Region:Global

Author(s):Shubham

Product Code:KRAA1922

Pages:91

Published On:August 2025

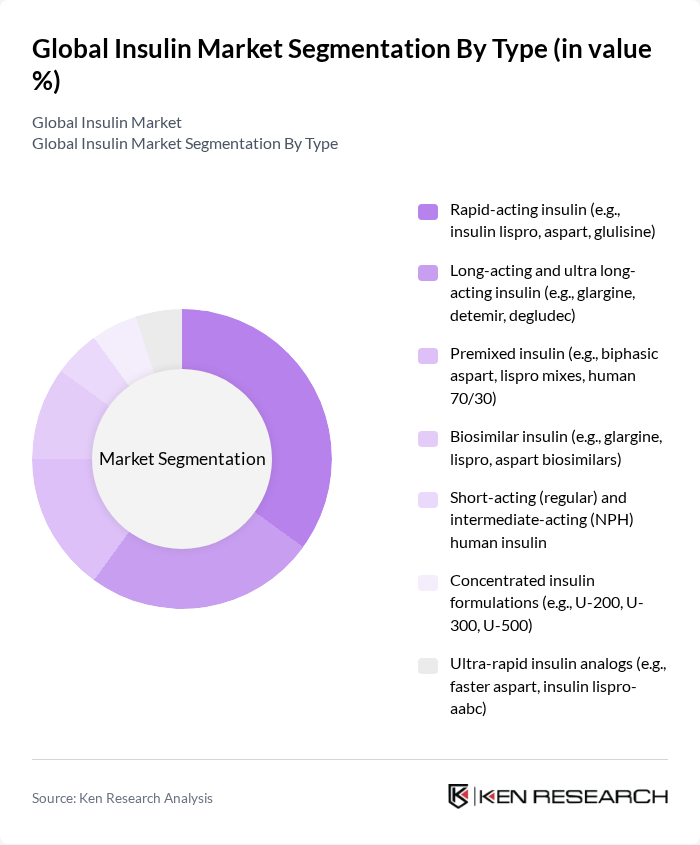

By Type:The insulin market is segmented into various types, including rapid-acting insulin, long-acting and ultra-long-acting insulin, premixed insulin, biosimilar insulin, short-acting and intermediate-acting human insulin, concentrated insulin formulations, and ultra-rapid insulin analogs. Among these, long-acting insulin has been the largest product group by revenue in recent audits, supported by prescribing patterns favoring basal analogs for their duration and reduced injection frequency; uptake of rapid-acting and ultra-rapid insulins is reinforced by growing pump use and mealtime control needs, while biosimilars continue expanding access in many markets .

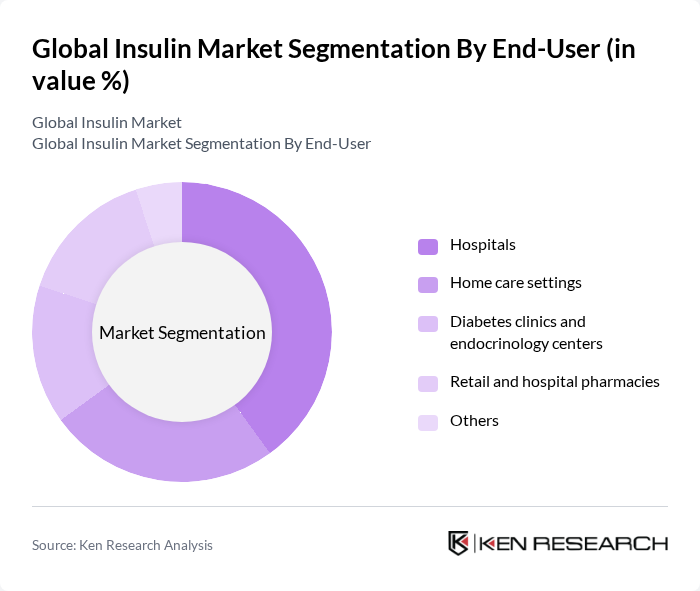

By End-User:The insulin market is segmented by end-user into hospitals, home care settings, diabetes clinics and endocrinology centers, retail and hospital pharmacies, and others. Hospitals handle high inpatient insulin utilization, but a substantial share of insulin is dispensed through outpatient and retail channels as part of chronic self-management, supported by home care, clinics, and pharmacy distribution infrastructures .

The Global Insulin Market is characterized by a dynamic mix of regional and international players. Leading participants such as Novo Nordisk A/S, Sanofi S.A., Eli Lilly and Company, Biocon Ltd., Wockhardt Ltd., Tonghua Dongbao Pharmaceutical Co., Ltd., Gan & Lee Pharmaceuticals Co., Ltd., Julphar (Gulf Pharmaceutical Industries), Ypsomed AG, Insulet Corporation, Medtronic plc, Beta Bionics, Inc., Roche Diabetes Care (F. Hoffmann-La Roche Ltd.), Abbott Laboratories, Sandoz Group AG contribute to innovation, geographic expansion, and service delivery in this space.

The future of the insulin market appears promising, driven by technological advancements and increasing healthcare investments. As the prevalence of diabetes continues to rise, the demand for innovative insulin delivery systems and personalized treatment options will likely grow. Additionally, the integration of digital health solutions and telehealth services is expected to enhance patient engagement and adherence. With ongoing collaborations between pharmaceutical and technology companies, the market is poised for significant transformation, improving patient outcomes and accessibility to insulin therapies.

| Segment | Sub-Segments |

|---|---|

| By Type | Rapid-acting insulin (e.g., insulin lispro, aspart, glulisine) Long-acting and ultra long-acting insulin (e.g., glargine, detemir, degludec) Premixed insulin (e.g., biphasic aspart, lispro mixes, human 70/30) Biosimilar insulin (e.g., glargine, lispro, aspart biosimilars) Short-acting (regular) and intermediate-acting (NPH) human insulin Concentrated insulin formulations (e.g., U-200, U-300, U-500) Ultra-rapid insulin analogs (e.g., faster aspart, insulin lispro-aabc) |

| By End-User | Hospitals Home care settings Diabetes clinics and endocrinology centers Retail and hospital pharmacies Others |

| By Distribution Channel | Direct sales and tenders (institutional/government) Retail pharmacies Online pharmacies and mail-order Hospital pharmacies Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Others |

| By Patient Type | Type 1 diabetes Type 2 diabetes requiring insulin Gestational diabetes Others |

| By Formulation | Injectable insulin (vials, cartridges, prefilled pens) Inhalable insulin Others (e.g., investigational oral/patch formulations) |

| By Pricing Strategy | Premium pricing (innovator analogs, ultra-long/ultra-rapid) Competitive pricing (human insulin, select analogs) Value-based and outcomes-based contracts Tender-based and differential pricing (LMIC/government) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Endocrinologist Insights | 100 | Endocrinologists, Diabetes Specialists |

| Pharmacist Feedback | 80 | Community Pharmacists, Hospital Pharmacists |

| Patient Experience Surveys | 120 | Diabetes Patients, Caregivers |

| Healthcare Provider Perspectives | 70 | General Practitioners, Diabetes Educators |

| Market Analyst Opinions | 40 | Healthcare Market Analysts, Industry Experts |

The Global Insulin Market is valued at approximately USD 30 billion, reflecting steady demand driven by the increasing prevalence of diabetes and obesity, as well as the adoption of advanced insulin delivery systems like pens and pumps.