Region:Global

Author(s):Dev

Product Code:KRAC0372

Pages:97

Published On:August 2025

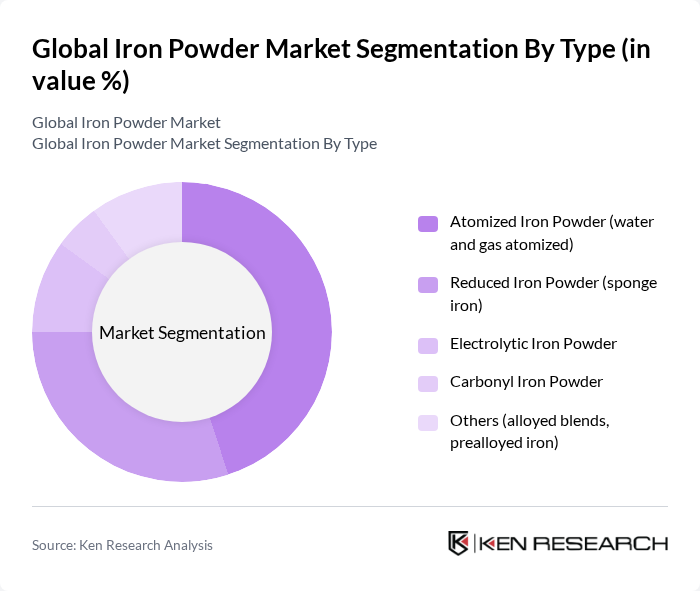

By Type:The iron powder market includes Atomized Iron Powder, Reduced Iron Powder, Electrolytic Iron Powder, Carbonyl Iron Powder, and Others. Atomized iron powder is widely used in powder metallurgy and additive manufacturing for its flowability and consistent particle morphology, supporting complex part production in automotive and industrial applications. Reduced iron powder remains important in PM parts, chemical reduction uses, and specialty applications requiring specific porosity and compressibility characteristics.

By End-User:The end-user segmentation of the iron powder market includes Automotive and Transportation, Industrial Machinery and Tools, Electrical & Electronics, Chemicals, Pharmaceuticals & Food Fortification, Aerospace & Defense, and Others. The Automotive and Transportation sector is the dominant end-user, driven by the increasing production of vehicles and the growing trend of lightweight materials in automotive design. This sector's demand for iron powder is primarily for manufacturing components through powder metallurgy processes, which offer enhanced performance and reduced weight.

The Global Iron Powder Market is characterized by a dynamic mix of regional and international players. Leading participants such as Höganäs AB, Rio Tinto Metal Powders, JFE Steel Corporation (Iron Powder Division), Industrial Metal Powders (India) Pvt. Ltd., Pometon S.p.A., CNPC Powder Material Co., Ltd., JSC Ufaleynikel (Ufaley Metallurgical Plant), ABC Powders GmbH, KosmoSino Group (Jilin Jien Nickel & Iron Powder), JFE Shoji (distribution for iron powders), Sundram Fasteners Limited (PM Division), GKN Powder Metallurgy (for iron-based PM materials), Mettal Powder Company Ltd. (MEPCO), Shenghua Group Dezhou Hengyuan Metallurgical Co., Ltd., and Zhejiang Jinxing Industrial Co., Ltd. (iron powder) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the iron powder market appears promising, driven by technological advancements and a shift towards sustainable practices. As industries increasingly adopt eco-friendly production methods, the demand for iron powder is expected to rise. Furthermore, the expansion into emerging markets, particularly in Asia-Pacific and Latin America, will provide new growth avenues. Companies that innovate in production techniques and develop new applications will likely capture significant market share, positioning themselves favorably in a competitive landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Atomized Iron Powder (water and gas atomized) Reduced Iron Powder (sponge iron) Electrolytic Iron Powder Carbonyl Iron Powder Others (alloyed blends, prealloyed iron) |

| By End-User | Automotive and Transportation Industrial Machinery and Tools Electrical & Electronics Chemicals, Pharmaceuticals & Food Fortification Aerospace & Defense Others (construction, energy) |

| By Application | Powder Metallurgy (sintered structural parts, PM bearings, filters) Soft Magnetic Components (SMC cores, magnetic alloys) Welding & Brazing (electrodes, fluxes) Chemical Applications (iron catalysts, water treatment, fortification) Additive Manufacturing/3D Printing Others (friction materials, coatings) |

| By Distribution Channel | Direct Sales (OEMs and Tier-1s) Distributors/Traders Online/Portal-Based Procurement Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Low Price Mid Price High Price |

| By Packaging Type | Bulk Packaging (big bags, drums) Retail/Small-Lot Packaging Custom/Specification-Based Packaging Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Applications | 100 | Product Engineers, Procurement Managers |

| Aerospace Manufacturing | 80 | Quality Managers, R&D Directors |

| Electronics Industry | 70 | Supply Chain Analysts, Manufacturing Supervisors |

| Construction Materials | 60 | Project Managers, Materials Suppliers |

| Metal Powder Innovations | 90 | Research Scientists, Technical Sales Representatives |

The Global Iron Powder Market is valued at approximately USD 6 billion, reflecting a five-year historical analysis. This growth is driven by increasing demand across various applications, including powder metallurgy, automotive components, and additive manufacturing.