Region:Global

Author(s):Dev

Product Code:KRAD0428

Pages:87

Published On:August 2025

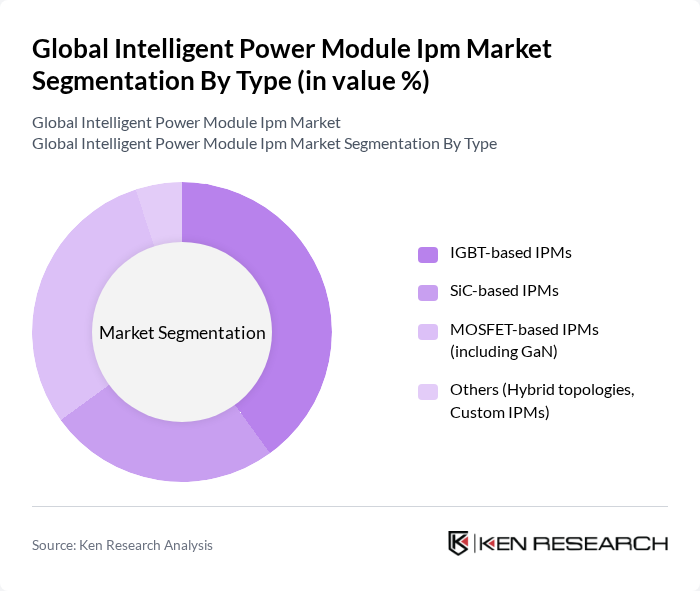

By Type:The market is segmented into various types of intelligent power modules, including IGBT-based IPMs, SiC-based IPMs, MOSFET-based IPMs (including GaN), and others such as hybrid topologies and custom IPMs. Each type serves different applications and industries, contributing to the overall market dynamics.

The IGBT-based IPMs segment is currently dominating the market due to their widespread use in industrial applications and electric vehicles. Their ability to handle high voltages and currents efficiently makes them a preferred choice for manufacturers. Additionally, the growing trend towards electrification in various sectors is further boosting the demand for IGBT-based solutions, solidifying their leadership position in the market.

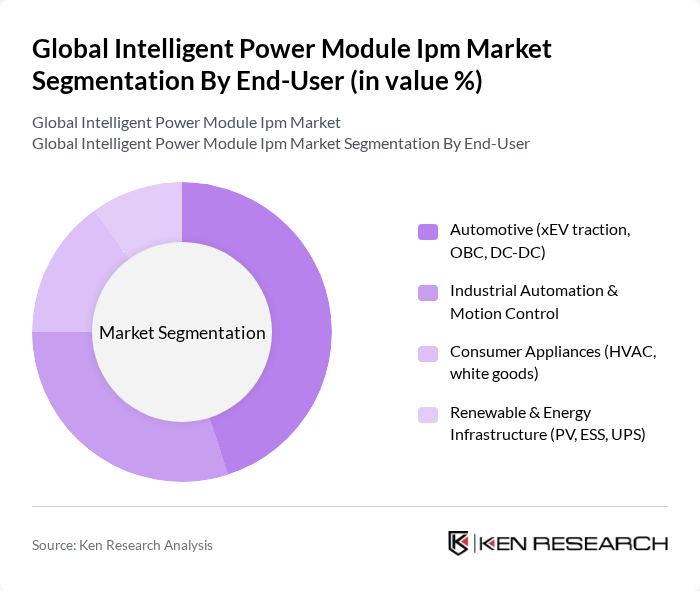

By End-User:The market is categorized based on end-users, including automotive (xEV traction, OBC, DC-DC), industrial automation & motion control, consumer appliances (HVAC, white goods), and renewable & energy infrastructure (PV, ESS, UPS). Each end-user segment has unique requirements and applications for intelligent power modules.

The automotive segment, particularly in electric vehicles, is leading the market due to the increasing demand for efficient power management systems. The shift towards electrification and the need for advanced battery management systems are driving the adoption of intelligent power modules in this sector. As a result, automotive applications are expected to continue dominating the market in the coming years.

The Global Intelligent Power Module Ipm Market is characterized by a dynamic mix of regional and international players. Leading participants such as Infineon Technologies AG, Mitsubishi Electric Corporation, onsemi (ON Semiconductor Corporation), STMicroelectronics N.V., Fuji Electric Co., Ltd., Renesas Electronics Corporation, Semikron Danfoss, Toshiba Electronic Devices & Storage Corporation, Littelfuse, Inc. (IXYS), ROHM Co., Ltd., CR Micro (China Resources Microelectronics), Microchip Technology Inc., Power Integrations, Inc., Vishay Intertechnology, Inc., Wolfspeed, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the intelligent power module market appears promising, driven by technological advancements and increasing regulatory support for energy efficiency. As industries continue to prioritize sustainability, the demand for modular power solutions is expected to rise. Additionally, the integration of IoT technologies in power management systems will enhance operational efficiencies, enabling real-time monitoring and control. This trend will likely foster innovation and collaboration across sectors, positioning the IPM market for significant growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | IGBT-based IPMs SiC-based IPMs MOSFET-based IPMs (including GaN) Others (Hybrid topologies, Custom IPMs) |

| By End-User | Automotive (xEV traction, OBC, DC-DC) Industrial Automation & Motion Control Consumer Appliances (HVAC, white goods) Renewable & Energy Infrastructure (PV, ESS, UPS) |

| By Application | Motor Drives & Servo Drives Inverters & Power Supplies UPS and Energy Storage Systems HVAC, Elevators, and Home Appliances |

| By Component | Power Devices (IGBT/MOSFET/SiC/GaN) Gate Drivers & Protection ICs Thermal Interface & Packaging Passive Components (Diodes, Capacitors) |

| By Sales Channel | Direct to OEMs Authorized Distributors Online/E-commerce Others |

| By Distribution Mode | Design-in/FAE-led Catalog/Stocking Distribution EMS/ODM Channels Others |

| By Price Range | Entry (? 600 V, low-current) Mid (601–1200 V, mid-current) Premium (>1200 V and/or high-current) Custom/Automotive-qualified |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Power Module Applications | 120 | Automotive Engineers, R&D Managers |

| Industrial Automation Systems | 90 | Operations Managers, System Integrators |

| Renewable Energy Solutions | 80 | Project Managers, Energy Consultants |

| Consumer Electronics Integration | 60 | Product Development Engineers, Marketing Managers |

| Telecommunications Infrastructure | 100 | Network Engineers, Technical Directors |

The Global Intelligent Power Module market is valued at approximately USD 3 billion, driven by the increasing demand for energy-efficient solutions, particularly in the automotive and renewable energy sectors.