Region:Global

Author(s):Shubham

Product Code:KRAB0685

Pages:89

Published On:August 2025

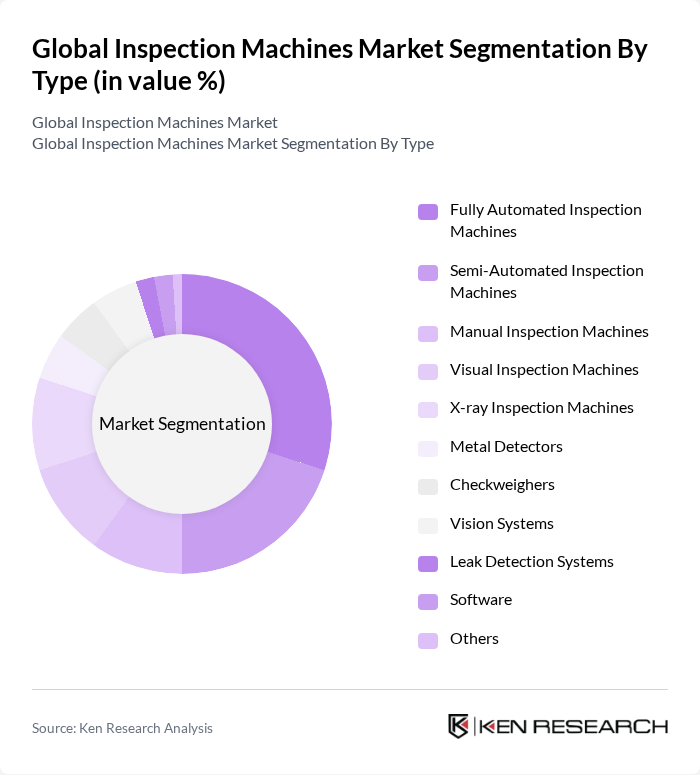

By Type:The market is segmented into various types of inspection machines, each serving specific functions and industries. The subsegments include Fully Automated Inspection Machines, Semi-Automated Inspection Machines, Manual Inspection Machines, Visual Inspection Machines, X-ray Inspection Machines, Metal Detectors, Checkweighers, Vision Systems, Leak Detection Systems, Software, and Others. Among these,Fully Automated Inspection Machinesare gaining significant traction due to their efficiency and accuracy in high-volume production environments. The adoption of vision systems and AI-driven inspection is accelerating, particularly in pharmaceutical and food sectors, to meet evolving regulatory and quality demands .

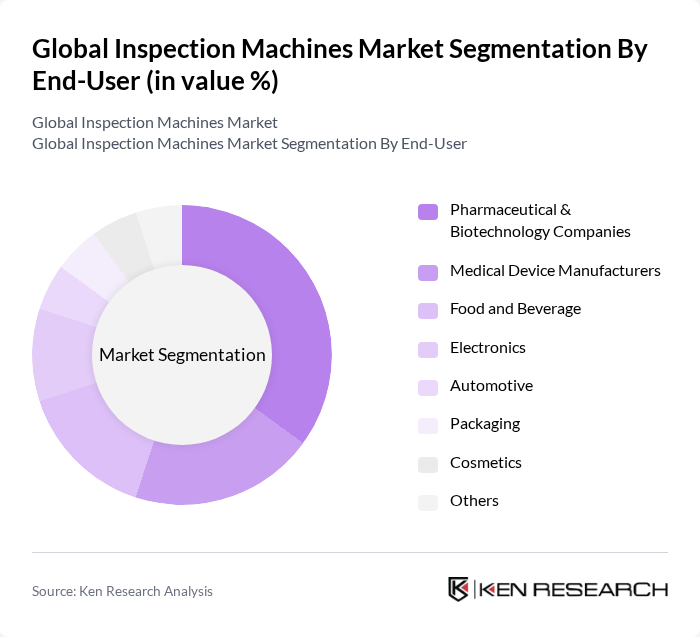

By End-User:The inspection machines market serves various end-user industries, including Pharmaceutical & Biotechnology Companies, Medical Device Manufacturers, Food and Beverage, Electronics, Automotive, Packaging, Cosmetics, and Others. ThePharmaceutical & Biotechnologysector is the leading end-user, driven by stringent regulatory requirements and the need for high-quality standards in drug manufacturing. The food and beverage industry is also expanding its adoption of inspection machines to comply with global food safety standards and prevent contamination .

The Global Inspection Machines Market is characterized by a dynamic mix of regional and international players. Leading participants such as Mettler-Toledo International Inc., Siemens AG, Thermo Fisher Scientific Inc., Beckman Coulter, Inc., Omron Corporation, Keyence Corporation, Cognex Corporation, Ishida Co., Ltd., SICK AG, AMETEK, Inc., ACG Worldwide, Bizerba GmbH & Co. KG, Eagle Product Inspection, Loma Systems, Anritsu Corporation, Antares Vision S.p.A., Bosch Packaging Technology (Syntegon Technology GmbH), Teledyne Technologies Incorporated, Optel Group, Seidenader Maschinenbau GmbH contribute to innovation, geographic expansion, and service delivery in this space.

The future of the inspection machines market in None is poised for significant transformation, driven by technological advancements and evolving consumer expectations. As industries increasingly adopt IoT-enabled devices, the demand for real-time data analytics will rise, enhancing operational efficiency. Furthermore, the shift towards sustainable practices will encourage manufacturers to develop eco-friendly inspection solutions, aligning with global sustainability goals. These trends indicate a dynamic market landscape, fostering innovation and growth opportunities in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Fully Automated Inspection Machines Semi-Automated Inspection Machines Manual Inspection Machines Visual Inspection Machines X-ray Inspection Machines Metal Detectors Checkweighers Vision Systems Leak Detection Systems Software Others |

| By End-User | Pharmaceutical & Biotechnology Companies Medical Device Manufacturers Food and Beverage Electronics Automotive Packaging Cosmetics Others |

| By Application | Quality Control Product Safety Compliance Testing Process Monitoring Packaging Integrity Others |

| By Packaging | Ampoules and Vials Syringes Blisters Bottles Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Low-End Mid-Range High-End |

| By Technology | Automated Inspection Manual Inspection Hybrid Inspection Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food & Beverage Inspection | 100 | Quality Control Managers, Production Supervisors |

| Pharmaceutical Quality Assurance | 70 | Regulatory Affairs Managers, QA Directors |

| Electronics Manufacturing Inspection | 80 | Manufacturing Engineers, Process Improvement Managers |

| Automotive Component Quality Control | 60 | Supply Chain Managers, Quality Assurance Engineers |

| Textile Industry Inspection Processes | 50 | Production Managers, Compliance Officers |

The Global Inspection Machines Market is valued at approximately USD 936 million, reflecting a significant growth trend driven by the increasing demand for quality assurance and safety across various industries, including pharmaceuticals, food and beverage, and electronics.