Region:Global

Author(s):Geetanshi

Product Code:KRAA2085

Pages:97

Published On:August 2025

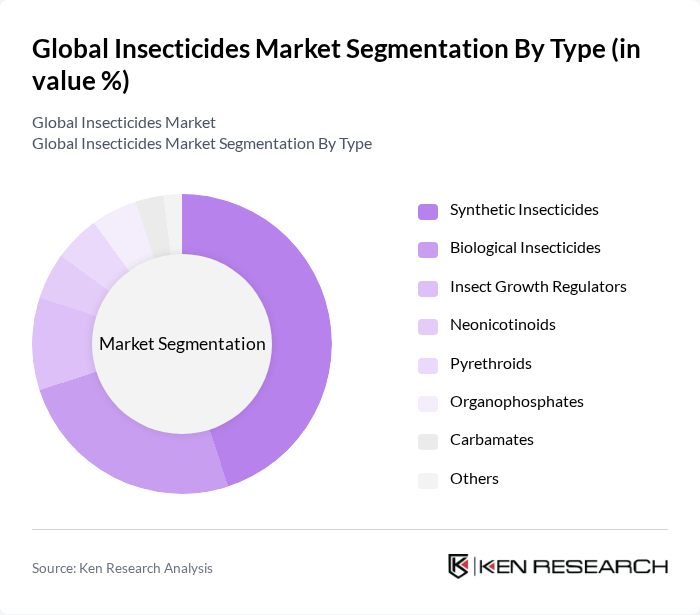

By Type:The insecticides market is segmented into Synthetic Insecticides, Biological Insecticides, Insect Growth Regulators, Neonicotinoids, Pyrethroids, Organophosphates, Carbamates, and Others.Synthetic Insecticidescontinue to dominate due to their proven efficacy and broad-spectrum activity in agriculture. However,Biological Insecticidesare gaining market share as regulatory pressures and consumer preferences shift toward sustainable pest management. Integrated Pest Management (IPM) practices and the development of low-toxicity, environmentally friendly products are accelerating the adoption of biological and growth regulator segments.

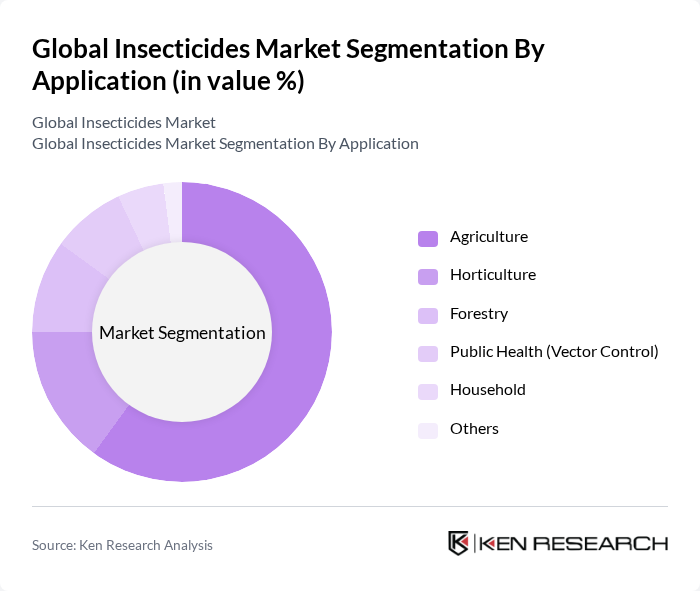

By Application:Insecticides are applied across Agriculture, Horticulture, Forestry, Public Health (Vector Control), Household, and Others.Agricultureremains the largest segment, driven by the need to protect crops and maximize yields.Horticultureis significant for ornamental and specialty crops, whilePublic Healthapplications are expanding due to increased attention to vector-borne diseases such as malaria and dengue. Forestry and household uses contribute to overall market diversity, with ongoing innovation in application methods and product safety.

The Global Insecticides Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bayer AG, Syngenta AG, BASF SE, Corteva Agriscience, FMC Corporation, ADAMA Agricultural Solutions Ltd., Sumitomo Chemical Co., Ltd., UPL Limited, Nufarm Limited, Arysta LifeScience Corporation, Marrone Bio Innovations, Inc., Valent BioSciences LLC, Isagro S.p.A., Certis Biologicals, Biobest Group NV contribute to innovation, geographic expansion, and service delivery in this space.

The future of the insecticides market is poised for transformation, driven by technological advancements and a shift towards sustainable practices. As precision agriculture gains traction, farmers are increasingly adopting data-driven pest management solutions, enhancing efficiency and reducing chemical usage. Additionally, the integration of biopesticides into traditional pest control methods is expected to grow, reflecting a broader trend towards environmentally friendly practices. These developments will shape the market landscape, fostering innovation and addressing consumer concerns about safety and sustainability.

| Segment | Sub-Segments |

|---|---|

| By Type | Synthetic Insecticides Biological Insecticides Insect Growth Regulators Neonicotinoids Pyrethroids Organophosphates Carbamates Others |

| By Application | Agriculture Horticulture Forestry Public Health (Vector Control) Household Others |

| By End-User | Farmers Agricultural Cooperatives Government Agencies Pest Control Operators Others |

| By Distribution Channel | Direct Sales Retail Stores Online Platforms Distributors/Dealers Others |

| By Formulation | Liquid Granular Powder Emulsifiable Concentrates Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Low Medium High Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cereal Crop Insecticide Usage | 100 | Farmers, Agronomists |

| Fruit and Vegetable Pest Management | 80 | Horticulturists, Crop Protection Specialists |

| Commercial Insecticide Distribution | 60 | Distributors, Retail Managers |

| Organic Insecticide Adoption | 50 | Organic Farmers, Sustainability Advocates |

| Regulatory Compliance Insights | 40 | Regulatory Affairs Managers, Environmental Consultants |

The Global Insecticides Market is valued at approximately USD 21.4 billion, driven by the increasing demand for food security and agricultural productivity. This market is expected to grow significantly in the coming years, reflecting the critical role of pest control in agriculture and urban environments.