Region:Global

Author(s):Shubham

Product Code:KRAD0678

Pages:90

Published On:August 2025

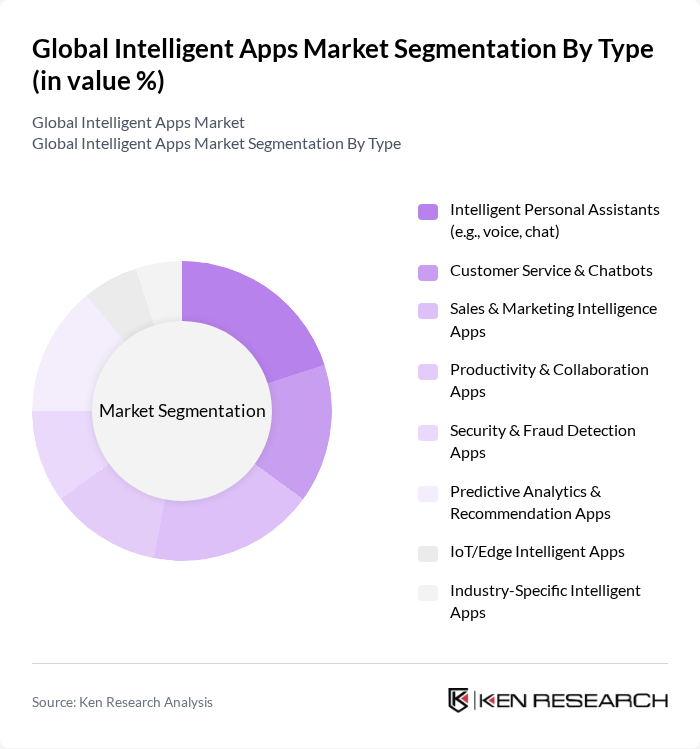

By Type:The market is segmented into various types of intelligent applications, including Intelligent Personal Assistants, Customer Service & Chatbots, Sales & Marketing Intelligence Apps, Productivity & Collaboration Apps, Security & Fraud Detection Apps, Predictive Analytics & Recommendation Apps, IoT/Edge Intelligent Apps, and Industry-Specific Intelligent Apps. Each of these sub-segments plays a crucial role in enhancing user experience and operational efficiency. Recent adoption drivers include the mainstreaming of conversational AI and copilots in enterprise suites, embedded recommendation systems in commerce and media, fraud analytics in BFSI, and on-device/edge inferencing to reduce latency and costs for IoT scenarios .

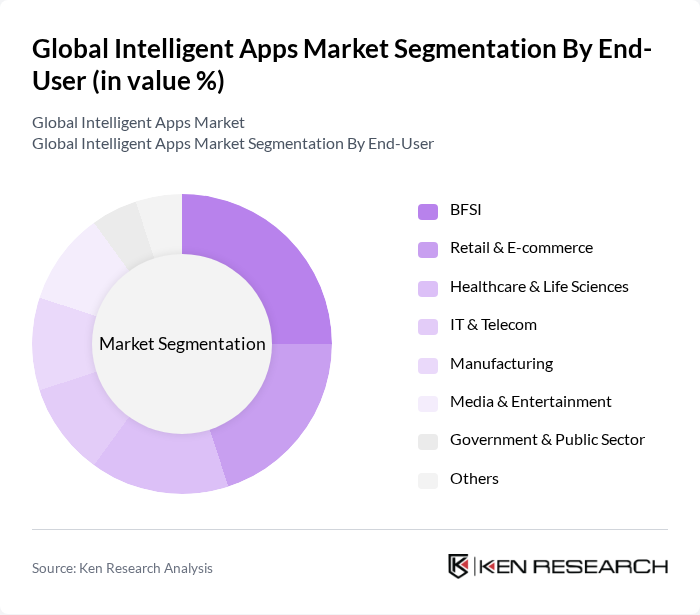

By End-User:The end-user segmentation includes various industries such as BFSI, Retail & E-commerce, Healthcare & Life Sciences, IT & Telecom, Manufacturing, Media & Entertainment, Government & Public Sector, and Others. Each sector utilizes intelligent applications to improve efficiency, enhance customer engagement, and drive innovation. Adoption is particularly strong in BFSI for fraud/risk analytics and personalized banking, retail for recommendations and dynamic pricing, healthcare for clinical decision support and patient engagement, and IT & Telecom for AIOps and service automation .

The Global Intelligent Apps Market is characterized by a dynamic mix of regional and international players. Leading participants such as Google LLC, Apple Inc., Microsoft Corporation, Amazon.com, Inc., International Business Machines Corporation (IBM), Salesforce, Inc., SAP SE, Oracle Corporation, Adobe Inc., Tencent Holdings Ltd., Alibaba Group Holding Limited, Meta Platforms, Inc., Samsung Electronics Co., Ltd., Baidu, Inc., ServiceNow, Inc., UiPath Inc., Splunk Inc., Snowflake Inc., Zoom Video Communications, Inc., Twilio Inc. contribute to innovation, geographic expansion, and service delivery in this space. Vendors are embedding AI copilots, recommendation engines, fraud detection, and automation into core product suites, accelerating intelligent app penetration across enterprise workflows .

The future of intelligent apps is poised for transformative growth, driven by advancements in AI and machine learning technologies. As user expectations for personalized experiences continue to rise, developers will increasingly focus on integrating these technologies into their applications. Additionally, the expansion of 5G networks is expected to enhance app performance and accessibility, further driving adoption. Companies that prioritize user-centric design and data privacy will likely lead the market, positioning themselves for success in this evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Intelligent Personal Assistants (e.g., voice, chat) Customer Service & Chatbots Sales & Marketing Intelligence Apps Productivity & Collaboration Apps Security & Fraud Detection Apps Predictive Analytics & Recommendation Apps IoT/Edge Intelligent Apps Industry-Specific Intelligent Apps |

| By End-User | BFSI Retail & E-commerce Healthcare & Life Sciences IT & Telecom Manufacturing Media & Entertainment Government & Public Sector Others |

| By Application | Personalized Recommendations Virtual Assistants & Conversational AI Predictive Maintenance Customer Analytics & Engagement Fraud Detection & Risk Scoring Workflow Automation Others |

| By Distribution Channel | Direct (Vendor/Enterprise Sales) Cloud Marketplaces (e.g., AWS, Azure, GCP) Mobile App Stores (iOS, Android) OEM/ISV Partnerships |

| By Pricing Model | Freemium Subscription (Seat- or Usage-Based) Per-Transaction/Consumption-Based One-Time License In-App Purchases |

| By User Demographics | SMBs Large Enterprises Individual Consumers Geographic Regions |

| By Device Type | Smartphones Tablets Wearables Smart TVs & Connected Devices Edge/IoT Devices |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| AI-Driven Mobile Applications | 120 | Product Managers, UX Designers |

| IoT-Enabled Intelligent Apps | 100 | Technical Architects, IoT Specialists |

| Enterprise Software Solutions | 80 | IT Managers, Business Analysts |

| Consumer-Focused Apps | 120 | Marketing Directors, Customer Experience Managers |

| Healthcare Intelligent Applications | 90 | Healthcare IT Professionals, Clinical Managers |

The Global Intelligent Apps Market is valued at approximately USD 45 billion, reflecting a significant growth trend driven by the rapid adoption of AI-enabled software and analytics across various sectors.