Region:Global

Author(s):Dev

Product Code:KRAC0472

Pages:90

Published On:August 2025

By Type:The insect feed market is segmented into various types, including Black Soldier Fly (BSF), Mealworms (Tenebrio molitor), Crickets (Acheta domesticus), Other Insects (e.g., housefly larvae, locusts), and product derivatives such as Protein Meal, Insect Oil, and Frass. Among these,Black Soldier Fly (BSF)is the leading sub-segment due to its high protein content, favorable amino acid profile, and efficiency in converting organic side-streams into valuable feed. Rising sustainability requirements in aquaculture, poultry, and pet nutrition, along with regulatory acceptance in Europe and growing commercial-scale BSF facilities, are driving demand for BSF in animal feed formulations.

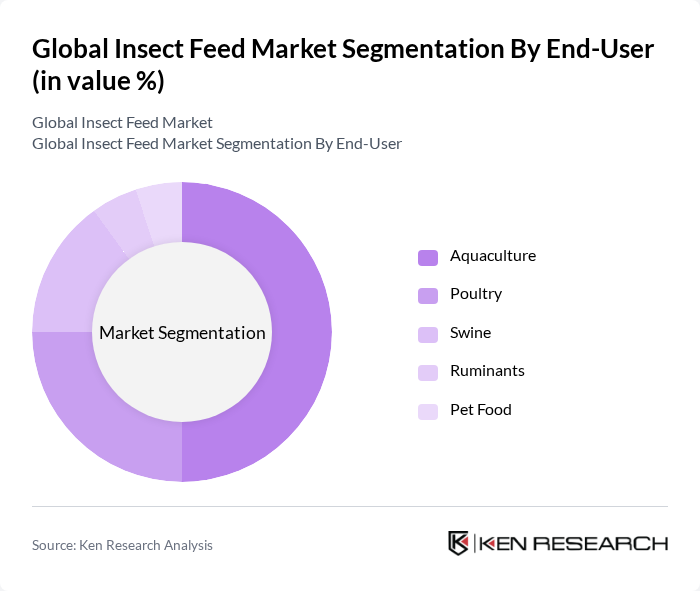

By End-User:The end-user segmentation includes Aquaculture, Poultry, Swine, Ruminants, and Pet Food. Theaquaculturesector is the dominant end-user, driven by demand for sustainable fish feed alternatives and regulatory allowances enabling insect meals to substitute a portion of fishmeal. Increasing global seafood consumption and the need to mitigate pressure on forage fisheries are accelerating the shift toward insect-based feeds, which offer high digestibility and a balanced nutrient profile.

The Global Insect Feed Market is characterized by a dynamic mix of regional and international players. Leading participants such as Protix, Innovafeed, Ÿnsect, Enterra Feed Corporation, Alltech Coppens, Darling Ingredients (EnviroFlight), Bühler Group, Beta Hatch, nextProtein, Nasekomo, Entofood Sdn Bhd, Hipromine, Loopworm, Hexafly, Entomo Farms contribute to innovation, geographic expansion, and service delivery in this space.

The future of the insect feed market appears promising, driven by increasing investments in sustainable agriculture and technological innovations. As consumer awareness grows, the demand for insect-based products is expected to rise, particularly in regions with high protein consumption. Additionally, collaborations between insect farming companies and agricultural sectors are likely to enhance market penetration, fostering a more sustainable food system. The focus on circular economy practices will further support the industry's growth trajectory, aligning with global sustainability initiatives.

| Segment | Sub-Segments |

|---|---|

| By Type | Black Soldier Fly (BSF) Mealworms (Tenebrio molitor) Crickets (Acheta domesticus) Other Insects (e.g., housefly larvae, locusts) By Product Derivative (Protein Meal, Insect Oil, Frass) |

| By End-User | Aquaculture Poultry Swine Ruminants Pet Food |

| By Application | Fish Feed (salmonids, tilapia, shrimp) Poultry Feed (broilers, layers) Piglet and Grower Feed Pet Nutrition (dry, wet, treats) Organic Fertilizers (frass-based soil amendments) |

| By Distribution Channel | Direct B2B (feed integrators, farms) Distributors and Wholesalers Online B2B Platforms Retail and Specialty Stores (pet specialty) |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Entry (commodity-grade meal/oil) Mid (functional formulations) Premium (certified, traceable, hypoallergenic) |

| By Product Form | Whole Dried Larvae Insect Protein Meal Insect Oil/Lipids Frass (organic fertilizer) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Aquaculture Feed Producers | 100 | Feed Formulators, Aquaculture Managers |

| Poultry Farmers | 80 | Poultry Farm Owners, Nutritionists |

| Pet Food Manufacturers | 70 | Product Development Managers, Procurement Officers |

| Insect Farming Operations | 60 | Farm Operators, Business Development Managers |

| Regulatory Bodies and NGOs | 50 | Policy Makers, Environmental Scientists |

The Global Insect Feed Market is valued at approximately USD 1.2 billion, driven by the increasing demand for sustainable protein sources in animal feed and advancements in insect farming technologies.