Region:Global

Author(s):Shubham

Product Code:KRAA1711

Pages:91

Published On:August 2025

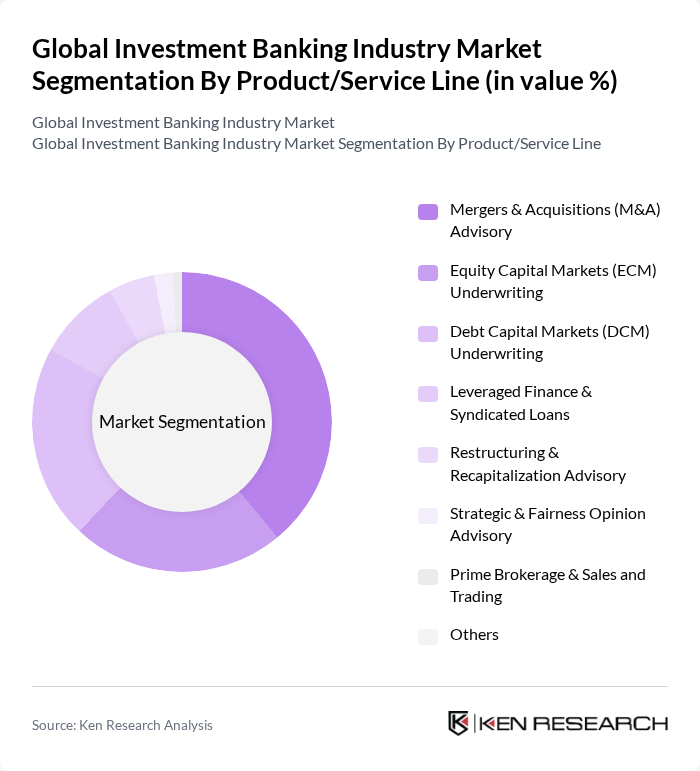

By Product/Service Line:The investment banking sector is segmented into various service lines, including Mergers & Acquisitions (M&A) Advisory, Equity Capital Markets (ECM) Underwriting, Debt Capital Markets (DCM) Underwriting, Leveraged Finance & Syndicated Loans, Restructuring & Recapitalization Advisory, Strategic & Fairness Opinion Advisory, Prime Brokerage & Sales and Trading, and Others. Among these, M&A Advisory is the leading segment, supported by a resurgence in corporate appetite for transformative deals and sponsor-backed transactions as financing markets improve and boardroom confidence normalizes.

By Client Type:The investment banking market also segments by client type, including Corporates (Large Enterprises & SMEs), Financial Sponsors (Private Equity, Venture Capital), Sovereigns & Government Agencies, Financial Institutions (Banks, Insurers, Asset Managers), Ultra/High Net Worth Individuals & Family Offices, and Others. Corporates represent the largest client segment, given their recurring needs for capital markets access and strategic advisory; Financial Sponsors remain a core demand driver as private equity dry powder supports buyouts, add-ons, and exits through IPOs and secondary offerings.

The Global Investment Banking Industry Market is characterized by a dynamic mix of regional and international players. Leading participants such as Goldman Sachs Group, Inc., JPMorgan Chase & Co., Morgan Stanley, Bank of America Securities, Citigroup Inc. (Citi), Deutsche Bank AG, Barclays PLC, UBS Group AG, Credit Suisse (UBS Investment Bank), Wells Fargo & Company, HSBC Holdings plc, BNP Paribas S.A., RBC Capital Markets (Royal Bank of Canada), Nomura Holdings, Inc., Jefferies Financial Group Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the investment banking industry appears promising, driven by ongoing digital transformation and a focus on sustainable investment practices. As firms increasingly adopt advanced technologies like AI and machine learning, operational efficiencies are expected to improve significantly. Additionally, the growing emphasis on environmental, social, and governance (ESG) criteria will likely reshape investment strategies, creating new avenues for growth and innovation in the sector, particularly in emerging markets.

| Segment | Sub-Segments |

|---|---|

| By Product/Service Line | Mergers & Acquisitions (M&A) Advisory Equity Capital Markets (ECM) Underwriting Debt Capital Markets (DCM) Underwriting Leveraged Finance & Syndicated Loans Restructuring & Recapitalization Advisory Strategic & Fairness Opinion Advisory Prime Brokerage & Sales and Trading Others |

| By Client Type | Corporates (Large Enterprises & SMEs) Financial Sponsors (Private Equity, Venture Capital) Sovereigns & Government Agencies Financial Institutions (Banks, Insurers, Asset Managers) Ultra/High Net Worth Individuals & Family Offices Others |

| By Industry Vertical of Deal Activity | Financial Services (BFSI) Healthcare & Pharmaceuticals Technology, Media & Telecommunications (TMT) Energy & Power (incl. Renewables) Industrials & Manufacturing Real Estate & Infrastructure Consumer & Retail Others |

| By Region | North America Europe Asia-Pacific Middle East & Africa South America Others |

| By Transaction Size | Small-Cap (Less than USD 250 million) Mid-Market (USD 250 million – 1 billion) Large-Cap (USD 1 – 5 billion) Mega-Cap (More than USD 5 billion) Others |

| By Deal Nature | Domestic Cross-Border Public Markets Private Markets Others |

| By Funding Instrument | IPOs & Follow-Ons Investment-Grade Bonds High-Yield Bonds Convertible Securities Private Placements Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| M&A Advisory Services | 120 | Investment Bankers, Corporate Development Executives |

| Capital Markets Operations | 100 | Equity Analysts, Debt Capital Market Specialists |

| Asset Management Trends | 80 | Portfolio Managers, Wealth Advisors |

| Regulatory Compliance Insights | 70 | Compliance Officers, Risk Management Executives |

| Investment Banking Technology Adoption | 90 | IT Managers, Digital Transformation Leaders |

The Global Investment Banking Industry Market is valued at approximately USD 110115 billion, reflecting a cyclical recovery in advisory and underwriting services, driven by renewed M&A activity, equity issuance, and active debt refinancing as interest rates stabilize.