Region:Global

Author(s):Dev

Product Code:KRAC0452

Pages:90

Published On:August 2025

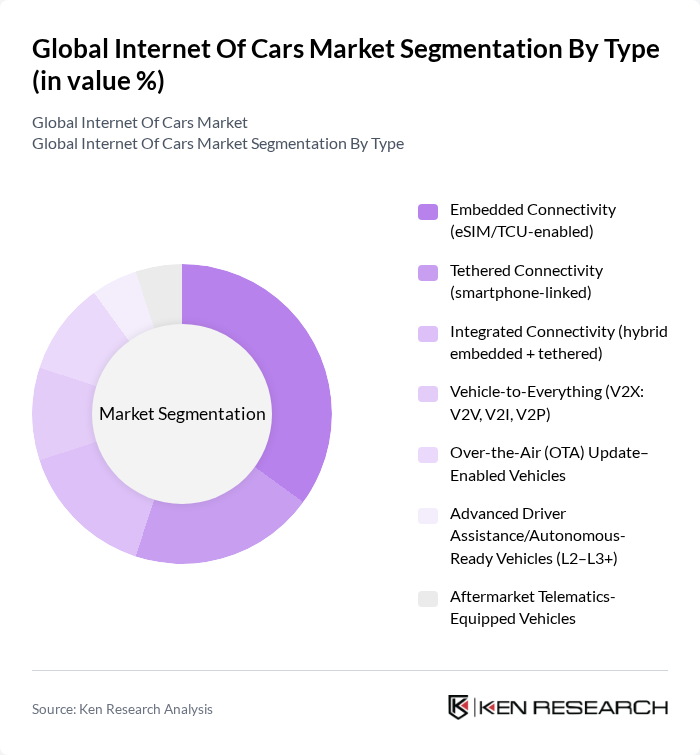

By Type:The Internet of Cars market is segmented into various types, including Embedded Connectivity, Tethered Connectivity, Integrated Connectivity, Vehicle-to-Everything (V2X), Over-the-Air (OTA) Update–Enabled Vehicles, Advanced Driver Assistance/Autonomous-Ready Vehicles, and Aftermarket Telematics-Equipped Vehicles. Among these, Embedded Connectivity is currently the leading subsegment due to its seamless integration into vehicles, providing constant connectivity and access to real-time data. This trend is driven by consumer demand for enhanced safety features and infotainment systems, and by OEM strategy to ship factory?fitted telematics control units enabling 4G/5G, eCall, OTA, and data services .

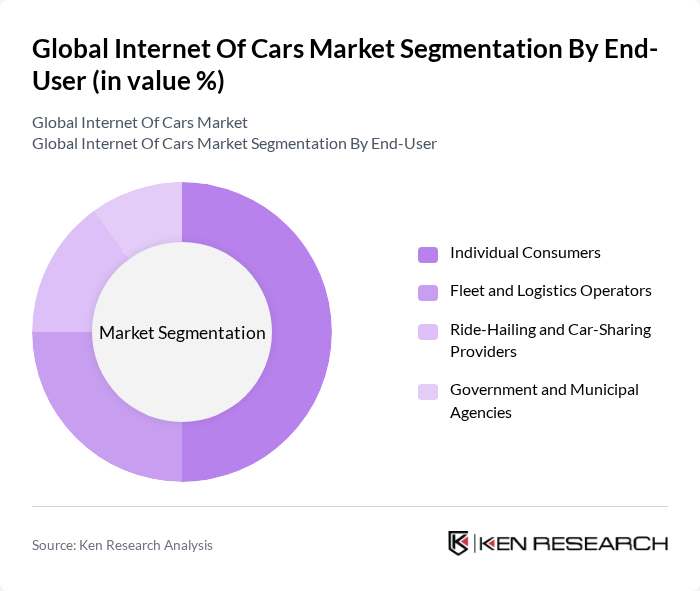

By End-User:The market is segmented by end-users, including Individual Consumers, Fleet and Logistics Operators, Ride-Hailing and Car-Sharing Providers, and Government and Municipal Agencies. The Individual Consumers segment is currently the most dominant, underpinned by rising fitment rates of connected infotainment, safety, navigation, diagnostics, and app ecosystems in passenger vehicles; fleets also accelerate adoption for telematics, route optimization, and OTA-enabled maintenance .

The Global Internet of Cars Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tesla, Inc., Ford Motor Company, General Motors Company, BMW AG, Audi AG, Toyota Motor Corporation, Honda Motor Co., Ltd., Volkswagen AG, Mercedes?Benz Group AG, Hyundai Motor Company, Nissan Motor Co., Ltd., Cisco Systems, Inc., Qualcomm Technologies, Inc., Intel Corporation, Ericsson AB, Robert Bosch GmbH, Continental AG, Aptiv PLC, Harman International (Samsung Electronics), NVIDIA Corporation, TomTom N.V., HERE Technologies, Waymo LLC (Alphabet Inc.), Vodafone Group Plc, China Mobile Limited contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Internet of Cars market is poised for transformative growth, driven by technological advancements and evolving consumer preferences. The expansion of 5G networks is expected to enhance vehicle connectivity, enabling real-time data exchange and improved user experiences. Additionally, the rise of electric vehicles will further integrate smart technologies, creating a seamless driving experience. As manufacturers increasingly collaborate with tech companies, innovative solutions will emerge, reshaping the automotive landscape and addressing consumer demands for safety and convenience.

| Segment | Sub-Segments |

|---|---|

| By Type | Embedded Connectivity (eSIM/TCU-enabled) Tethered Connectivity (smartphone-linked) Integrated Connectivity (hybrid embedded + tethered) Vehicle-to-Everything (V2X: V2V, V2I, V2P) Over-the-Air (OTA) Update–Enabled Vehicles Advanced Driver Assistance/Autonomous-Ready Vehicles (L2–L3+) Aftermarket Telematics-Equipped Vehicles |

| By End-User | Individual Consumers Fleet and Logistics Operators Ride-Hailing and Car-Sharing Providers Government and Municipal Agencies |

| By Application | Infotainment, Navigation, and In-Car Commerce Remote Vehicle Diagnostics and Prognostics Safety, ADAS, and Emergency Services (eCall) Vehicle Management: Fleet, Usage-Based Insurance (UBI), and Telematics V2X for Traffic Management and Smart Infrastructure |

| By Component | Hardware (TCU, eSIM, Telematics Sensors, Gateways) Software/Platforms (OS, Middleware, Data Platforms, Cybersecurity) Services (Connectivity, Cloud, Analytics, OTA, Managed Services) |

| By Sales Channel | OEM-Installed Aftermarket |

| By Connectivity Technology | G/LTE G Dedicated Short-Range Communications (DSRC) Cellular V2X (C-V2X) |

| By Region | North America Europe Asia Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Connected Vehicle Technology Adoption | 150 | Automotive Engineers, Product Managers |

| Consumer Preferences for IoT Features | 140 | Car Owners, Tech Enthusiasts |

| Fleet Management Solutions | 100 | Fleet Managers, Operations Directors |

| Regulatory Impact on IoT in Automotive | 80 | Policy Makers, Compliance Officers |

| Market Trends in Smart Transportation | 120 | Urban Planners, Transportation Analysts |

The Global Internet of Cars Market is valued at approximately USD 145 billion, reflecting the consolidation of automotive IoT, connected cars, and the internet of vehicles. This market is expected to grow significantly in the coming years due to increasing demand for connected vehicle technologies.