Region:Global

Author(s):Shubham

Product Code:KRAB0555

Pages:90

Published On:August 2025

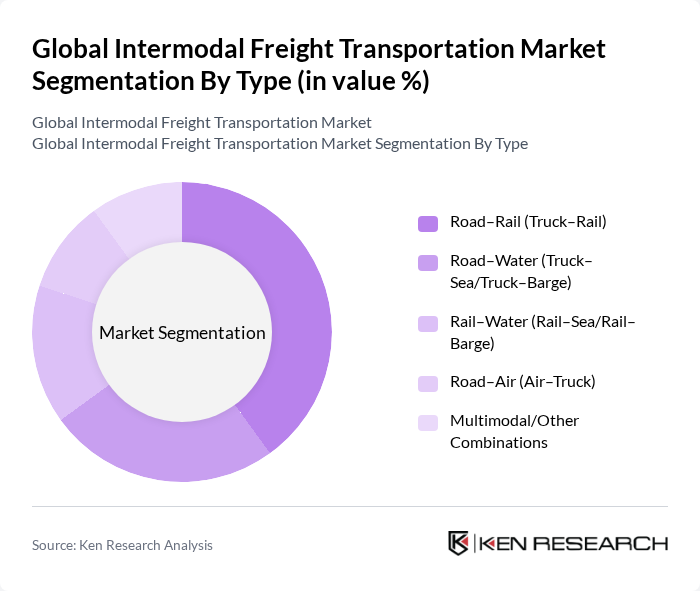

By Type:The intermodal freight transportation market can be segmented into various types, including Road–Rail (Truck–Rail), Road–Water (Truck–Sea/Truck–Barge), Rail–Water (Rail–Sea/Rail–Barge), Road–Air (Air–Truck), and Multimodal/Other Combinations. Among these, the Road–Rail segment is currently leading due to its efficiency in transporting goods over long distances while minimizing costs, supported by networked rail corridors and cost advantages in long-haul moves compared with over-the-road trucking .

By End-User Industry:The market is also segmented by end-user industries, including Consumer Goods & Retail, Industrial & Manufacturing, Automotive & Mobility, Food & Beverages, Chemicals, Pharmaceuticals & Healthcare, Energy, Mining & Commodities, and Aerospace & Defense. The Consumer Goods & Retail segment is currently the most dominant, driven by the increasing demand for fast and reliable delivery services in e-commerce and omnichannel fulfillment requiring balanced cost–speed intermodal solutions .

The Global Intermodal Freight Transportation Market is characterized by a dynamic mix of regional and international players. Leading participants such as A.P. Moller – Maersk, DHL Global Forwarding & DHL Supply Chain, DB Schenker (Deutsche Bahn AG), C.H. Robinson Worldwide, Inc., XPO, Inc., UPS Supply Chain Solutions (United Parcel Service), J.B. Hunt Transport Services, Inc., Kuehne+Nagel, DSV, CMA CGM Group (CEVA Logistics & APL Logistics), Hapag-Lloyd AG, MSC Mediterranean Shipping Company, SNCF Group (Rail Logistics Europe/GEODIS), CSX Transportation, Union Pacific Railroad, Canadian National Railway (CN), Canadian Pacific Kansas City (CPKC), Norfolk Southern Railway, BNSF Railway, ZIM Integrated Shipping Services, Yang Ming Marine Transport Corporation, Evergreen Marine Corporation, Ocean Network Express (ONE), DP World, PSA International, Hutchison Ports, TCDD Ta??mac?l?k A.?. contribute to innovation, geographic expansion, and service delivery in this space.

The future of intermodal freight transportation is poised for significant transformation, driven by technological advancements and evolving consumer expectations. As companies increasingly adopt digital platforms for logistics management, the integration of IoT and big data analytics will enhance operational efficiency and decision-making. Additionally, the focus on sustainability will lead to the development of greener transportation solutions, aligning with global environmental goals. These trends will shape a more resilient and responsive intermodal freight landscape, fostering growth and innovation in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Road–Rail (Truck–Rail) Road–Water (Truck–Sea/Truck–Barge) Rail–Water (Rail–Sea/Rail–Barge) Road–Air (Air–Truck) Multimodal/Other Combinations |

| By End-User Industry | Consumer Goods & Retail Industrial & Manufacturing Automotive & Mobility Food & Beverages Chemicals, Pharmaceuticals & Healthcare Energy, Mining & Commodities Aerospace & Defense |

| By Cargo Type | ISO Containerized (Dry, Tank, Flat-rack) Refrigerated/Temperature-Controlled (Reefer) Bulk & Neo-bulk (e.g., grain, steel, timber via containers) Project & Over-dimensional Cargo Hazardous Materials (ADR/IMDG compliant) |

| By Service Type | End-to-End Intermodal Transport (Door-to-Door) Drayage & Terminal Handling Freight Forwarding & Brokerage Warehousing & Value-Added Services (VAS) Customs Brokerage & Trade Compliance |

| By Distribution/Contracting Mode | Direct Shipper–Carrier Contracts Third-Party Logistics (3PL) Fourth-Party Logistics (4PL)/Lead Logistics Provider Digital Freight Platforms & Marketplaces |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Pricing Model | Contract Rates (Long-term) Spot/Dynamic Pricing Index-Linked & Fuel Surcharge Mechanisms Performance-Based/Service-Level Pricing |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Intermodal Freight Operations | 120 | Logistics Managers, Operations Directors |

| Rail Freight Services | 90 | Railway Operations Managers, Freight Coordinators |

| Port Authority Management | 70 | Port Managers, Infrastructure Planners |

| Shipping and Freight Forwarding | 110 | Freight Forwarders, Shipping Line Executives |

| Environmental Compliance in Freight | 60 | Sustainability Officers, Compliance Managers |

The Global Intermodal Freight Transportation Market is valued at approximately USD 68 billion, reflecting a significant growth trend driven by the demand for efficient transportation solutions and the rise in global trade and e-commerce.