Region:Global

Author(s):Rebecca

Product Code:KRAA2099

Pages:98

Published On:August 2025

By Type:The investment banking market can be segmented into Mergers and Acquisitions Advisory, Equity Capital Markets Underwriting, Debt Capital Markets Underwriting, Financial Sponsor/Syndicated Loans, Corporate Finance Advisory, Asset Management, Wealth Management, and Others. Each segment plays a crucial role in facilitating corporate finance activities and investment strategies, with M&A advisory leading the market due to increased deal volume, and equity/debt underwriting benefiting from robust capital market activity and IPO resurgence.

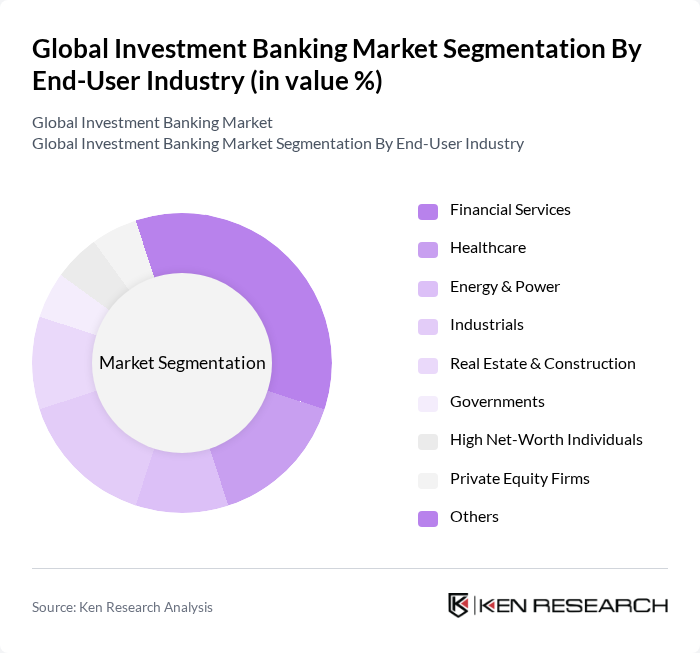

By End-User Industry:The investment banking market serves a diverse range of industries, including Financial Services, Healthcare, Energy & Power, Industrials, Real Estate & Construction, Governments, High Net-Worth Individuals, Private Equity Firms, and Others. Each industry has unique financial needs, with financial services and technology sectors leading deal volume, while healthcare and energy sectors drive innovation in capital raising and advisory services.

The Global Investment Banking Market is characterized by a dynamic mix of regional and international players. Leading participants such as Goldman Sachs Group, Inc., JPMorgan Chase & Co., Morgan Stanley, Bank of America Merrill Lynch, Citigroup Inc., Deutsche Bank AG, Barclays PLC, Credit Suisse Group AG, UBS Group AG, HSBC Holdings PLC, Wells Fargo & Company, BNP Paribas S.A., RBC Capital Markets, Nomura Holdings, Inc., Lazard Ltd, Evercore Inc., Jefferies Financial Group Inc., Macquarie Group Limited, Société Générale S.A., BMO Capital Markets contribute to innovation, geographic expansion, and service delivery in this space.

The investment banking sector is poised for transformative growth, driven by technological advancements and evolving client expectations. As firms increasingly adopt digital solutions, the focus will shift towards enhancing client-centric services and integrating ESG principles into investment strategies. Additionally, the rise of emerging markets will present new avenues for capital raising and M&A activities. By embracing innovation and strategic partnerships, investment banks can navigate challenges and capitalize on opportunities, ensuring sustainable growth in a dynamic financial landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Mergers and Acquisitions Advisory Equity Capital Markets Underwriting Debt Capital Markets Underwriting Financial Sponsor/Syndicated Loans Corporate Finance Advisory Asset Management Wealth Management Others |

| By End-User Industry | Financial Services Healthcare Energy & Power Industrials Real Estate & Construction Governments High Net-Worth Individuals Private Equity Firms Others |

| By Service Type | Investment Advisory Risk Management Research Services Trading Services Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Client Type | Retail Clients Institutional Clients Corporate Clients Government Clients Others |

| By Investment Size | Small Cap Mid Cap Large Cap Mega Cap Others |

| By Investment Source | Domestic Investments Foreign Direct Investments (FDI) Public-Private Partnerships (PPP) Government Schemes Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| M&A Advisory Services | 60 | Investment Bankers, M&A Analysts |

| Capital Markets Operations | 50 | Equity Analysts, Debt Syndication Managers |

| Wealth Management Trends | 40 | Wealth Managers, Financial Advisors |

| Trading and Brokerage Services | 40 | Traders, Compliance Officers |

| Regulatory Compliance in Investment Banking | 40 | Compliance Managers, Risk Assessment Officers |

The Global Investment Banking Market is valued at approximately USD 151 billion, driven by factors such as corporate mergers and acquisitions, capital raising demands, and the expansion of financial services worldwide.