Region:Global

Author(s):Shubham

Product Code:KRAB0766

Pages:98

Published On:August 2025

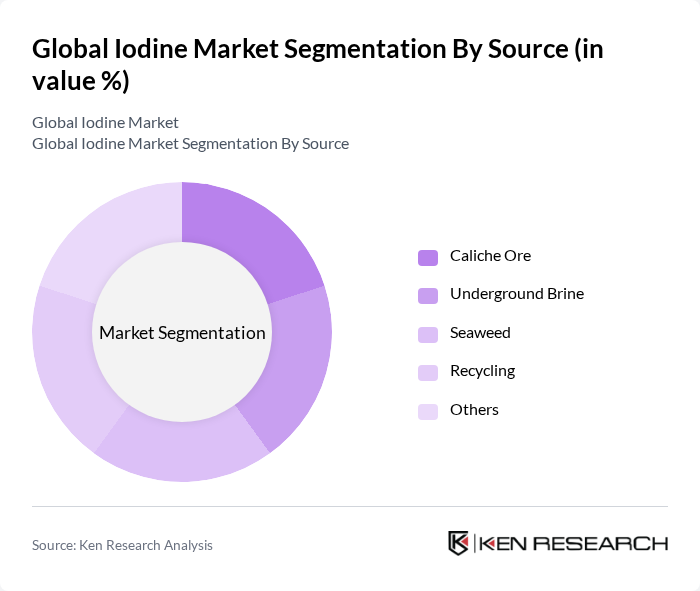

By Source:The iodine market is segmented by source into Caliche Ore, Underground Brine, Seaweed, Recycling, and Others.Caliche Oreremains the dominant source, accounting for the largest share due to its high iodine content and cost-effective extraction, particularly in Chile. Underground brine extraction is significant in the United States and Japan, while seaweed is a traditional but less prominent source. Recycling is gaining traction due to sustainability initiatives, but its overall share remains modest .

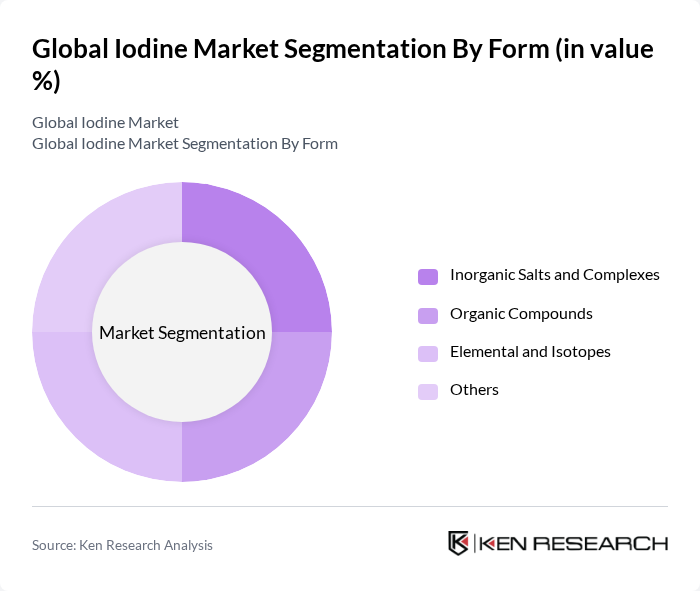

By Form:The iodine market is also segmented by form into Inorganic Salts and Complexes, Organic Compounds, Elemental and Isotopes, and Others.Inorganic Salts and Complexeshold the largest share, driven by their widespread use in pharmaceuticals, animal feed, and industrial catalysts. Organic Compounds are used in specialty chemicals and pharmaceuticals, while Elemental and Isotopes cater to medical imaging and research. The "Others" category includes less common derivatives and specialty blends .

The Global Iodine Market is characterized by a dynamic mix of regional and international players. Leading participants such as SQM S.A., Iofina plc, Albemarle Corporation, Godo Shigen Co., Ltd., Tohoku Chemical Co., Ltd., American Elements, Merck KGaA, Jiangsu Huachang Chemical Co., Ltd., Deepwater Chemicals, Inc., Nitto Denko Corporation, Nanjing Chemical Industry Group Co., Ltd., Kanto Chemical Co., Inc., Hubei Xingfa Chemicals Group Co., Ltd., Zhejiang Jianye Chemical Co., Ltd., Jiangxi Dide Chemical Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the iodine market appears promising, driven by increasing awareness of iodine's health benefits and its expanding applications across various sectors. Innovations in extraction technologies are expected to enhance production efficiency, while the rising demand for organic and sustainable iodine products will likely shape market dynamics. Furthermore, as global health initiatives focus on addressing iodine deficiency, the market is poised for growth, particularly in emerging economies where dietary deficiencies are prevalent.

| Segment | Sub-Segments |

|---|---|

| By Source | Caliche Ore Underground Brine Seaweed Recycling Others |

| By Form | Inorganic Salts and Complexes Organic Compounds Elemental and Isotopes Others |

| By Application | X-ray Contrast Media Pharmaceuticals Biocides LED/LCD Polarizing Films Feed Additives Human Nutrition Water Treatment Others |

| By End-User | Healthcare & Pharmaceuticals Chemical Industry Animal Feed Electronics Food & Beverage Others |

| By Region | Europe Asia-Pacific North America Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Applications | 100 | Pharmaceutical Manufacturers, Regulatory Affairs Specialists |

| Agricultural Use Cases | 60 | Agronomists, Crop Nutrition Experts |

| Industrial Applications | 50 | Manufacturing Engineers, Chemical Process Managers |

| Health and Nutrition Sector | 70 | Nutritionists, Health Policy Makers |

| Market Research Analysts | 40 | Market Analysts, Industry Consultants |

The Global Iodine Market is valued at approximately USD 1.88 billion, driven by increasing demand in pharmaceuticals, nutrition, and industrial applications. This valuation is based on a comprehensive five-year historical analysis of market trends and growth factors.