Region:Global

Author(s):Shubham

Product Code:KRAB0553

Pages:83

Published On:August 2025

By Type:The market is segmented into various types of intravascular catheters, including Short Peripheral Intravenous Catheters (PIVC), Integrated/Closed Peripheral IV Catheters, Central Venous Catheters (CVC), Peripherally Inserted Central Catheters (PICC), Dialysis Catheters (Hemodialysis & Peritoneal Access), Introducer Sheaths & Guiding Catheters, Specialty/Antimicrobial/Heparin-Bonded Catheters, and Accessories (Catheter hubs, securement, dressings). Among these, the Central Venous Catheters (CVC) segment is leading due to their critical role in administering medications and fluids in patients with complex medical conditions.

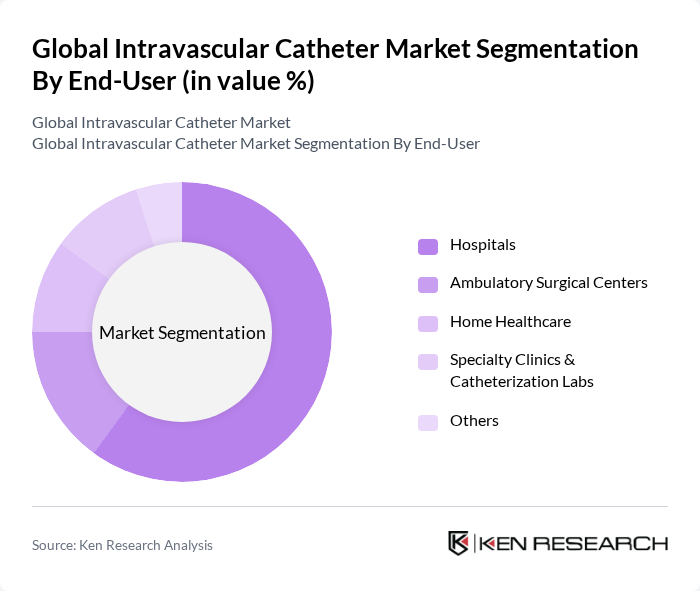

By End-User:The end-user segmentation includes Hospitals, Ambulatory Surgical Centers, Home Healthcare, Specialty Clinics & Catheterization Labs, and Others. Hospitals are the dominant end-user segment, primarily due to the high volume of catheterization procedures performed in these settings, coupled with the increasing number of patients requiring intravenous therapy.

The Global Intravascular Catheter Market is characterized by a dynamic mix of regional and international players. Leading participants such as Becton, Dickinson and Company (BD), B. Braun Melsungen AG, Teleflex Incorporated, ICU Medical, Inc. (including Smiths Medical portfolio), Terumo Corporation, Medtronic plc, Boston Scientific Corporation, Abbott Laboratories, Cook Medical, AngioDynamics, Inc., Merit Medical Systems, Inc., Fresenius Medical Care AG & Co. KGaA, Nipro Corporation, Vygon SA, Convatec Group Plc contribute to innovation, geographic expansion, and service delivery in this space.

The future of the intravascular catheter market in None appears promising, driven by ongoing technological advancements and a growing emphasis on patient-centric care. As healthcare systems increasingly adopt digital health technologies, the integration of smart catheters is expected to enhance monitoring and treatment efficacy. Additionally, the expansion of healthcare infrastructure in emerging markets will likely facilitate greater access to advanced catheter solutions, further propelling market growth and innovation in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Short Peripheral Intravenous Catheters (PIVC) Integrated/Closed Peripheral IV Catheters Central Venous Catheters (CVC) Peripherally Inserted Central Catheters (PICC) Dialysis Catheters (Hemodialysis & Peritoneal Access) Introducer Sheaths & Guiding Catheters Specialty/Antimicrobial/Heparin-Bonded Catheters Accessories (Catheter hubs, securement, dressings) |

| By End-User | Hospitals Ambulatory Surgical Centers Home Healthcare Specialty Clinics & Catheterization Labs Others |

| By Application | Oncology (chemotherapy, long-term venous access) Cardiology (interventional & diagnostic) Renal Disease (hemodialysis access) Infectious Diseases & Critical Care (ICU/CRBSI management) Gastroenterology & Parenteral Nutrition Others |

| By Material | Polyurethane Silicone Polyvinyl Chloride (PVC) Others |

| By Distribution Channel | Direct Sales Distributors Group Purchasing Organizations (GPOs) Online Sales Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Others |

| By Price Range | Low Range Mid Range High Range Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Procurement Departments | 120 | Procurement Managers, Supply Chain Coordinators |

| Clinical Practitioners in Vascular Access | 110 | Nurses, Physicians, Interventional Radiologists |

| Healthcare Administrators | 80 | Hospital Administrators, Policy Makers |

| Patients Using Intravascular Catheters | 70 | Patients, Caregivers, Patient Advocacy Groups |

| Medical Device Distributors | 60 | Sales Representatives, Distribution Managers |

The Global Intravascular Catheter Market is valued at approximately USD 7.6 billion, reflecting a significant growth driven by the increasing prevalence of chronic diseases and advancements in catheter technology.