Region:Global

Author(s):Dev

Product Code:KRAD0341

Pages:98

Published On:August 2025

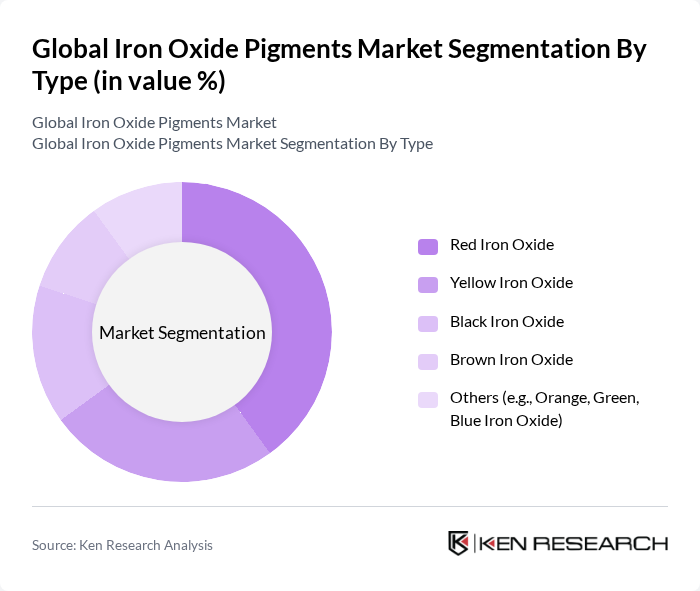

By Type:The market is segmented into various types of iron oxide pigments, including Red Iron Oxide, Yellow Iron Oxide, Black Iron Oxide, Brown Iron Oxide, and Others (such as Orange, Green, Blue Iron Oxide). Among these,Red Iron Oxideis the most dominant sub-segment due to its widespread use in construction, coatings, and plastics. Its vibrant color and excellent stability make it a preferred choice for manufacturers.Yellow Iron Oxidefollows closely, valued for its non-toxic properties and versatility in multiple applications .

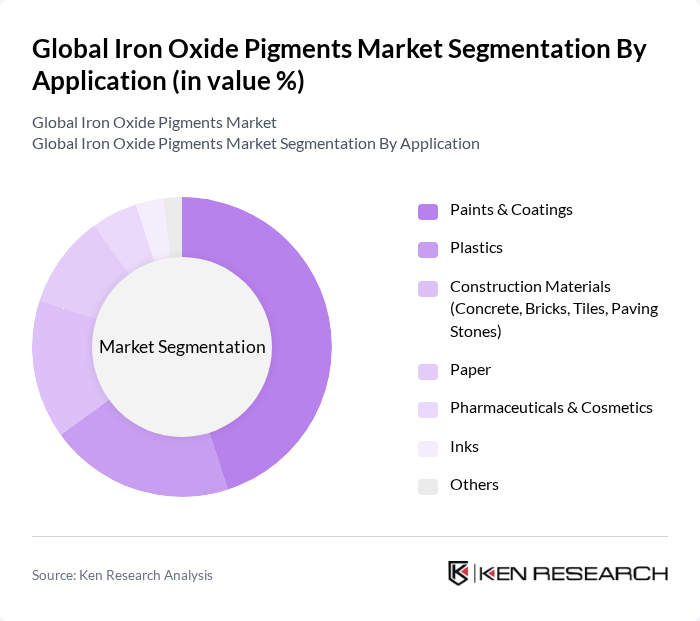

By Application:Iron oxide pigments are used in a wide range of applications, including Paints & Coatings, Plastics, Construction Materials (Concrete, Bricks, Tiles, Paving Stones), Paper, Pharmaceuticals & Cosmetics, Inks, and Others. ThePaints & Coatingssegment holds the largest market share, driven by the increasing demand for high-quality, durable coatings in the construction and automotive industries. Growth in the construction sector, especially in emerging economies, continues to propel demand for iron oxide pigments across these applications .

The Global Iron Oxide Pigments Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Huntsman Corporation, LANXESS AG, Cathay Industries Group, Clariant AG, The Chemours Company, Venator Materials PLC, DIC Corporation, Ferro Corporation, Kremer Pigmente GmbH & Co. KG, Sudarshan Chemical Industries Ltd., Yipin Pigments Co., Ltd., Zhejiang Deqing Huayuan Pigment Co., Ltd., Jiangsu Yuxing Industry and Trade Co., Ltd., and Tata Pigments Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the iron oxide pigments market appears promising, driven by increasing demand for sustainable and eco-friendly products. Innovations in pigment technology are expected to enhance performance and reduce environmental impact. Additionally, the expansion of manufacturing capabilities in emerging markets will provide new growth avenues. As industries prioritize sustainability, the shift towards bio-based and recycled pigments will likely reshape market dynamics, fostering a more environmentally conscious approach to pigment production.

| Segment | Sub-Segments |

|---|---|

| By Type | Red Iron Oxide Yellow Iron Oxide Black Iron Oxide Brown Iron Oxide Others (e.g., Orange, Green, Blue Iron Oxide) |

| By Application | Paints & Coatings Plastics Construction Materials (Concrete, Bricks, Tiles, Paving Stones) Paper Pharmaceuticals & Cosmetics Inks Others |

| By End-User Industry | Building & Construction Paints & Coatings Plastics Industry Paper Industry Pharmaceuticals & Cosmetics Others |

| By Distribution Channel | Direct Sales Distributors/Wholesalers Online Retail Others |

| By Region | North America (U.S., Canada, Mexico) Europe (Germany, U.K., France, Italy, Spain, Rest of Europe) Asia-Pacific (China, India, Japan, South Korea, Rest of Asia-Pacific) Latin America Middle East & Africa |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value-Based Pricing |

| By Product Form | Powder Granules Liquid Dispersion Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Industry Applications | 100 | Project Managers, Material Procurement Officers |

| Automotive Coatings Sector | 70 | Quality Control Managers, Product Development Engineers |

| Plastics Manufacturing | 60 | Production Supervisors, R&D Managers |

| Cosmetics and Personal Care | 50 | Formulation Chemists, Brand Managers |

| Industrial Applications | 80 | Operations Managers, Supply Chain Analysts |

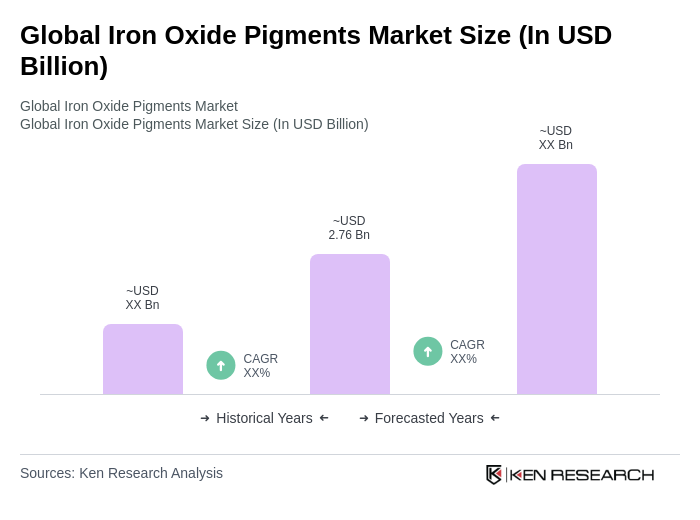

The Global Iron Oxide Pigments Market is valued at approximately USD 2.76 billion. This growth is driven by the increasing demand for high-performance pigments in various applications, including paints, coatings, and construction materials.