Region:Global

Author(s):Rebecca

Product Code:KRAC0240

Pages:88

Published On:August 2025

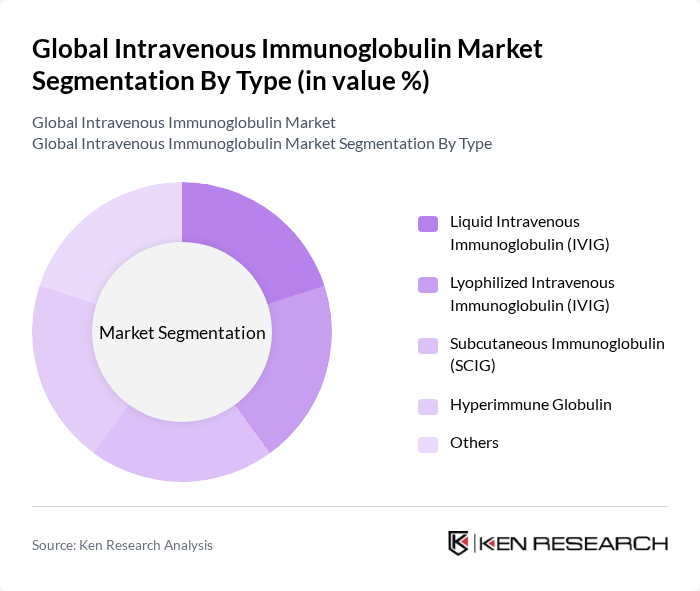

By Type:The market is segmented into various types, including Liquid Intravenous Immunoglobulin (IVIG), Lyophilized Intravenous Immunoglobulin (IVIG), Subcutaneous Immunoglobulin (SCIG), Hyperimmune Globulin, and Others. Among these, Liquid IVIG is the most widely used due to its ease of administration and rapid absorption rates, making it a preferred choice for healthcare providers. Lyophilized IVIG is also gaining traction due to its longer shelf life and stability, while SCIG is increasingly adopted for home-based therapies, supporting patient preferences for convenience and self-administration .

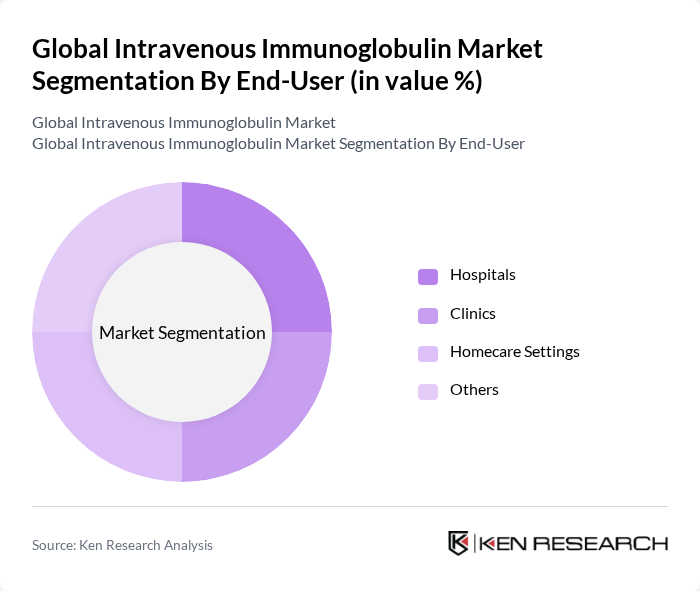

By End-User:The end-user segmentation includes Hospitals, Clinics, Homecare Settings, and Others. Hospitals are the leading end-users of intravenous immunoglobulin due to their capacity to manage complex cases and provide comprehensive care. Clinics are also significant users, particularly for outpatient treatments, while homecare settings are emerging as a vital segment, driven by the growing trend of patient-centered care and the convenience of at-home therapies. The hospital pharmacy segment continues to dominate the distribution channel for IVIG products .

The Global Intravenous Immunoglobulin Market is characterized by a dynamic mix of regional and international players. Leading participants such as Grifols S.A., Takeda Pharmaceutical Company Limited, CSL Behring (CSL Limited), Octapharma AG, Kedrion S.p.A., Biotest AG, Emergent BioSolutions Inc., LFB S.A., Haffkine Bio-Pharmaceutical Corporation Ltd., Shanghai RAAS Blood Products Co., Ltd., Japan Blood Products Organization, BPL Plasma, Inc. (Bio Products Laboratory Ltd.), China Biologic Products Holdings, Inc., Sanofi S.A., Bio Products Laboratory Ltd., Baxter International Inc., ADMA Biologics, Inc., Kamada Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the IVIG market in the None region appears promising, driven by ongoing advancements in production technologies and an increasing focus on personalized medicine. As healthcare providers adopt more tailored treatment approaches, the demand for IVIG is expected to rise. Additionally, the integration of digital health technologies will enhance patient monitoring and adherence, further supporting market growth. Collaborative efforts among key players will likely foster innovation and improve access to IVIG therapies, ensuring a robust market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Liquid Intravenous Immunoglobulin (IVIG) Lyophilized Intravenous Immunoglobulin (IVIG) Subcutaneous Immunoglobulin (SCIG) Hyperimmune Globulin Others |

| By End-User | Hospitals Clinics Homecare Settings Others |

| By Application | Primary Immunodeficiency Disorders Chronic Inflammatory Demyelinating Polyneuropathy (CIDP) Guillain-Barré Syndrome (GBS) Immune Thrombocytopenic Purpura (ITP) Multifocal Motor Neuropathy (MMN) Kawasaki Disease Secondary Immunodeficiency Disorders Autoimmune Diseases Neurological Disorders Others |

| By Distribution Channel | Hospital Pharmacies Specialty Pharmacies Direct Sales Distributors Online Sales Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Patient Demographics | Pediatric Patients Adult Patients Geriatric Patients |

| By Pricing Tier | Premium Mid-range Economy |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Providers | 100 | Physicians, Nurses, Pharmacists |

| Patients Receiving IVIG | 80 | Patients, Caregivers |

| Pharmaceutical Distributors | 50 | Supply Chain Managers, Sales Representatives |

| Regulatory Bodies | 40 | Regulatory Affairs Specialists, Policy Makers |

| Clinical Researchers | 60 | Research Scientists, Clinical Trial Coordinators |

The Global Intravenous Immunoglobulin Market is valued at approximately USD 14 billion, driven by the rising prevalence of immunodeficiency and autoimmune disorders, increased awareness of immunoglobulin therapy benefits, and advancements in plasma collection and manufacturing technologies.