaging Textile Printing |

| By Application | Graphics and Signage Commercial Printing Industrial Printing Label Printing D Printing |

| By Ink Type | Dye-based Inks Pigment-based Inks Water-based Inks Solvent-based Inks UV-curable Inks |

| By Geography | North America Europe Asia Pacific Latin America Middle East and Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Printing Applications | 100 | Print Shop Owners, Production Managers |

| Packaging Industry Insights | 90 | Packaging Designers, Operations Directors |

| Textile Printing Technologies | 60 | Textile Manufacturers, R&D Specialists |

| Consumer Electronics Printing | 50 | Product Managers, Quality Assurance Engineers |

| Industrial Printhead Applications | 70 | Manufacturing Engineers, Supply Chain Managers |

The Global Inkjet Printhead Market is valued at approximately USD 4.5 billion, driven by increasing demand for high-quality printing solutions across various sectors, including packaging, textiles, and commercial printing.