Region:Global

Author(s):Rebecca

Product Code:KRAB0235

Pages:90

Published On:August 2025

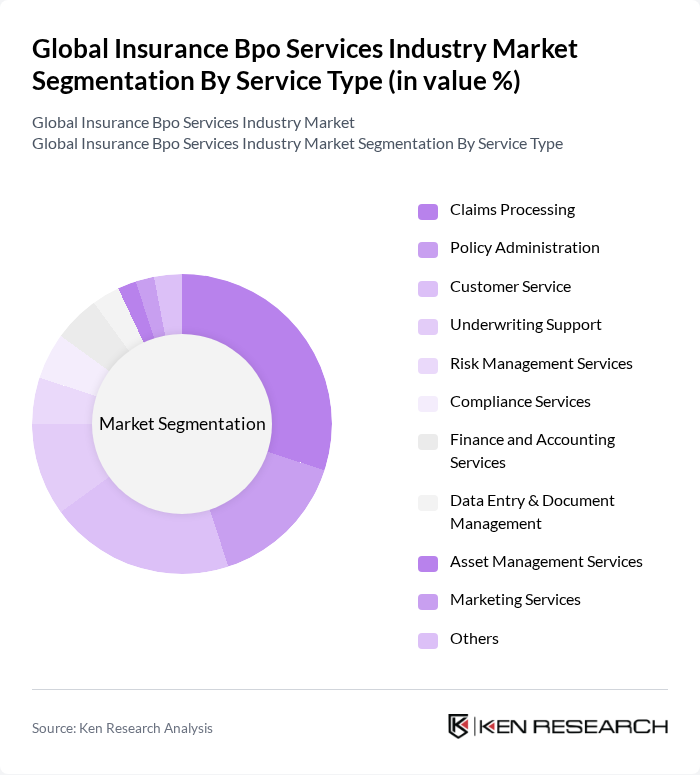

By Service Type:The service type segmentation includes various subsegments such as Claims Processing, Policy Administration, Customer Service, Underwriting Support, Risk Management Services, Compliance Services, Finance and Accounting Services, Data Entry & Document Management, Asset Management Services, Marketing Services, and Others. Among these, Claims Processing is currently the leading subsegment, accounting for over 30% of total market revenue. This dominance is attributed to the increasing volume of insurance claims and the need for efficient, technology-enabled processing solutions to enhance customer satisfaction and operational efficiency .

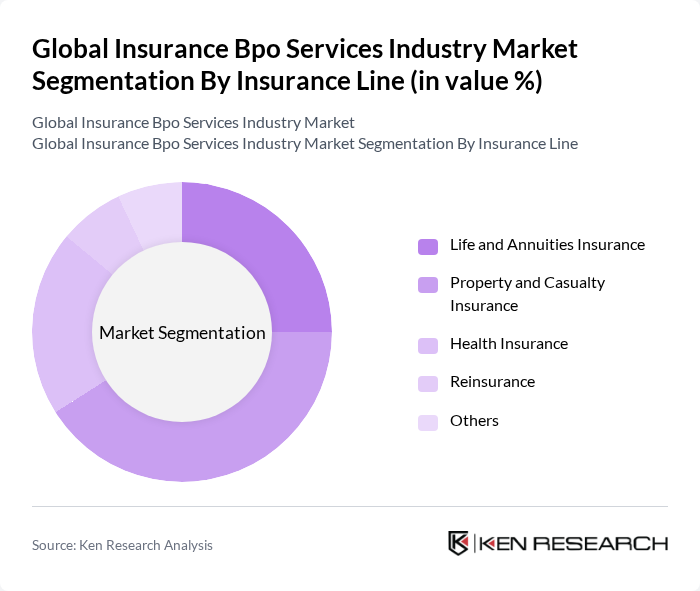

By Insurance Line:The insurance line segmentation encompasses Life and Annuities Insurance, Property and Casualty Insurance, Health Insurance, Reinsurance, and Others. Property and Casualty Insurance is the largest subsegment, holding over 41% of the market share, driven by the increasing demand for digital claims management, risk mitigation, and coverage solutions in a volatile economic environment. Growing consumer awareness and regulatory complexity further support this trend .

The Global Insurance BPO Services Industry Market is characterized by a dynamic mix of regional and international players. Leading participants such as Accenture, Cognizant, Genpact, Infosys BPM, Wipro, Tata Consultancy Services (TCS), EXL Service, Capgemini, HCLTech, Sitel Group, Teleperformance, Concentrix, Alorica, Sykes Enterprises (now part of Sitel Group), Arvato (Bertelsmann) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the insurance BPO services market appears promising, driven by ongoing digital transformation and the increasing adoption of advanced technologies. As companies continue to prioritize customer experience and operational efficiency, the demand for specialized BPO services is expected to rise. Additionally, the integration of AI and machine learning will enhance service delivery, allowing providers to offer more tailored solutions. This evolution will likely lead to a more competitive landscape, with firms that embrace innovation gaining a significant advantage.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Claims Processing Policy Administration Customer Service Underwriting Support Risk Management Services Compliance Services Finance and Accounting Services Data Entry & Document Management Asset Management Services Marketing Services Others |

| By Insurance Line | Life and Annuities Insurance Property and Casualty Insurance Health Insurance Reinsurance Others |

| By Technology | Robotic Process Automation (RPA) Artificial Intelligence (AI) Machine Learning (ML) Cloud Computing Others |

| By Delivery Model | Onshore BPO Offshore BPO Nearshore BPO Hybrid BPO |

| By Client Size | Small and Medium-sized Enterprises (SMEs) Large Enterprises |

| By Geographic Region | North America Europe Asia Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Claims Processing Services | 100 | Claims Managers, Operations Directors |

| Customer Service Outsourcing | 80 | Customer Experience Managers, Call Center Supervisors |

| Policy Administration BPO | 60 | Policy Managers, IT Directors |

| Fraud Detection Services | 50 | Fraud Analysts, Risk Management Officers |

| Data Management Solutions | 70 | Data Analysts, IT Managers |

The Global Insurance BPO Services Industry Market is valued at approximately USD 7.5 billion, reflecting a significant growth driven by the demand for cost-effective solutions and enhanced operational efficiency among insurance companies.