Region:Global

Author(s):Dev

Product Code:KRAD0561

Pages:94

Published On:August 2025

By Type:The IPTV market can be segmented into various types, including Live/Linear IPTV, Time-Shifted/Replay TV, Video on Demand (VoD), Subscription-Based (SVoD), Pay-Per-View (PPV)/Transactional (TVoD), Advertising-Supported (AVoD/FAST), and Hybrid (Multicast + Unicast/OTT Bundles). Among these, Video on Demand (VoD) is currently the leading sub-segment, driven by consumer preferences for on-demand content and the flexibility it offers. The rise of binge-watching culture and the availability of diverse content libraries have further solidified VoD's dominance in the market.

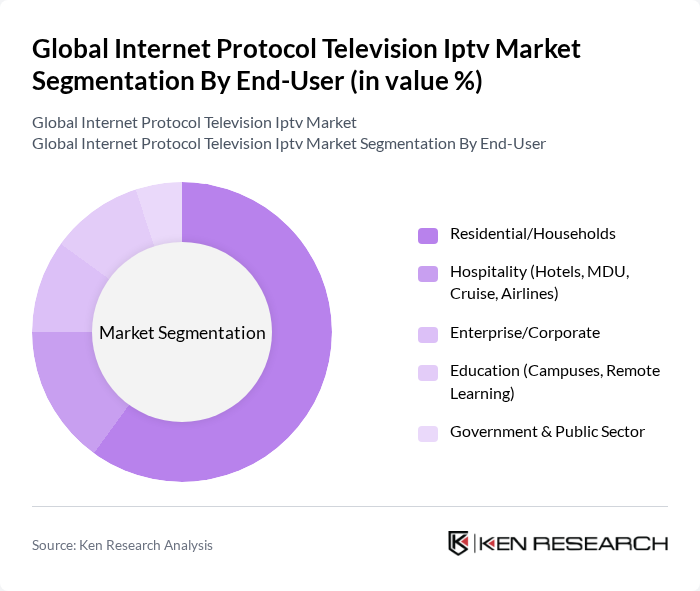

By End-User:The IPTV market is segmented by end-user into Residential/Households, Hospitality (Hotels, MDU, Cruise, Airlines), Enterprise/Corporate, Education (Campuses, Remote Learning), and Government & Public Sector. The Residential/Households segment is the most significant, as the majority of IPTV subscriptions are driven by individual consumers seeking diverse entertainment options. The increasing trend of cord-cutting and the demand for personalized viewing experiences have further propelled this segment's growth.

The Global Internet Protocol Television Iptv Market is characterized by a dynamic mix of regional and international players. Leading participants such as China Telecom Corporation Limited (Tianyi IPTV), China Unicom (Hong Kong) Limited, China Mobile Limited (Migu/OTT-Integrated IPTV), Orange S.A. (Orange TV), Deutsche Telekom AG (MagentaTV), BT Group plc (BT TV/EE TV), Sky Group (Sky Glass/Stream; NOW in select markets), Telefónica S.A. (Movistar Plus+), Vodafone Group plc (GigaTV/Vodafone TV), Altice France (SFR TV) and Altice USA (Optimum TV), Swisscom AG (blue TV), KPN N.V. (KPN iTV), Telus Corporation (Optik TV), Bell Canada (Bell Fibe TV), AT&T Inc. (AT&T U-verse TV legacy/IPTV footprint), Verizon Communications Inc. (Fios TV), Comcast Corporation (Xfinity Stream/IP video), DISH Network Corporation (Sling TV IP-delivered live TV), Roku, Inc. (The Roku Channel/OS-enabled IPTV distribution), Hulu, LLC (Live TV; IP-delivered linear bundle), fuboTV Inc., Amazon (Prime Video Channels/Live sports rights), Netflix, Inc. (IP content distribution; ad tier), NTT Docomo, Inc. (dTV/LEONET partnerships), PCCW Limited (Now TV, Hong Kong) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the IPTV market appears promising, driven by technological advancements and evolving consumer preferences. As internet speeds continue to improve and more users embrace streaming services, IPTV providers are likely to enhance their offerings with interactive features and personalized content. Additionally, the integration of artificial intelligence and machine learning will enable better content recommendations, further engaging subscribers. The focus on user experience will be crucial for retaining customers in an increasingly competitive landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Live/Linear IPTV Time-Shifted/Replay TV Video on Demand (VoD) Subscription-Based (SVoD) Pay-Per-View (PPV)/Transactional (TVoD) Advertising-Supported (AVoD/FAST) Hybrid (Multicast + Unicast/OTT Bundles) |

| By End-User | Residential/Households Hospitality (Hotels, MDU, Cruise, Airlines) Enterprise/Corporate Education (Campuses, Remote Learning) Government & Public Sector |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Technology | xDSL Fiber/Fiber-to-the-Home (FTTH) Cable (HFC/DOCSIS) Satellite/IP Hybrid Wireless/5G Fixed Wireless Access |

| By Application | Entertainment & Media Education & Training Sports & Live Events News & Public Broadcasting Advertising/Commerce-Enabled Streams |

| By Revenue Model | Subscription Pay-Per-View/Transactional Advertising-Supported (AVoD/FAST) Hybrid (Subscription + Ads/PPV) |

| By Delivery Method | Multicast IPTV (Managed Networks) Unicast IPTV (OTT/On-Demand) CDN-Optimized/Edge Delivery |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential IPTV Users | 150 | Household Decision Makers, Tech-savvy Consumers |

| Commercial IPTV Clients | 120 | Business Owners, IT Managers |

| Content Providers | 90 | Content Acquisition Managers, Licensing Executives |

| Telecom Service Providers | 80 | Network Engineers, Product Development Managers |

| Industry Analysts | 50 | Market Researchers, Technology Analysts |

The Global Internet Protocol Television (IPTV) market is valued at approximately USD 70 billion, reflecting significant growth driven by the demand for high-quality video content and the shift from traditional cable services to internet-based streaming solutions.